Asuransi Usaha Adalah – League Insurance – Dear readers, how are you? We hope your business is not running smoothly and achieving the best results this year.

This article is inspired by current facts that have insurers in Indonesia and in the international market that experience financial difficulties. One of the reasons is the result of SAVID-19 crisis that happened almost 3 years ago.

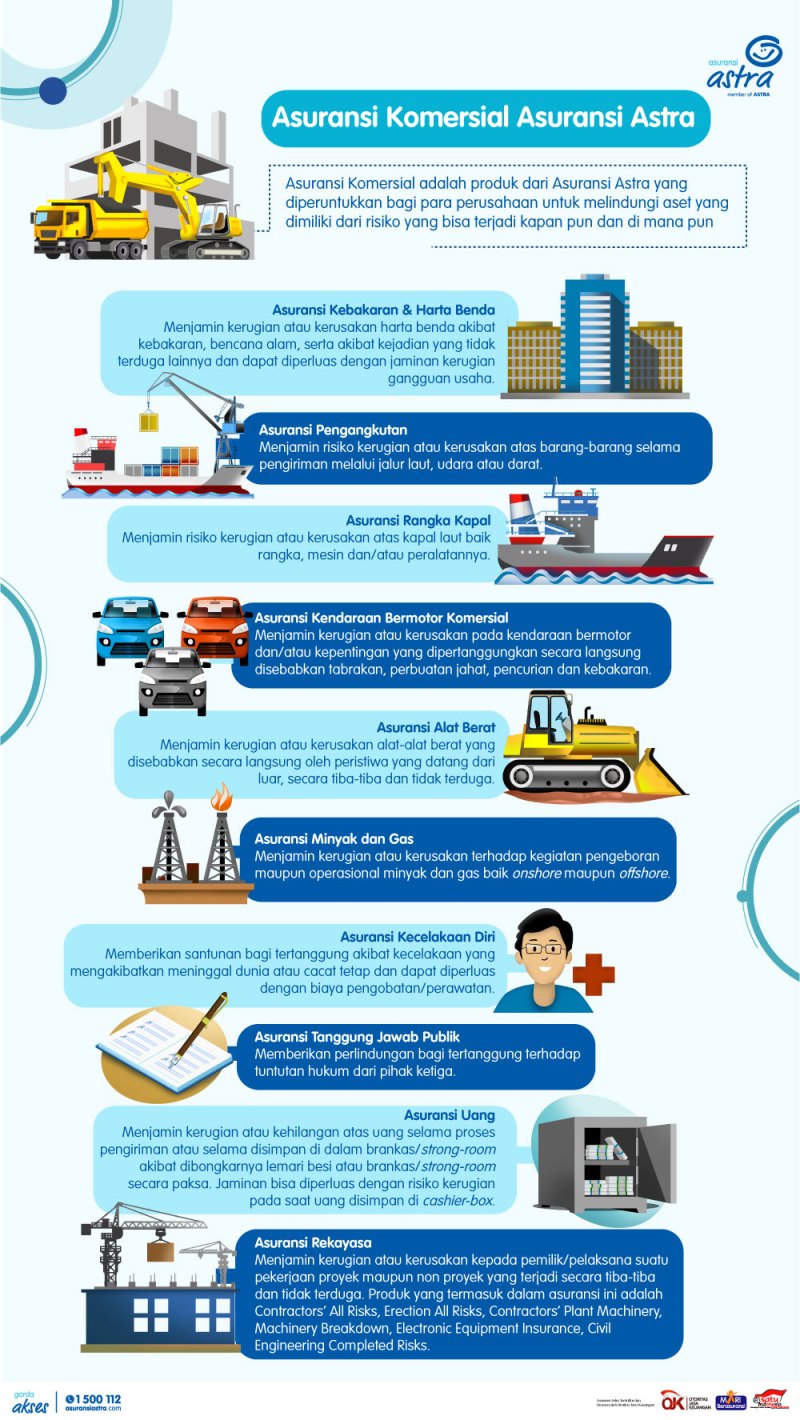

Asuransi Usaha Adalah

Therefore, we must be careful in choosing an insurance company, if the wrong decision can cause your accident to be unpaid, or even if not expected as expected.

003 Proses Bisnis Asuransi Kesehatan

As you may know that the purchase of insurance is a big decision, which is why choosing the right carrier is important. So how do you get if the carrier is good or not? Our articles will help you identify quality insurance companies. You will be easier to decide which to choose.

Basically, the purchase of insurance can be very difficult. Definitions, conditions, scope, exception and support can cause confusion and can make you dizziness.

Imagine losing everything you have for fire and you are not sure to bring your life back on the right path.

When you ask people who are insurers, they usually happen, “I don’t know” or give me the name of their brokers.

Asuransi Dan Usaha Perasuransian Di Indonesia

For your consideration, whether in your home, your car or business has a loss, the last thing you want to do is find out who your carrier is and who your broker and how to help you when your life is upside down.

For your information, not all agents and mediators of insurers and insurers have permission to work in Indonesia. According to the rules, you can only buy licenses from the Indonesian financial (OJK) organ, because in this way you can count on OJK to help you if there are problems. To find out what companies are licensed in your country, contact the State Department.

Credibility is one of the key types of a good carrier. The well-insurance company is dedicated to its customers and remains loyal to its mission.

Does the carrier have a good reputation in this industry? Does the carrier have a good cash notion? Do their partners / intermediates and customers believe and remain justified? Are they fulfilling their promises? How long have they been established? These are some of the questions you need to explore.

Bisnis Dengan Asuransi

The main reason for buying insurance is to find peace of mind. You want to make sure that if you set a favorable situation, your insurance company will have to protect you on the road so you can focus on returning to property. Therefore, seeing the financial situation of the carrier is very important.

Check that they pay prior request and how did it promise? They have a solid request on the request? Who is the guarantee of the show?

There is no way you find a company with just a positive review. If information does not answer all your questions or feels true, test other companies. Like other purchase decisions, you must feel comfortable with your decision.

If there is a difficult situation to claim, you do not want to hear your insurance company that you cannot pay for your condition due to bad financial results. Many insurance companies work with independent rating agencies that review many factors and financial results in order to determine the value or outcome of the letters.

Rahasia Kesuksesan Di Balik Pendirian Perusahaan Asuransi: Panduan Lengkap Dari Pengertian Hingga Struktur Organisasi

You are buying insurance to find you and ensure peace of mind. Choose a company that will probably be financially healthy for many years, using ranking from independent rating agencies.

Leading insurers continue to run importance and expats, ensuring that their products are competitive. They develop the products to suit changes in the customer’s life. Ask yourself – can they provide flexible options so customers can choose and choose what they need? Can I pay only that, in terms of level and area of protection? What is involved in politics? How much is involved in politics? Politics ensure that customer needs need? Does it provide automatic update?

Many companies sell insurance policies and prices are very different from one to the other, so it really pays for purchases. For certain types of insurance, OJK can provide guidelines that show what carrier brings for different rules in different parts of your country.

Although the price must be considered when buying insurance, it should not be the only one. Remember the former proverbs, “You get what you pay.” There are many reasons why prices are between insurance operators.

Mengapa Sebuah Tempat Usaha Harus Memiliki Asuransi ?

Lower prices may mean you have fewer bands. Less protection means more money in pockets when there is a loss. Lower prices may also mean that insurance operators enter the new market so that it may have no experience to have other insurers.

A good insurance company will always make sure you get good money. Find out if the carrier has a different cost structure at each special target audience.

You should feel comfortable by buying your insurance, if you buy it from the local broker, directly from the company by phone or online. Verify that a broker or company will be easy to reach if you have questions or must submit a request.

Your insurance company and its representatives must answer your questions and provide the requirements properly, efficiently and quickly and quickly. You may feel whether this is a problem with conversations with other customers who have used a particular company or broker.

Alur Klaim Asuransi Usaha Tani Padi

Research and choice that insurance is most appropriate for you and your property is a very demanding process. So it is important that the carrier is clearly in communications.

This includes a clear explanation of the fees, using terminology and standard definitions and informing members of the reason behind the premium inflation. In addition, providing required information to consumers for product evaluation is clearly presented in general format facilitating simple comparison, there is a clear procedure for requests, etc.

Credit rating of insurers is an opinion of an independent institution regarding the financial force and ability of the company to pay claims on political owners. This does not show how well the security performance of the carrier for investors. In addition, the assurance of insurers is considered an opinion, not done, and the same ranking of insurers may vary between classified institutions.

There are four main rating of institutions of insurers: mood ‘. The best am, Fitch and standard and poor (all except A.M also best provides credit rating companies for investors). Each agency has its own ranking scale that is not always the same as ranking of other companies, even when the ranking looks similar.

Sosialisasi Asuransi Usaha Di Desa Yungyang

Credit ranking from insurers is important because many people and businesses depend on insurance companies to pay their demands when they suffer from security losses. Insurance risk is usually a risk that will cause high financial loss if not assured. However, insurers can only pay if they have money. As other companies, insurance companies can go bankrupt.

As you can read from the description above that there are at least 10 things you need to know in choosing a carrier.

If you make a correct choice, then the accident you may suffer from should be replaced by insurance and will not pay because the carrier cannot be paid.

Insurance brokers are still updated with the development of the insurance industry. Continue to follow every change in the state of all existing insurers. Insurance brokers will only choose the best insurers that meet almost all of the above criteria.

Arah Baru Asuransi Kredit, Mampu Selamatkan Asuransi Dan Perbankan?

– Looking for insurance products? Don’t waste time and also contact us L&G phone 24 Hours: 0811-8507-773 (Call-Whatsapp-SMS)

Taufik arifin has over 30 years of experience in the insurance mediation industry. It has an insurance certificate and financial institution New Zealand Australia (Anzifi Snr.assoc) CIP and Indonesian Certified Broker (CIIB). Follow the Instagram author to get to know each other better: @ Taufik.Arifin.31 working as driving in a full curved row. Although you are careful, the risk may come at any time. Here is the importance of protection such as business insurance.

Consistent such as fire, flood or theft can be destroyed importantly for business reasons. Without insurance coverage, repairs or losses that occur can be very large, even at the risk of bankruptcy bankruptcy.

Then what exactly is business insurance and why should their business owners? Come on, see business insurance in this article!

Bem Km Fp Unand

, is a type of special business protection from financial risk due to unexpected events during business. Starting in natural disaster, lawsuits, accidents, operational illnesses can bring this insurance.

Simply put, business insurance helps business owners to prepare for the worst possibility without getting lost. Therefore, insurance is not an additional burden, but investment is important for a safer business future.

For business owners, and small, medium, to large extent, business insurance can provide many real benefits, including:

Properties such as buildings, supplies, operating machines, can be damaged or lost due to fire, flood or flight. The insurance will provide financial compensation so you do not need to submit all the losses yourself.

Asuransi Dan Usaha Perasuransian Di Indonesia

When this effort is exposed to major disasters, not some people finally must stop temporarily stop working. With the right business assurance, the costs appear when the business is diverted by insurance so that the operation will increase immediately.

In doing business, the risk of lawsuits is still there, for example from customers, partners or third parties. Liability insurance (

Employees are important funds in business. Some types of business insurance also include employee protection, such as accidental injury or collective health insurance. This method can increase its loyalty and productivity.

No indirect insurance, work