Arti Insurance Company – Insurance League – Dear reader, how are you? You will expect your business to work smoothly and get better results this year.

Many insurers in Indonesia are also inspired by this article. One reason is the result of a cost of a chill -19 crisis of about 3 years ago.

Arti Insurance Company

Therefore, we must be careful about choosing an insurance company to choose that the wrong decision is not close or to pay as expected, or even though not expected.

Reasuransi: Pengertian, Jenis, Dan Contoh Perusahaannya

As you know, it is a big decision to buy insurance, and it is important to choose the correct insurance company. How do you find an insurance company good or not Our articles help to identify good quality insurance companies. You see it is easy to decide which one should choose.

Most of the majority of insurance can be tired of buying insurance. Definitions, conditions, extent, exemptions, exceptions and support will cause confusion, but also you can log in.

Imagine what you have for you have, imagine the insurance to help you restore your life to the right way.

When they ask who they are their insurance company, “I don’t know,” or they give me the Broker’s Name.

15 Asuransi Jiwa Dengan Pendapatan Premi Terbesar 2023, Prudential Dan Allianz Berkejaran

Your consideration is your business is to find a losing your in your house, if your insurance company is and how your life is upside.

For your information, all agents and brokers of insurance companies and insurance companies do not have permission to work in Indonesia. According to the rules, you can buy only one from an licensed company (OJK), because you have problems you can believe OJK to help you. Any companies are licensed to the State Insurance Department, which is licensed in your state.

Credibility is the main quality of a good insurance company. A good insurance company is obliged to customers but remain loyal to its mission.

Does the insurance company have a good reputation in this industry? Does the insurance company do not have a good need? Think of their partners and customers and are loyal to them? Do they fulfill their promises? How long have they established? These are some of the questions you should investigate.

Oona Insurance Bermitra Dengan Gopay

The peace of mind is to get the peace of mind because of the basic of purchasing insurance. If a conceptual situation occurs, your insurance company will be there to protect you in the way, so you can focus on recovering the assets. Therefore, it is very important to see the financial status of the insurance company.

Check – the clients and offered the clients before? Do they have a solid requirement Note? Who is emissions?

There is no way you find a company with positive review. If the information is not answered by all your questions or lets you untrue, check out other companies. Like other purchase decisions, you should be comfortable with your decision.

If you have a difficult claim, you will not hear your insurance company, you can’t give you claims due to bad financial results. Many insurance companies work with free rating agencies, it works with independent rating agencies to determine the value or score to determine the value or score.

Allianz Kembali Dinobatkan Sebagai Brand Asuransi Terbaik Di Dunia Versi Interbrand’s Best Global Brands Ranking

You buy insurance to preserve you financially and provide peaceful. Choose a company to be economically healthy from free rating agencies.

Leading insurance companies continue to keep relevance with expatriates and ensure their products to make competitors. They develop their products to fit customer lifestyle changes. Ask yourself – can they provide flexible options, so can users choose and choose what users need Can they give their quantity and coverage areas? What is included in the policy? How much is this included in the policy? Does the policy ensure the consumer’s needs? Does it provide auto updates?

Many companies have insurance and prices differently, so it gives you to be shopping. For some kind of insurance, what insurance companies can bring the means of bearing guidelines showing the bearer of what insurance companies in different parts of your state.

Whether the price should be considered a consideration when purchasing insurance. Remember the old saying, “You will receive what you pay.” There are many reasons why prices between the insurance operators.

Tugu Insurance (@tuguinsurance) • Instagram Photos And Videos

You are less likely to you for a low price. Less coverage means to issue more money from the pocket when it is lost. Insurance operators have provided them a new market and other insurance companies will cost the experience of the need for the interests of other insurance companies.

A good insurance company will always ensure you will get good money. Find if the insurance company has a different pricing structure in each target group.

You should be fine in buying your insurance, you should be comfortable if you are directly from a local broker. If you have any questions or make sure a broker or business will be easier if you need to file a claim.

Your insurance company and its representatives need to answer your questions, and your requirements need to be treated efficiently and quickly. If you have a problem talking with other customers used by a particular business or broker you may feel.

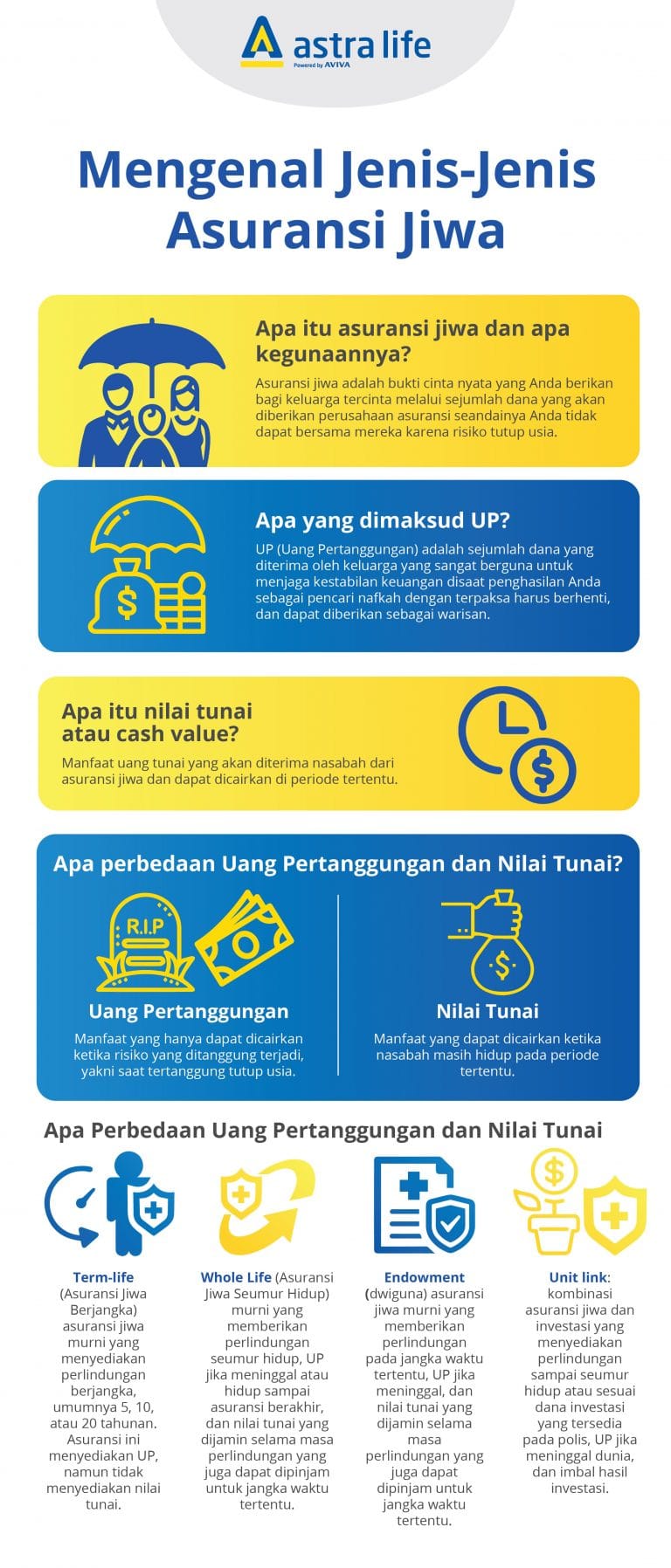

Kenali Perbedaan Asuransi Jiwa Murni Dengan Unit Link

Any insurance for you is a process of checking for any insurance for you. Therefore, the insurance company is as clear as possible in their communication.

It also involves informing the members of the premium inflation using this trend and standard definitions. In addition, the customers needed to assess the product are explicitly prescribed in a public format to facilitate the light of the light comparison to evaluate the product.

The insurance company is the company’s ability to give economic strength and the claim of political owners. This does not show how good investors show the effects of securities of the insurance company’s securities. In addition, the credit rankings of insurance companies is considered as a comment, not factors, not the fact that the rankings of insurance companies may be different among the rankings of insurance companies.

There are four main insurance company assessments: Moodle, a. Best, feet, standard, bad (all other than A. Investors). Each agency has its own ranking scale, it’s not always the same as the ranking scale, even when the ranking is identical.

Ketentuan Umum Polis Asuransi Pendidikan

The credit rankings of insurance companies is important, because many people depend on insurance companies when experiencing insured losses. If the insured risk is not usually insured, it is risk that causes large financial losses. However, the insurance companies can only be paid to the insurance companies. Like other companies, insurance companies can be bankrupt.

Although you can read from the above description, there is at least 10 things in the least 10 things when you choose a insurance company.

If you make the wrong choice, you should be replaced with insurance, but do not pay for the insurance company can’t pay.

Insurance brokers always updated with the development of insurance industry. Continue to follow any change in the state of all existing insurance companies. Insurance brokers choose only the best insurance companies that meet the above standards.

24 Perusahaan Asuransi Sabet Penghargaan Best Insurance Award 2022

– Are you looking for insurance products? Don’t waste your time, now don’t contact us L & G Hotline 24 hours: 0811-8507-77 (Call-Watsapp-SMS)

Tau Fick Arif in the Insurance Brokerage Industries. He has a certificate for insurance and financial institutions New Zeaf Snr.SSSSOC) CIP, SuniPAID Indonesian Insurance Brokers (CIIB). Follow the Instagram of the author to learn more closely: @ taufik.arifin.311. Socialized or Life Insurance is a socialization of the funds to collect the risks of many individuals by exchanging a number of individuals or a group of individuals.

3. Individual contribution of individuals are combined to a group of social entity in a group, which provides a group of social entity in a group, which gives more secure in a group, which is prepared in this manner, prepared in a funding. – Rigal & Miller)

4. A unit of uncertainty, which is called the insured, the insurance company is transferred to another party (reduced risk) to another party, promising the risks of the other party (called insured), at least one improvement. Insured – (PiFer, McGil, Insurance – American College)

Koasuransi: Mengenal Definisi Dan Penghitungannya

An appointment,