Asuransi Dasar Adalah – You will definitely have different financial plans for family welfare in the future. But is there a guarantee that you will avoid the results of life to life?

Basic Badness Insurance with a detailed insurance period will increase in 10 years with a detailed insurance period

Asuransi Dasar Adalah

The advantages of this dead will be reduced by a premium that has not yet been paid for the policy owner according to the general requirements of politics and other responsibilities; And cause to end the policy.

Pihak-pihak Dalam Asuransi

No-30 calendar days before a written date of 30 calendar days before the written date, you do not authorize the policy officer in writing after any 30 calendar days.

If the insured is still alive on the final date of basic insurance. The detailed insurance period begins with a detailed insurance period (“Date of the insurance period prescribed by each wizard described in (” insured not exceeding 80 years and is still not alive per complex insurance period and insured not exceeds 90 years of insurance insurance.

Leaders insurance insurance insurance insurance insurance insurance insurance insurance insurance insurance insurance insurance insurance insurance insurance insurance insurance insurance insurance for initial basic insurance. In this case, the amount of premiums should pay a clerk or premium taxpayer) in accordance with the insured and applicable adridring arrangements; Or (ii) less than the value of coverage coverage for early basic insurance. However: (II.A) The value of adjustable coverage should not be less than the minimum coverage specified by the arrangements of the Alignise Officer; I (I.B) Premiums must be paid by owners or premium actors or will ensure alliances adapt to the provisions of justification.

In particular, a person’s insured person and / or 5 years, under the hill of death, the following possible potential potential threats are never separated from death fees. Bad things can happen at any time, anyone and anywhere. Risks that can have a bad effect on physical, mentally, from time to come. Therefore, protection or insurance for us is very important for the expectation of security or risk of insurance.

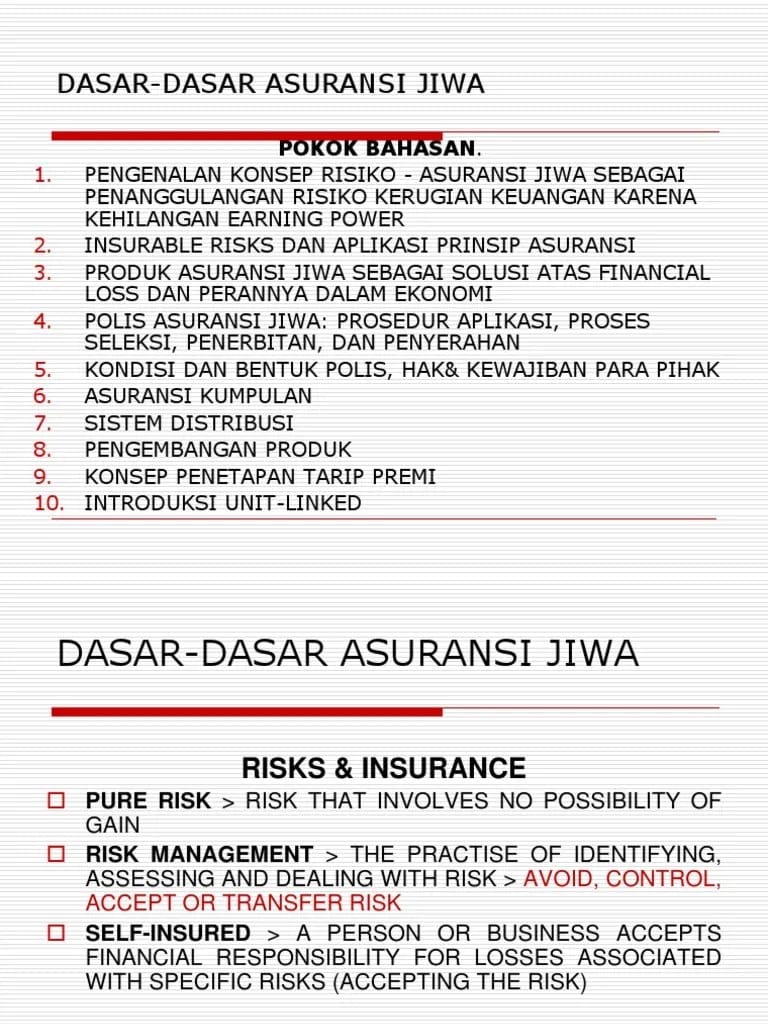

Konsep Dasar Cara Kerja Asuransi

From the presence of some of these risks you can prepare your product for only insurance and create yourself that you can get property security. But unfortunately, many people do not understand the benefits of insurance. Special health insurance, serious insurance and life insurance diseases. These three is an important part of insurance

That provides maximum protection for each phase of life. Then, what are the securing triangles and what actions?

The safety triangle is the same as the financial planning pyramid. To become a security triangle to provide guidance in the direction of life for the importance of three insurance in the layer of life. From these following benefits:

Health insurance is the first phase of security that is medical in the community, the point is to protect your health. Without health insurance, you need to reach a bag to treat finance. If you receive any health accident, it will have a bad impact on your financial situation.

Makalah Prinsip Dasar Asuransi Dan Polis Asuransi

If you already have health insurance, you don’t have to feel sick or more concern about the accident. Be careful like vaccination and it is also included in the benefits of health insurance.

Health insurance insurance is located at the bottom of the triangle. It shows that health insurance should be a basic thing that should be in your life.

After health insurance, critical disease insurance, the next step is. Critical illness is a type of disease that requires sustainable and requires a long time and process. Some examples of serious diseases that can bear to submit to bear insurance, stroke, cancer, diabetes, kidney failure remains.

With serious diseases, insurance, you can get additional protection for medical emergencies for which more costs. Insurance of critical illnesses can be preserved through the benefits provided by financial risk.

Apa Itu Rider Asuransi? Plus Kategori Dan Tipsnya

Life insurance is the tip of life insurance in the insurance protection triangle. Life insurance is another phase of life security. Useful life insurance for the provision of financial security to the family.

Ideally, life insurance can be saved by life insurance family. Life insurance will benefit from successor as insurance money. With the money of this insurance, leaving family, despite the main bread, will continue his life.

Entering an insurance in a financial plan will help you be ready to be ready to face all the chances if life is a risk of life. With insurance, you can protect your own, maintain family financial stability and understand the future.