Car Insurance Betterment Fee Malaysia – Home »NCD, Improvement and rate through Auto NCD Insurance, Bestment & Recyss Rates in Car Insurance

Before buying politics, there are three main concepts that insurance and insurance insurance must be understood to introduce yourself. It’s NCD, improvements and extras. Although it seems easy for others, these concepts can be a source of chaos during the payment of new claims and policies because they include numbers.

Car Insurance Betterment Fee Malaysia

But worried, we haven’t gathered everything in one place, so you can easily refer it to it when you have doubts. Be sure to save this tunnel for future use. It can be very important.

Axa Car Insurance 2022: Everything You Need To Know!

Claim Discount (NCD) is a discount by insurance companies for insurance. Surrender is determined by the Insiransi am AM Malaysie (PiaM) to encourage safe driving. It acts as a reward/motivation for car owners and good behavior. Some people are also referred to as NCD as a bonus without any (NCB).

NCD rates for new vehicles start at zero in the first year of purchase and gradually accumulate on time. If no requirements are presented or placed against this policy, car owners can take advantage of a 55% high discount (from the sixth year), while motorcyclists receive a large 25% discount (from 4 years less).

Improvement fee has to do with the situation in which the insurance company may require a policy owner to pay the cost of changing the damaged part, even if the damaged part of the damaged nature was used or in the past. The reason is the idea of refinement or refinement – the idea that is changed now is “better” than in the past.

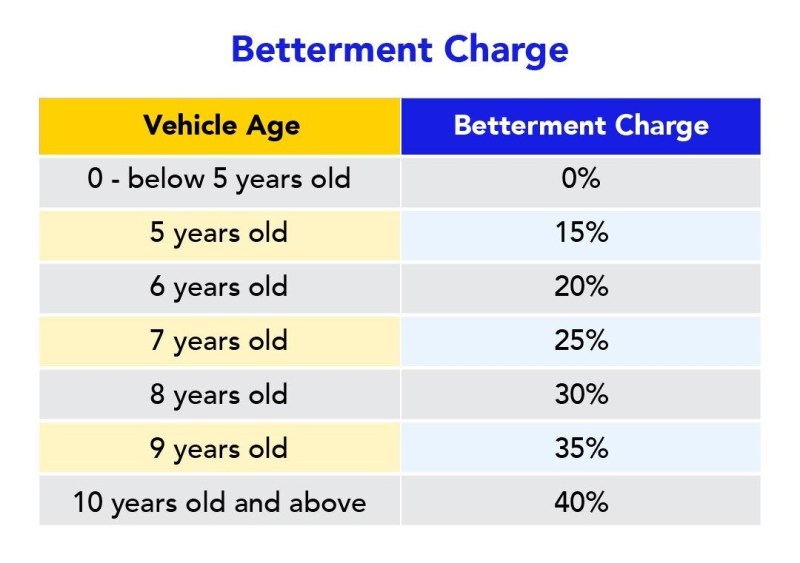

Improvement fee is usually charged for vehicles over 5 years. The minimum starts at 15%, while the maximum is 40%. The rate varies depending on the age of the vehicle as shown below:

Roadside Assistance & Insurance

Extra is the initial payment required by the previous protection of the preceding vaccine provided by the insurance. Depending on some circumstances, it is often consistent and necessary for policy owners.

Mandatory multiplication is a permanent amount (usually RM400) installed by insurance companies for young, high -quality drivers. Policy owners are forced to pay this amount if they fall into one of the types below:

It is one of the largest Malaysian web site by comparing insurance and offers policies from more than 10 products. Get free insurance offer from today! The purpose of the insurance contract is to restore the owner’s financial status to what it was before the accident. Improvements are used to replace the old part of the damaged car in the repair process. Improvement is the percentage of consumer costs that produce when the damaged part is replaced by a new natural component. Since the car will be in a better position to work before the accident, insurance providers need a car owner to pay for cost differences.

Someone who is completely responsible for your accident cannot be responsible for the aging and value of your car. In practice, there are unlawful parts that make a car (such as a car door, hat, mud or shoe cover), rarely placed under depletion because they are usually repaired rather than replaced. The deterioration of things is done as a result of their age or use and determine how much you receive from the residence. Other features in your car have a “life expectancy” and your insurance provider may consider. For example, if your car tire takes 60,000 miles, but during an accident it is used for 30,000 miles, your insurance company may only decide to pay 50% for a new tire. In most cases, insurance companies will not address the cost of better parts than those that have been repaired or replaced in a car during the repair process. A car insurance company should make you after a collision, not better than ever. It replaces car parts with the best or most expensive parts that can qualify as “improvement” for car insurance requirements.

Explore Bmw Financial Services: Motor Insurance Programme

Malaysia car insurance redemption began in July 2016. The overall insurance industry is in a complete free process in the phases in which many new products are designed to meet consumers’ needs. So far, 66 new car products have been released from the market. They can get the best coverage for the requirements and budget of customers by shopping close. In order to fully understand their coverage and their rights in the event of an accident, it is recommended that policy owners carefully review the nature of their car policies. Users can complain directly with the ombudsman about financial services (offs) when they disagree with insurance about the vehicle resource insurance requirements. OFS is an independent way of alternative resolution of conflict.

Many insurance companies have developed an interesting automotive management supplement that offers more benefits to improve benefits. This method will reduce the financial load of the old car owner, which uses new spare parts in the crash. These standards will be determined by means of the insurance improvement rate received as shown below:-

Buy a policy of “desperate” supplements or require old or old equipment to prevent improving payments. The decision is yours. If you look at insurance insurance, you can get a jargon as a “improvement” that is not a personal service. Although it may be a rise of a war that understands the meaning of every time of insurance, there are several basic words that you should understand.

In our old article we dealt with several basic conditions in car insurance. This time we will address the next date of the basic insurance of the vehicle: improvement. Read more to understand what this means and how it relates to your car insurance claims.

Phased Liberalisation Of Motor Insurance

According to the general community of Malaysia (PiaM) “Improvement is part of the cost that users will be forced to carry when the damaged part of the vehicle is replaced by a completely new natural part.”

Since the car will be in good shape with a new natural part, the insurance company will require a car owner or policy owner to carry cost differences.

Example: Your rear bumper is damaged by the car. Because the bumper is out of repair, you must find a new section. Your insurance company will save an improvement fee because the value of a new bumper is not the same as the bumper used. The cost difference of a new natural part that you should carry is “improvement”.

(Note: To repair vehicles, many insurance companies will pay only the cost of spare parts for vehicles aged 5 years old and over.)

Jika Kereta Anda Berusia 5 Tahun Ke Atas, Anda Mungkin Perlu Membayar Caj Pembaikan Apabila Alat Ganti Asli Yang Baharu Digunakan Untuk Menggantikan Bahagian Yang Rosak Selepas Kemalangan. Bayaran Ini Dikenakan Kerana

Another thing you need to remember is that even if your part of your car is caused by a third party, you cannot claim an improvement fee from the party. This is how you will benefit from the use of new natural car equipment, not more than the wine side.

Complete insurance covers the cost of repair for your car as a result of the accident. However, if the age of your car is an accident that has been damaged for 5 years or more, your insurance will save payments to a new natural part.

In addition to risk management, the insurance company puts an improvement fee to prevent any act of damage to its vehicle parts as a program that will transform those parts and new parts of nature through insurance claims.

Example: Your seven -year -old car will have an accident. As a result, you need to replace one part of your car and the cost is RM3, 000. Since the improvement rate is 25% of the new component, the upgrade fee you have to pay, RM750. Your insurance will address the remaining 75% of the cost, which is RM2, 250.

Auto Insurance 101: Waiver Of Betterment In Car Insurance

With assuming that you have added to your policy to cover up the improvement, you will not have to pay any fees for the new parts. Your insurance will fully address the cost of a new natural component.

(Note: Improvement costs include the cost of a new natural component. The cost of labor is not included.)

From the example above, you get a new and natural part of the car instead of the second hand or the part used if you buy surrender to cover the improvement. From the factory you will use a new part of the car and not any part of the vehicles and non -long.

This file is only eligible for 5 to 10 years of vehicles. However, the appropriate age of the vehicle may differ from insurance companies.

Msig+motor+insurance Mpc+mpd+pds+ (r)

As a car owner and policy owner, we recommend that you understand the basic situation in your insurance contract. Understanding important conditions can prevent misunderstandings and slow down the car insurance process.

In addition, if your car age is 5 years or older, consider increasing the surrender by covering your policy. This will release you a payment for you when changing the damaged part of a new, natural vehicle. You will save more money and let the damaged part of the car be replaced by new, natural without any problem by getting this vaccine. View our old copy