Banking Routing Number – If you have a bank account, you’ve probably heard of routing numbers. Now you are looking to understand the part they play in the banking process. Neede You need access to your bank account to ensure not only your routing number of your bank, but also your account number. Your routing number is usually not used often enough to remember or always continue, so you know how to find it can be useful immediately.

Routing number consists of nine digits that identify a specific US bank or credit union in a financial transaction. Game when you do things like planning of electronic payments, setting direct deposits or sending and receiving electronic payments through mobile programs.

Banking Routing Number

Routing figures are also called ABA routing numbers, which refer to US bankers, which is responsible for the allocation of each financial institution.

How To See The Routing Number In Bank Of America (step By Step)

The root numbers are used only in the United States and shows that the financial institution has an account with the Federal Reserve. This also shows that the account is authorized at a federal or state level. Large national and multinational banks may have more routing numbers, but some banks and credit associations have only one.

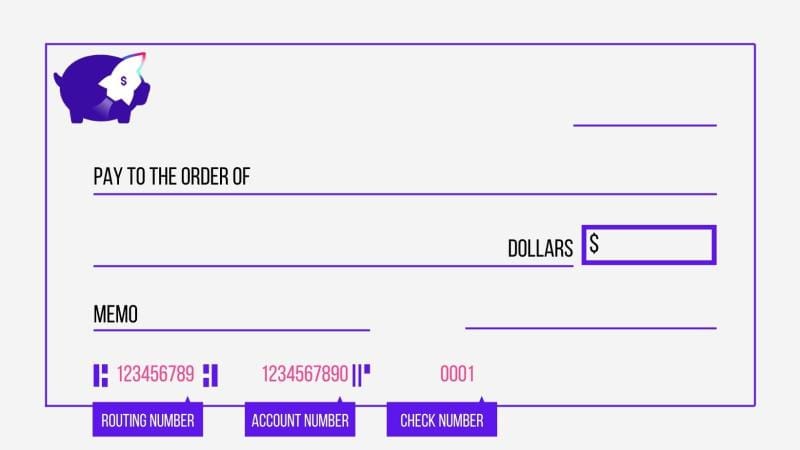

If your control account comes with paper checks, this is one of the first places where you can look for your bank routing number. Find your routing and account number at the bottom of each of your checks, as shown below.

No check? No problem! There are several ways to find your routing number without using a physical check.

Once you log in to your account, you can usually find your routing number in the account details.

How To Find Your Routing Number Vs. Account Number

The bank’s Bank Tell must be able to provide your number of routing personally, by phone or on the driving window.

The number of routing your bank and account number are necessary to ensure that money is deposited or withdrawing from the correct account. In the simplest terms, routing numbers indicate which bank is your account, while account numbers are your only identifier in this bank.

Account numbers are assigned to each account you own. For example, if you have a check account and austerity account in the same bank, they would have different account numbers, but one routing number. Your account -number provides access to the funds you have kept in your account so you want to keep it safe.

Now that you know how to access and use your routing number, you go well to make your transactions. Happy banking! Routing Bank number is a nine -digit number associated with a particular bank or financial institution, while your account number is assigned to your bank account. You may have more accounts in one bank, each with a single account number, but the same number of routing.

Where To Find Bank Account And Routing Numbers

The number of routing your bank The calculation check number is used when you write a check and send or receive electronic means. The routing number identifies the bank, while the account number identifies the account due or credited that bank. Discover how your account works and routing and how to locate and use them.

When you open a bank account, you get a unique account number and the bank’s routing number. You can find both at the bottom of paper checks or your online account. To make many financial transactions, such as setting up a direct deposit or online order checks, you will need routing your bank number and your account number.

Account numbers are similar to customer identifiers or fingerprints specific to each account owner. Account -Numeres are designated to indicate exactly where the transaction finances originate from (obliged) or the final destination for finances (credited).

Similarly, routing numbers identify each banking institution. The root numbers are nine digits long, and account numbers are usually between nine and 12 digits, although some may be longer.

Accounts And Account Numbers — Increase

Whenever you make an electronic financial transfer through a bank, the number of routing and accounts must be given to relevant financial institutions.

The number of routing is a string of nine digits used by banks to identify specific financial institutions in the United States. The number of routing is also called the number of routing or the number of ABA routing, short for the US banking association.

The number of routing proves that the bank is a federal or state table institution and maintains an account with the Federal Reserve.

Routing numbers ABA were sometimes used with paper checks, and ACH routing numbers were linked to electronic transfers and accounts. However, most banks today use one number of routing for all transactions.

Where Do You Find The Routing Number On A Check?

The control also contains a symbol of routing in the upper corner, usually just below the individual check number. This symbol is usually three or four digits and also identifies the bank. Don’t use much more.

Different number of routing is used for domestic and international wire transfers. In other words, you cannot use the routing number listed at the bottom of your checks. Contact your financial institution or check their web site for approved routing numbers for international transfers.

Small banks generally own only one number of routing, while large multinational banks can have several different, usually based on the state where you have the account. Routing numbers may be required for the following:

Account -number works regarding the number of routing. While the routing number identifies the name of the financial institution

Golden Bank, N.a.

Account – number – usually between eight and 12 digits – identifies your account. If you have two accounts in the same bank, routing numbers will usually be the same, but the number of your accounts will be different.

Anyone can locate the number of bank routing, but your account number is unique to you, so it is important to store it, just as you would do your social security number or a PIN code.

To protect fraudsters from access to your accounts, create a strong password of at least 12 characters for your bank’s web site and payment programs. Choose security questions for which you know the answer and use multi-active authentication.

You can find your account and routing numbers on the lower left side of the paper checks issued by your check account. Alternatively, you can often find the number of routing when logging in to the Internet Bank portal.

How To Find The Routing Number Of Icici Bank (how Do I Get The Routing Number For Icici Bank?)

Since the number of routing your financial institution is not unique to your account, you can find it online. Just make sure the page you are using is the one owned by your bank or credit unit.

If you need to know your routing numbers and accounts and have no useful check, login to your bank’s website or program. On your account page, click on the full account number that must display the routing number. If you can’t find them, call your bank for your account number and bank routing number after controlling your identity.

At the bottom of the check, you will see three groups of numbers. From left to right, the 9-digit routing number usually appears first, the account number second, and the number of thirds specified. However, these numbers can sometimes occur in a different sequence of coffin checking.

These series of numbers are embedded in magnetic ink, known as your check (recognizing magnetic ink sign). Maker pronounced, magnetic ink allows for processing each bank to read and process account information.

Bank Routing Numbers Database 1.0.2

You can find the two series of numbers in some places, including your checks, a banking statement, your mobile bank application or the bank’s website. The root numbers are usually printed on the left bottom of your check followed by the check number number.

The routing number appears first, followed by the account number. This is because the routing number is how a financial institution is identified and, attached to your bank account number, can be used to find your account.

To get money from a direct deposit, the person or institution making the deposit will need your bank’s routing number, along with your account number, to get the funds.

While no banks will have the same number of routing, large financial institutions may have more routing numbers specific to the state or the location of your account.

What Is Main Street Bank’s Routing Number?

Iban is the number of an international bank account, a global standard for sending bank payments. It consists of 34 alphanumeric characters that identify the country, bank, branch and account.

North American, Australian and Asian countries do not use IBA for domestic monetary transfers and will only do so when sending payment to an Iban country.

The number of routing your bank is linked to a separate bank or financial institution, while your account number is only related to your bank account. If you are not sure how to distinguish between routing and account number, contact your banking institution. Remember to double check the two numbers whenever you give them to the other side to make sure the transaction goes smoothly.

They are looking for writers to use basic sources to support their work. These include white papers, government data, original reporting and interviews with industry experts. We also refer to the original research from other respectable publishers, where properly. You can find out more about the standards we follow