Banking Number On Check – The route number, officially called the ABA Routing Transit Number, is a series of nine digits that match a bank, fund or other financial institution. You use the number to route the account number with an account number to make an electronic payment or write a check.

The check route can be found at the bottom of the front of the check, next to the account number and below the note and signature lines. You can also find the route number by entering your online bank account and checking your bank statement. If you do not have access, you can get your route number by contacting the bank directly.

Banking Number On Check

You can use your bank account to make and receive payments. But to start a transaction using your bank (or credit cooperative), you need two information: your account number and your ABA route number.

Routing Transit Numbers And Account Numbers: A Perfect Banking Duo

Your bank account number must be maintained, except when used in a transaction. It has between eight and 12 digits, depending on your bank or cash register. Your savings account will have a different account number from that of your current account, but your check and savings account must have the same route number if you open them in the same place.

Your route number is public information. You can even find the route number online by going to the US Bankers’ website (ABA) and using its search feature or just on Google your bank name plus your condition. Consider the route number as a shared address for all branches of a bank or private fund in your region.

The route number shows where the bank account is. Each branch of a bank in the same place uses the same route number. For example, the route number for all pursuit banks in New York is 021000021; If your bank account is pursued in Brooklyn, your checks will have a route number 021000021. But if you have opened your account at a Montana pursuit bank, your checks will say 044000037 for the route number.

Your ABA route number is at the bottom of any personal check issued by your bank. You can also contact your bank’s website. The route number may be indicated on the page itself or you may need to find it in your bank statement. You can also call or send an email to your financial institution for this information.

What Is A Routing Number…

The number for routing controls can be surrounded by other figures, so it is important to distinguish them. In addition to the route number, you can see some of the following:

The nine digits for your route number must be entered every time you use your electronic payment bank account. The types of transactions and the following transfers require both an account and a route number:

The route number will identify your bank to the Payment Treatment Center – Automated Compensation House (ACH) – and will inform it that the account belongs to a specific institution in a particular area.

You may not always need your route number every time you are in cash or drop your check on a branch. This is because you are already on the site, so as long as you have your debit card and your PIN, you need to have access to the account.

Indian Bank Balance Enquiry Via Online, Missed Call, Sms, Mobile App

Zack Sigel is a former editor -then on who controls our mortgages, our taxes, our loans, our banks and internet users. Route number is a key element of all types of bank transactions. In addition to the account number, he points out to the banks where the money should go or come during a transaction.

It may be useful to know the route number of your bank account for a number of reasons. And you can search for a check number number. Add to your financial knowledge by learning more about the routing of figures and how to find them.

The route number is a set of nine -digit figures that work as an identifier or bank identification number or cash register. The American Bankers (ABA) Association attributes the route of financial institutions with bank accounts of the Federal Reserve.

Larger national financial institutions can have a different number of routes in different states. And some banks may have separate electronic transaction routes – known as route number of automated compensation house (ACH).

Huron Valley State Bank > Quick Links > Routing Number

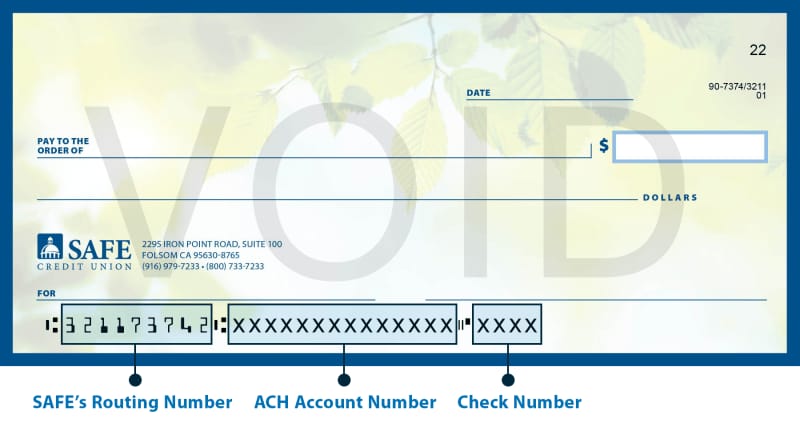

The route number on the inspection is the first group of numbers in the lower left corner. She has to withstand nine figures. The second set of numbers is the account number from the time, and the third set of numbers is the check number.

If you are a Capital One client, here’s how to find your route number on your Capital One account.

The route numbers are essential to ensure that the funds go or come from the right financial institution during a transaction. You may need to use your route number for:

The route numbers are nine -digitic codes that identify banks and other financial institutions. The route numbers are needed for many different types of bank transactions, so it’s a good idea to make sure your routing number is correct. If it is incorrect, this may prevent the transaction from continuing. You can find your check number online, or by contacting the bank.

Account And Routing Number Information

If you are new to banking services, there is even more to know more about checks. Here’s how to make a check to help you get started. He works with many financial advertisers to present his products and services to our audience. These brands compensate us to announce their products in messages on our site. This reward can affect how products and where products appear on this site. We are not a comparison tool and these offers do not represent all available deposits, investments, loan or credit products.

“The editorial team is committed to presenting you criticism and impartial information. We use methodologies based on data and service evaluation data – our opinions and notes are not influenced by advertisers. You can learn more about our editorial directives and our methodology for researching products and services.

With the advent of Venmo and Cash App, it may seem that paper checks may look if the last century, but that doesn’t mean you no longer need to know how to read a check. Some online transactions require understanding where to look for important information when verifying. For example, you can find the route and your check account so that you can configure a direct deposit or organize a bank transfer to your account.

In the upper left corner of the check you will find the personal information of the person to whom the number belongs. This usually includes their name and address.

Finding Your Wells Fargo Bank Routing Number

On the beneficiary line you will find a text that reads “Payment for the order”. This is the person or company to whom the money will be paid. If your check is done, you are the beneficiary. You will need to approve the check by signing your back when you are ready to collect or put it. Do not approve of it before you are ready to collect or deposit it.

Inside the dollar box, you will find the amount that the check deserves to be written in numbers. Write your amount like this: $ 20.65.

Start writing as close as possible to the left side of the box with the corrected dollar signs compared to the first issue. You don’t want anyone to change the check to $ 2220.65.

Write the amount of dollars in words in this order, which is below the beneficiary line. However, the census will always be in the format of the number. For example, the sum of the amount will say “twenty dollars and 65/100” for a check that amounts to $ 20.65. It must match the amount in the dollar box.

Account Number On A Check: Where To Find It

If there is room in this order, after writing the total amount, you can go through the rest of the space so that no one can adjust the amount without your knowledge.

The notes line is optional, but it is a good practice for following check payments. The note line is used to account for the cause of the transaction. For example, a tenant may write “March 2025 Back” on the notes line when writing a check to its owner.

Sometimes the paid part can indicate when the beneficiary should collect it. For example, you can make a check on March 5, but write March 15 on the date line. This is often done if the account funds will not be available before a certain future hour.

Although the beneficiary can potentially accept this as a waiting direction before removing the inspection, the inspection is valid from the moment it is signed by the transmitter. The beneficiary should not wait for the date on the date to collect the check. If the beneficiary tries to collect the check before the date of this line and the check bounces, the person who wrote the check and the one who may face the cost of his bank.

What Is A Bank Identification Number (bin), And How Does It Work?

If you have any questions or concerns about check, you can contact the bank listed on the check.

Some important control numbers are at the bottom of the check. One is the route number –