Asuransi Diri Adalah – If you are recognized as a result of death, people with disabilities, as well as medical costs or medical costs or treatment. The situation causes the physical condition that must be determined by scientific treatment.

To receive an application for a customer insurance policy in order to fulfill self -sufficiency. Below are some events that can call personal collapse and claim claims:

Asuransi Diri Adalah

The arrival of the accident must be immediately arriving, but if the benefits occur at the same time after the accident is assured. The insurance used in the waiting list is a 12 -month death and cannot be forever.

Asuransi Kecelakaan Diri Bukan Berarti Hanya Melindungi Kamu Ketika Terjadi Keceakaan Diri Saat Perjalanan Lalu Lintas, Tetapi Juga Berbagai Kejadian Seperti Keracunan Hingga Jatuh Ke Dalam Air Atau Tenggelam. Dapatkan Informasi Selengkapnya

What determines the status of self -sufficiency from the outside. This is what you need to know about health insurance through personal relationships. If the cause of death is a disease, it cannot help.

The arrival of this accident should be strictly violent, both chemicals such as harassment and violence such as collision.

Dying within 12 (twelve) months after the accident or disappeared and did not find at least 60 days after occurring

The amount of income with disabilities depends on the direct cause of the accident, in accordance with the law, which contains:

Asuransi Kecelakaan Diri

♦ Loss or failure: vision of eyes and arm; One eye and one hand; Or a leg and one arm.

It can also be determined as constant trust, such as anger or insurance guaranteed to be correct. This stability is accidentally required within 12 (twelve) months.

Which has been performed during the effort or restored pain or injury from insurance. Loss of danger on the digital channel 2024-10999T11: 44 + 00: 300, 2020 September | Categories: General

The negative status of the road can happen at any time, so we need responsibility for the risk of love. Especially for those who are safe, privacy insurance is very reasonable. This insurance has received the risk of events that occur at any time and anywhere. Although you are careful at your workplace, there are many things that can hurt you. It is difficult to compare how much the interactive affects the event.

Perusahaan Retail Berikan Asuransi Kecelakaan Bagi Konsumen

Anyone can apply at any time and in other places. Therefore, it is important to know that this insurance is important to you as a form of self -defense if there is nothing. Unfortunately, many people do not pay attention to the benefits of insurance that can help and easily load their burdens. When I have insurance, Garda, I will give you the main death of the results because of the results of the results. And if you have to stay in the hospital for five consecutive days, Agent I will change health care costs as the restrictions listed by law.

Garda, I give you peace of mind or keep the device. Because if the governor or owner has an accident that is disabled, it disappears in despair, losing it to lose their benefits.

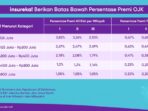

This is the key to self -insurance, especially for those who have hard work to get rid of weight. If you have personal insurance, you can work safely with those who do not have insurance, multi -insured staff. Protect yourself. Garda I provide personal protection against self -control at the right cost. Freely decide on the cost of respect or restrictions if necessary. 64 ASFA insurance special insurance, which receives the protection of 20% insurance privacy, is the initial 75,000,000 RP. #Peactfind

Hello, our administrator should be prepared to help you obtain information about insurance. Click the picture below to start the conversation. There is a privilege that at this time is very important. Especially with various risks that are often ignored and carried unexpectedly. But choose your own self insurance, not easy. Especially for those who are distinguished from uniforms.

Seberapa Pentingkah Asuransi Kecelakaan Diri?

In addition, all insurance is usually divided into multiple products. As a copy of a private life and lifestyle events. Before you choose one, of course you want to know the difference between the two species insurance. Both in terms of quality and quality of insurance. No need to be confused because the following explain the difference.

In order to find the difference, you can get to know all types of insurance. Start with the report of personal insurance that will be paid or paid, which gives you something for something.

Call it as an accident, suffer pain, suffer fatal mistakes. It is a collection of the most harmful risks, but you can’t ignore it when it happened. It provides special protection for itself.

Because this insurance provides or replaces the amount you need to bear when they are now being told. Although you cannot deny that this type of insurance is rare compared to other specific insurance.

Apakah Anda Perlu Asuransi Kecelakaan Diri?

But those who need the highest protection may not be abused when choosing insurance. In addition, you have to pay as much respect on your own, and the cheap frequency is to protect the protection.

If you already know the definition of self -insurance, we will continue to know that life insurance means. They only receive life insurance for family insurance if the cost. Most payments are made in cash or insurance family in the form of cash.

In a limited time that was agreed with the first. If there are benefits, it is not important that many people decide to use this type of insurance. There are many people with family members.

This is what is widely known from several people after the insurance mode and uses width. The reason for this is that the system is easy and repeatedly simple. Therefore, for those they do not know, they will not be confused when using this type of insurance.

Asuransi Kecelakaan Diri Kumpulan

Do you understand the difference between self -insurance and insurance life?. This explanation makes it easier for you to choose which insurance is best.

In order to protect yourself in the event of an accident, you can buy Garda for insurance personal identity statues. Garda I respect a minimal RP 50,000 years. How to make this insurance very simple, you can register. Get 15% off and e-right printing for 1 × 24 hours. So what do you expect, give your own risks because of the risk of the path, why the road can always occur why we need the risk of status. Because that was all the burden. #Peactfind

Hello, our administrator should be prepared to help you obtain information about insurance. Click the picture below to start the conversation. The accident can occur at any time without warning, both on the highway, the office, and in everyday life. Because of the situation, the expectation of risky money, without thinking about it, self insurance is a smart step. In this article you will find some examples of security insurance.

Self insurance with various results that can follow the needs. Below is an example of a dangerous health insurance option.

Pengertian Asuransi Kecelakaan Diri Serta Manfaat Dan Cara Klaimnya

This insurance is suitable for you that must be self -defense. It usually includes medical costs due to death, disabled people and accidents. Suitable for someone like workers, freelancers who usually travel or preferences.

The subscription process can be simple and can be online at affordable prices. With more than 2,000 hospitals and partnerships with partner clinic, you can always protect it with health services in Indonesia.

The purpose of security insurance is to determine the repair of the hedge costs, as the insurance is prevented in the event of an accident, both while driving. To avoid choosing a bad choice, you should know four specific health insurance and all its benefits.

You can buy directly to the agent or the Internet to register for private health insurance. You can shop online for insurance. Easy and fast, you get 3 vaccinations, which are standard, recommendations and respect.

Asuransi Kecelakaan Diri Aswata Pa

Here you can see that the amount that covers the value you get and choose which one meets your needs. The amount you have to pay directly

You can then add the details of protection that create your life and needs, ie:

The site gets the details of the results and costs received. You can choose a monthly payment or one year as a budget. If the content is based on your needs, click “to protect your own current protection” button to continue in the next section.

In the next step, you are asked to write some information about yourself, such as E -Mail addresses, phone numbers and others. Then you