Car Insurance Agreed Value Malaysia – The amount insured to protect the insurance may be familiar with the conditions that contradict the coordinated value when determining the insured amount of the market value. Understanding this is for you, especially for the car insurance policy. The selection between a controller and the market value will affect the amount of reimbursement in the future.

You must choose the right amount to ensure sufficient protection for your car to ensure your car insurance and road tax. Note the insured value, to have a disagreement with market value, to help the market value between the market value.

Car Insurance Agreed Value Malaysia

The protection of your car should be selected by the correct amount. But what does the insured amount mean? In simple terms, a person whose insured represents the insured amount of your car defined on the basis of the current market value.

Drive With Total Assurance

The amount of the vehicle for your car is usually affected by depreciation. You can select the correct coverage level, avoiding the control or unjustified circumstances, so you can guarantee enough protection for the car.

If your car is overwhelmed (or insurance), you will not be able to compensate to harm your car. In the event of an accident, you will not be able to fully fill in the insurance company. In addition, you:

However, if the coverage exceeds the market value of your car, you need to pay higher and excess insurance contributions.

In case of incidence of your car, the amount of compensation you receive restricts your car’s current market value.

Upgraded Honda Insurance Plus (hip) Launched

In cases, the insured amount is divided into two options – the market value is agreed. You can select one of these parameters depending on your needs and budget.

The market value represents the depositor’s insured amount on the basis of current market prices. The determination of this value is usually affected by the brand, model and car production.

Only illustration purposes can only be illustrated – circumstances or expenses, depending on politics and personal circumstances.

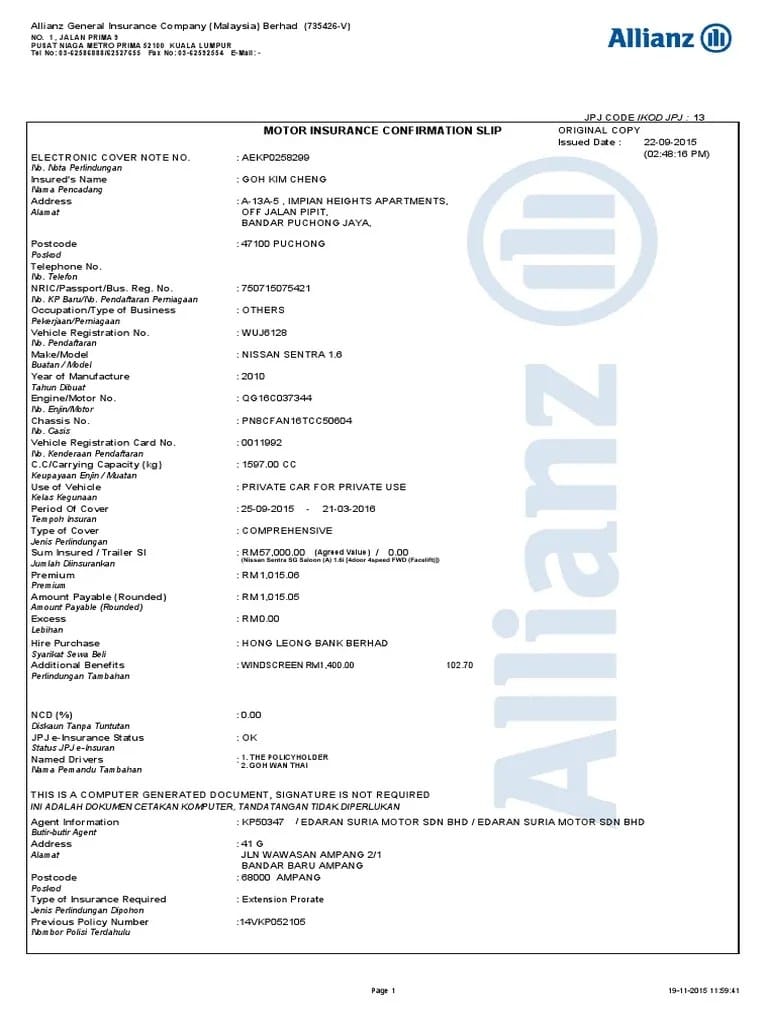

The value of the agreement means that you are insured between your car on the basis of an agreed meaning and the insurance company. The proposed insured amount is calculated in the event of a car model, year and purchase in the event of an insured.

Renew Your Etiqa Car Takaful Via The Etiqa+ App & Win!

In case of loss or total expenses, the insurance company will pay full compensation in accordance with the coordinated value. Even if your car’s car value is turned off, the size of this coverage will not change.

The market value agrees, agreed, agreed, agreed, and it is completely dependent on personal privileges. However, in determining the insured in your car, you can take the following factors into account:

The value, the agreed cost policy allows you to make up enough for you, allows you to degrade anxiety about depreciation or lack. On the other hand, the market value policy helps you save money if it is low.

The value that contradicts two opinions at market significance has their own benefits and shortcomings. This will be completely dependent on the needs of the person. It is important to understand the differences between these two policies for the correct and appropriate choice of these two policies.

Perbezaan Insurans “agreed Value” Vs “market Value”

Usually, the newest car will be rejected by the coordinated value. During theft or general losses, it offers fees better, but this means a little high awards. However, you can expand customer services on customer service providing customer service if you do not have an agreed value between the market value.

Comparison and insurance innovative platform, comparison to help you select the best insurance to your budget, needs, needs and insurance innovation platform. Buy Free Quote today, select your choice between the market value that contracts you!

As a tourist graduate, I wrote my love, and I was combined with my interest in learning others about financial and insurance.

The faith phone suggests you access to the best insurance and financial advisors. We leave the pesanan (message) and we will try to answer your questions and to ensure you can provide as soon as possible. As we explain the various vehicle insurance reward in Malaysia, we will use the purpose of notifying what these two means.

Understand Your Car Insurance Policy

If you have a car, if you have a car in Malaysia? The best way to coverage is

If your car is explained or completely disappeared, the insured amount appears.

The name of the vehicle at that time is based on the name. In January 2015, in January 2015, he offered to pay in January 2015 in January 2015. If you require the general loss or abduction of your car, then

However, the insurance provider is an agreed amount based on the year of your model and the year of your car. Check your car with a

A Complete Guide Of Loss Of Use Claim Malaysia 2023

If you need to demand a general loss, the amount of payment is based on your policies. One

, there is no threat to reduce the value of your car or overcome. However, like this, it ensures more than what has fallen, it will cost a little more in your premium payment.

However, there can be another point of viewing politics, because it will be your car cost. Eventually, deceive your car, for example, it must be based on the best coverage of the whole company, such as ALLIANZ.

It is better to prevent your car for injury to other parties against other parties to protect against other parties, which will protect against other parties to the fire and theft of the vehicle. In addition to the insurance of your car, it is good to achieve church with a improved 24 hourly help and a improved road of a reliable road to a reliable road.

Modifications That Make A Car Uninsurable

If you are looking for a second car, press this place for five tips to buy it. It seems that you wore your car insurance and you have met the confusion conditions. You do not consider the word “agreement”, “market value” and “the amount insured”, “market insured” and “the amount insured” when you decide to insure your car. When you read the car insurance products, you saw them in the investigation of the best car insurance plans.

If you buy first terms, especially the optional policy, it should be the first time. If you have filed a claim or complaint for the total loss, you will affect the amount of your choice.

If you understand the insured person, the coordinated value and the market value, you can choose the best insurance policy for your car, as well as to choose the best insurance policy for your own car.

Simply put, the insured person is determined by the value of your current market value as the sum of your car. Your car value will decrease each year and generally the cost of your selected value will decrease accordingly.

Piam Backs Jpj’s Call For Stringent Checks On Repaired Vehicles To Ensure Compliance And Roadworthiness

By choosing the correct level of coverage, you can ban your car to be excessive or guaranteed. If your car is saved, you will not be able to compensate for loss or damage to your loss. On the other hand, if you are insured, you will pay higher (and excess) reward. This is because the amount of compensation you receive is still restricted with your current market value.

As part of the buyer, you usually have two insured options: Market value or coordinated value. However, options depends on politics and insurance.

The insurance insurer depends on the current market value, depending on the “Current Market Cost”, depends on the current market value, depending on the current market value. Therefore, when you give the aim to a general loss or stealing, the insurer appreciates your own requirements, depending on the market value of your car.

The current market value of the vehicle is from different sources depending on the insurer. Some insurance services are Malaysia (ISM), and others can use their own information sources.

Ultimate Guide To Car Insurance In Singapore (2023)

The advantage of your car insurance-based car is the priority of your car, if you pay a cheaper rewards every year, you may sometimes be marginal. However, if you submit a general loss or theft, you can be less charged than the amount of your vehicle, your car would be written.

You also need to repay the lease loan with the help of your money, because with the help of your money after the whole settlement. This is especially the balance of a large amount of balance that is owed by the Bank.

Ali’s car was rated above RM50, 000