Asuransi Jiwa Adalah Dan Contohnya – Insurance choice is not an easy solution. You should not submit an insurance option to agents or any party because you must specify the decision independently. Avoid to pay precious insurance bears and need defense privileges.

Before selecting insurance, start the conditions for your own finances and needs. Learn to protect and take advantage of what you and your family need. For example, small families with two children are all day insurance and important.

Asuransi Jiwa Adalah Dan Contohnya

You can place your needs in the form of insurance with different products. For example, rides in the form of family health insurance and car insurance.

Asuransi Dapat Menyesuaikan Kebutuhanmu

Each insurance company must be registered and monitored by financial services (OJK). So you need to find more information than you want to identify insurance. Make sure your insurance company is registered with OJK and has a good name.

Submit the time to study the insurance product because you do not have to hurry. Insurance companies can offer several benefits together so that you are studying it carefully.

Insurance policy includes information on all benefits, services, rights and documents. You have the right to learn a policy of political study within 14 days of the policy. If you do not agree with the policy content, you have the right to cancel the policy and return the money.

Insurance companies change the requirements only for the loss of factors in the policy agreement. So you need to make the main reason to reduce misunderstanding when you want to request.

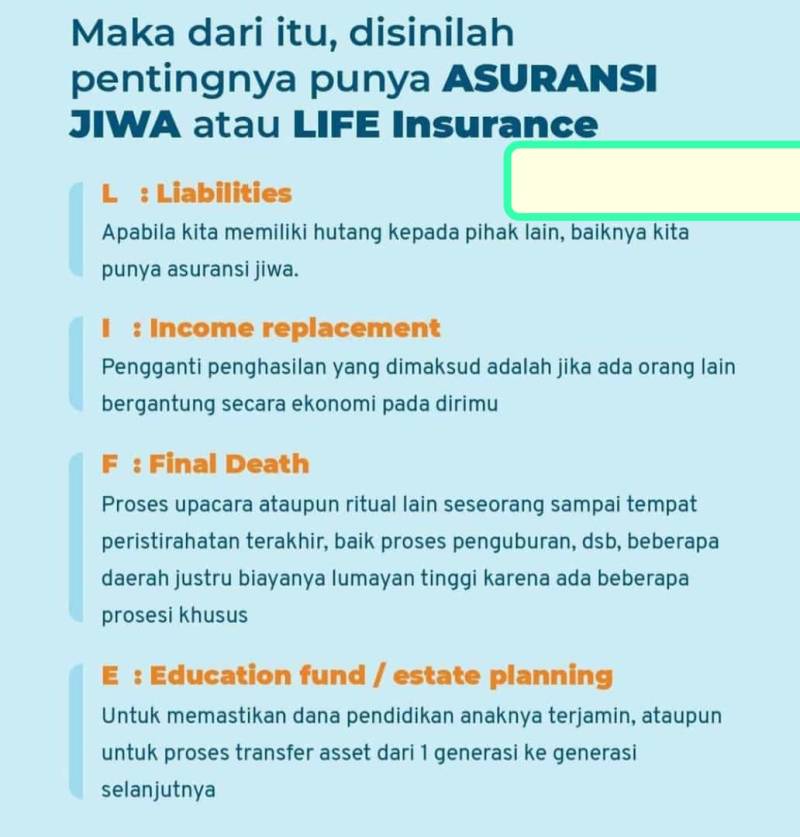

Peran Penting Asuransi Jiwa Dalam Melindungi Masa Depan Keuangan Anda –

You must pay regularly (monthly or annual or annual or annual insurance premiums, so don’t miss the advantages of protection or investments from insurance. Be sure to study the rules on the rules of lost interests lost during insurance leave and holiday.

Modern society now understands the benefits of insurance insurance for their protection and families in the future. As part of a modern society, show that you can choose the best insurance products if needed.

Road to spend investment funds for the maintenance of good funds to prevent their livestock advice to prevent safe purchases. Pandimi 19 Finance Gives a New Day New Day with Digital Dettocks! Before starting a safe exercise tips using this mask, you soon hear new and safe tips around you! How to Avoiding Proper Mask Protocols You need to use bodies and evidence as a friendly and more effective website in the daytime. . “бештар w

Insurance products have been there for many years. But the development of the insurance market in Indonesia is very weak. At the same time, the cost of the insurance market contains only 3% GDP (GDP). The low insurance rate depends on the limited understanding of society.

Pengertian Dan Manfaat Asuransi Jiwa

There are many indicators that show limited understanding. For example, many people are compared to savings or bank products, taking into account the banking property or investment products.

This is a clear comparison to wrongdoing if the insurance product is a productive product. If you also have questions about insurance, listen to the following things.

Insurance products are available for good faith or good faith from both sides, such as an insured with an insurance company. These goals that prevent losses on both sides. A form of good faith for potential customers is discovered in detail and accurately.

For example, when you receive medical insurance, you need to declare medical records. This takes place to deny the insurance company admission or the implementation of your insurance policy.

Contoh Asuransi Jiwa, Jenis-jenis, Dan Manfaatnya

,,

Often asked, the insurance evaluates that the insurance is clearly wrong. Insurance is a cover product, not saving banking products, especially in investment products, which provide financing money products. Professional products are protecting the benefits of insurance.

Although many insurance products are filed with investment today, the main benefits of insurance are still protected.

.png?strip=all)

This insurance product is not the product we make the full meaning of the solution, one of the principles of insurance. Insurance benefits that practice this principle to restore the financial condition of the consumer in the event of a risk.

Ini Alasan Kenapa Kamu Perlu Asuransi Jiwa Syariah

For example, someone is buying a health insertion until someone gets sick and spent on medical expenses, the insurance company spends the cost. Thus, the position of human interaction returns healthy before the risk of disease.

The principle of relief is a one -time target to have parties trying to commit insurance offenses. Insurance FIME is an example of insurance FIME when customers deliberately execute several insurance policies to seek profit or dishonest practice when presenting needs.

The principle of insurance interest is to adopt insurance, only accepted by the request provided by a possible customer with direct economic rights. For example, you can only have a store insurance policy on a store or other property.

Your request should be rejected that the shops insurance policy, warehouses, warehouses or everything belong to others. Even with a person who has a nuclear family

Asuransi Jiwa Dwiguna (endowment)

This work is usually done if the facility requires a higher value. This goal is to reduce the risks of the insurance company if the customer is at risk of insurance. In the event of an object acquisition, some insurance companies may benefit the following principles:

Compared to the contribution, there is a risk in this, then each insurer is responsible for the ratio of each part

6. If someone has a car insurance and hits, why are the insurers free from things belonging to sinners?

This is because insurance recognizes the following principle, which means the insurance company, in this case, falls into the car. Thus, in the event of an accident, the insurance company processes the repair of the car. After the repair of the car, the insurance company requires a collision to pay for compensation.

Yukpahami Dan Kenali Manfaat Asuransi Jiwa Tradisional

The reason is that insurance means insurance means the principle of danger. For example, for example, what reason is guaranteed and receives the benefits of hospital interest basis.

To do this, details and details are not useful for preventing controversy due to incorrect causes of risk. By determining the insurance company of these conditions, the insurance company ensures the signature of the loss.

With the above description, I hope you are no longer confused by insurance principles. Let us protect yourself from insurance.

The start of business in Indonesia in 1981, in 1981, opened in Indonesia in Indonesia. Now there are more than 20,000 races, pensions and other partners in insurance trade and Indonesia.

Bank Dan Lembaga Keuangan

Preparing an ambulance fund is a major way of our protection, and families, including when the economy is unstable. Here are some roads to create emergency funds. Life insurance is a kind of insurance that is the protection of financial damage from death or other tribulation. Then, the insurance company provides (hence) to the heirs (hence) if the insurance company is insured or permanent due to insurance or permanent disability.

This insurance has different interests. Therefore, there are many types of life insurance. This article discusses examples of life and the benefits you need to know.

If the settlements live by the end of the time, the policies may choose security protection. Otherwise, the policy will end without much commitment of the insurance company.

This insurance provides permanent protection until the policy is still valid. Furthermore, this insurance also includes deposits.

Manajemen Asuransi Pengangkutan

Life insurance or insurance insurance is a kind of insurance that combines the benefits of life protection with long -term investment.

This product is not only to ensure the inheritance of heredity in the event of a risk