Banking Value Chain – Retail banking has entered a new era – featured by fast digitalization, consumer expectations and developing competitive landscapes.

Customers were loyal to their surrounding bank branch, the days have long been gone. Today, customers hope that banking services will be available at 24/7, at the tip of their fingers. Due to the finite disruption of the traditional region sector and the disappearance of digital-first banks, retailers need to be newly defined their price proposal to remain competitive.

Banking Value Chain

Retail banking value chains in the center of this transition. This strategic design outlines the main activities needed to provide banking products and services, manage the risk and provide customer skills.

Blog: Open Banking And The Future Of Card Payments

In a world where speed, benefit and protection are universal, banks need to make every aspect of their value discipline to create the same value for their customers and shareholders.

Retail banking is the spine of how the banks work and how they produce values. This is a design that ensures each process-consumer-fossing or hiding behind the screen -work integrated for the provision of excellent service.

This is not only about the operation but also to increase the trust, take the risk and ensure the adherence to a highly controlled environment.

For retail banks, integrating both primary and assistance activities allow them to provide unpaid, protected and innovative services to today’s customers. In this new banking era, the ability to balance skills with continuous innovation has become the key to survival.

Financial Services Platform Playbook

Most of the serious activities of the retail banking value chain are particularly important in today’s environment for financial transactions and fraud prevention.

These 2 activities create not only the customer’s satisfaction but also the basis of confidence, which is essential to maintain a long -term customer relationship.

Processing transactions may seem like earthly activity, but this is the most important thing for retailers. Customers expect their transactions – transferring money, bills or deposits – will be quick and without any friction. The process of nuclear transactions is well reflected on the quality of the bank’s overall service. Banks investing in modern transaction platforms are capable of operating high electricity, giving their customers confidence that their money is always safe and accessible.

With the growth of digital wallets, mobile banking and non -communications, parts of the process are never much higher. Retail banks should ensure that their systems are not only faster but also palate and safe. Failure to supply these fronts can cause confidence loss and customers can be transferred to more cute fintech contestants.

Back Office Activities In Banking And Financial Value Chain Ppt Example

Some things are important in the world of retail banking. Customers trust banks to protect their financial information and prevent unauthorized access to their accounts. Preventing fraud, therefore, is a negotiation aspect of the value chain. Since cyber threats are further sophisticated, retailers should constantly develop their protection protocols.

Modern fraud resistance depends on AI and Machine Learning Algorithm, which monitors transactions for suspicious activities in real-time. By analyzing samples and anomalies, these systems can flag potential frauds before the bank and its customers’ protection. However, banks must maintain balance – a strong security system should be applied without creating unnecessary friction for the customers. The best banks to prevent frauds create a smooth, protected experience, trust and loyalty.

Retail banking is no longer about providing basic financial services; This is a digital-first, extremely competitive market before it is curved. Innovation is required to maintain speed with increasing consumer expectations and to meet the challenges caused by fintech disruption. Banks who have been successful in this new landscape are adopting technology and use them to create better, more personalized experiences for your customers.

Digital conversion is at the center of retail banking innovation. Banks are quickly receiving digital equipment to increase everything from customer service to back-end operations. For example, AI-based chats are now searching for a lot of regular customers, freeing human workers to focus on more complex issues. Also, mobile applications that allow customers to manage banking transactions at any time at any time, now there are values.

Digital Banking: Separating Leading Banks From The Rest Of The Pack

Personalization is another main area of innovation. Today’s customers expect more than cooking-cutter financial products. They want to be properly resolved according to their unique financial needs. By taking advantage of data TICS nalitics, banks can provide personalized services to provide customized loan options from recommending investment products based on customer financial attention. This level of personalization only increases the customer’s satisfaction and also increases holding.

Open banking is an emerging trend that changes how retailers run. With the permission to access (with their consent) customers’ customers of the third party, the open banking has enabled the development of innovative financial products that provide more preferences and control their money. A new door is being opened for the spouse’s retail banks, allowing them to partnership with the fintech companies that provide them with sophisticated services.

Finally, Blockchain has begun to make his mark in retail banking. This technology is likely to be revolutionary to strengthen cryptocurgence, how banks deal and manage data. By creating a safe, transparent account of the transaction, blockchane can reduce fraud, reduce the flowing process, and provide customers with high levels of integrity of their financial information.

Retail banking is one of the world’s weighty controlled industries and continuous reasons. Banks are responsible for ensuring that large numbers of sensitive customers manage data and are safe and legal. Regulatory consent, hence the retail banking value is an important part of the chain.

75% Of European Banks To Move Parts Of Payments To Saas

For regulators, data privacy is with the highest concern, especially the increasing number of cyberpates and data violations. Due to rules such as General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA), banks apply strict requirements on how banks collect, store and use data. For retail banks, following these rules means investing in powerful data governance framework that ensures data protection at every step of the standard subject.

Another main area of consent is the money laundering (AML). To prevent illegal activity in the financial system, retailers should apply strict AML methods. This includes everything from the customer to the ongoing observation of the account activity for suspicious behavior (know your customer) from the customer. Failure to comply with the AML rules can lead to heavy penalties and more importantly, the confidence in consumers and controllers can be reduced.

Open banking also introduces new consent challenges. While banks are starting to share customer data with third -party suppliers, they must ensure that all parties participating are completing the same high quality data protection. To ensure the regulatory consent of the open banking ecosystem, close cooperation is required to cooperate with banks, fintech companies and controllers.

Finally, banks must navigate complex financial rules, which runs everything from ning to capital. These rules agree to maintain financial stability and make sure the customers are safe in financial crisis. Retail banks must be at the top of developing regulatory requirements for long -term success.

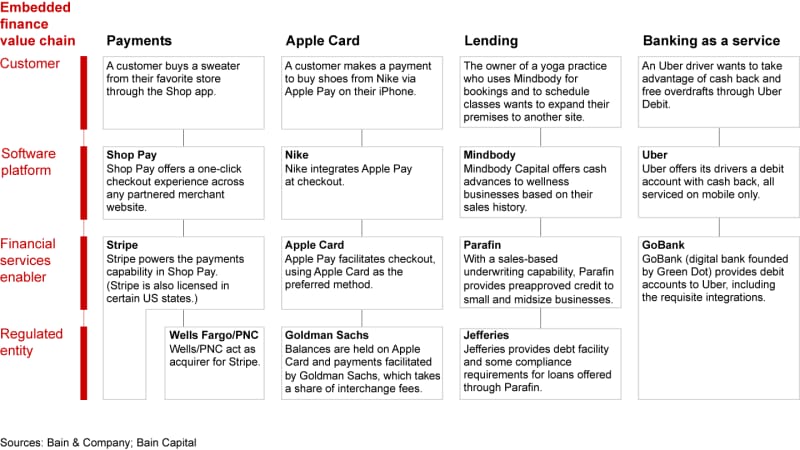

Embedded Finance: The Dilemma For Incumbent Banks • Definex

Invest in modern transaction platforms that provide customers smooth access, skeletons and safe, financing them for their financing.

Use AI-power fraudulent detective mechanisms working in the background to monitor suspicious activities without adding friction to the customer’s experience.

Leave data analyzes to understand the behavior of the customer and provide the right products that adjust their financial goals and needs.

Embed up with the process of developing a product by working closely with legal and compliance parties that meet new measures.

Open Banking Apis

Blockchain provides skills in increased protection, transparency and transactions, reduces the risk of fraud, and creates customer confidence.

Apply strong data governance framework, invest in protected data storage solutions, and review regular consent protocol to meet the latest regulatory values.

In the meantime the user enhances the interface, expand the service range through mobile and online platforms and ensure high level protection.

Fintech is interrupting, increasing customer expectations, and in the world of strict rules, banks should constantly develop each aspect of their activities. This is an important role in prolonged success in increasing digital banking, improving fraud resistance or navigating complex regulatory natural views.

How Banks Will Profit By Rethinking Their Purpose

As the retail banking sector is changing, the banks of successful banks accept such innovative, priority to consumers -concentrated strategies, and maintain their promise with consent.

The fate of the retail banking is that of companies that can provide protected and personalized experiences – customers can meet them wherever they are and continue to join or sign in by clicking on their service, you have a user agreement, privacy policy and agree.

When a bank has virtually international, majority of payments, P2P transfer, zero transaction fees, communication cards, communication cards and bitcoins, ethrium and other cryptocurrency, the financial world will be faster and take steps to notice.

And what did not the notification revolve do. In the case of revolt money and affiliation, the first digital-cable bank for the consumer space is one of the banks. As a result, the value of the process from traditional banking to digital-bank banking is a complete example of the chain.

Generative Ai For Banking Value Chain

Rawlt Moves, Mons, Hellobank, First Direct and Digibank Dazzon (Economic Brand, 2021) have joined.

The biggest advantage for customers is that banks do not need to see, no line to test tolerance and have no attractive documents to deal with