Car Insurance Companies Near Me – By 2024, car insurance is more expensive than ever. So getting cheap car insurance for you is more important than ever. Auto insurance is mandatory in the UK. No one can use public roads without insurance on the car they are driving. Doing so can impose a lot of amounts to you. In some cases, this will make you lose your car. The only time you don’t have insurance on a car is whether it is said on the road.

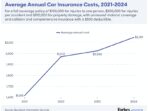

This means that it is not in use and is therefore not guaranteed. There are a wide range of car insurance companies to choose, and they all have different insurance references from cheap valuables. The price range of low car insurance quotes is between 1 281 and 3 333 per annum. Different factors affect the reference that each person finds. It is important that you compare several insurance references from different companies before deciding.

Car Insurance Companies Near Me

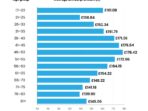

One of the biggest benefits of getting cheap car insurance is that it saves money. An insurance supplier is a factor that affects how expensive you are. Another factor that affects how expensive your insurance is, is the car insurance group. The model of the car affects how much insurance you pay. There are different types of cars, and depending on what groups fall under, they have different insurance costs. Cheap car insurance provides a car that is part of a low group. This means that an insurance company spends less for its insurance. The following group of cars are thought to be a low-risk and cheap range or replacement, as it may be in this case. The highest group of cars promise more. Because they are considered a high risk, they can also have expensive accessories and the cost of replacement is high. The group belonging to a car is determined by many factors. For example, damage, replacement parts, repair costs, repair time, new car cost, performance, brake and safety. There are only three basic steps of car insurance insurance. The first is completely complete hope, which is the highest level of protection available to the car. It protects all kinds of damage and protects the driver and other third parties. The total amount of comprehensive insurance costs an average of 5 555. The second type of protection is a third part, fire protection and theft. These policies only protect the third parties involved in the accident. Third, Fire and Flight Protection. Also protect your car in the event of a flight or fire damage. Third, Fire and Flight Protection. Cost average 41 841. The third -party cover of the third level of the third level you can get to the car. The least legal requirement you need to drive on a public road is usually the most expensive type, especially for new drivers. Protects others who are affected by third -party cover accidents and their vehicles and assets. The third party costs an average of £ 1, 157. The top three national companies that offer good service and cheap car insurance references include AXA, Hotline and LV =. Depending on your location, your type of car, your driving history and the high factors, the current price you pay will change. Of the three, the cheapest AXA (Swiftcover), the average reference profile is 1 281. This is about 18% cheaper than hotline (privileges), which cost an average of 9 299 and is more than 30% cheaper than LV = and its average reference of £ 333.

Your Car Insurance Company Could Give You Credit, Refunds Due To Covid-19

Swiftcover was created in 2005. Swiftcover launched a virtual-only carrier and aims to provide good value consumer insurance. According to reports, Swiftcover was the first company in the UK, allowing its customers to print their car insurance certificates instead of posting. Swiftcover was performed in 2007 by AXA and remains a supporter under him since then. The AXA Headquarters (Swiftcover) is located in Sarre’s Cobham and spread several call centers in the UK. Swiftcover specializes in two -level car insurance. One is a complete protection, and another tertiary, fire and flight cover. Swiftkower offers two types of protection: standard and more. Standard and more usually include two -level insurance. The switchcover plus also offers additions such as bad fuel covers, stolen key covers and party travel covers. Many consider the company to be cheap insurance suppliers, with an average monthly cost of £ 23 and an annual £ 281. The AXA offers a good car insurance discount, which includes the option that allows you to save by paying for advance.

Switchcover is popular among young drivers enjoying their best service. Below are the advantages of obtaining your car insurance through the switchcover.

Hotline is one of the highest grade insurance suppliers and the UK is the third largest car insurance company. Peter Wood started the Hotline group as a phone insurance supplier in 1985. Hotline Consumer Service and Policy Features are a top choice for UK residents. Some of the best features that the company offers in its entire car insurance protection include a long guarantee of strip cover, courtesy car and repair products. Direct Line Protection Group Offers vary between standards and high levels. The two stages of protection include the third party, Fire & Theft and Complete. Hotline groups not only provide valuable services but also give customers the opportunity to reduce their barriers to access and discounts. Hotline groups provide multiple car discounts, joint cars and home insurance discounts. Hotline groups are especially recommended for young drivers. Driverplus packs offer black box insurance for drivers 25 years or younger. Black box keeps an eye on the driver’s driving practice. Most security points mean small premiums when it is time to update. Hotline is also great for those with top -notch cars because they have a protection of Premier Insurance. Average line insurance price group 9 299. The average monthly group insurance cost is £ 25.

There are not much domerits to trade with Hotline. Complaints 24/7 are not available on the hotline claim line. They have less protection in car keys.

Car Insurance Company Profits Skyrocket As Drivers Pay More For Less Coverage

LV means Liverpool Victoria. LV = is another popular and cheapest insurance supplier in the UK. LV = provides a variety of standard car insurance protection and electric cars. LV = has a long history of insurance, which is until 1843. LV = gives the cover of both steps: third party, fire and theft and fully comprehensive. They also provide third -party covers to existing customers with other car driving; However, this is not autonomous policy. Some of the features that give LV = at the entire level include damage cover, par and glass cover windows, fire and flight cover and personal injury cover. LV = also offers the Aich of Aich Al -ಿಕ Extra listed below:

LV = has an average annual £ 333. LV = average monthly cost is £ 28. LV = is a good choice for all kinds of drivers. There are some benefits to get your car insurance by LV = = listed below:

Aviva is sometimes called the UK’s largest common insurance supplier. Aviva offers a wide range of protection and is not limited to the car. Aviva’s origin can be found until 1696. According to reports, it was created in 2000 after the merger of the Norwich Union and the CGU. Aviva’s name was adopted in 2002 and has since grown as an insurance house. Aviva offers third -party, fire and flight covers and full covers, both of which are annual control. Customers in Aviva enjoy the flexible option known as the avivaplus. Avivaplus is a Pay-R-Go deal, allowing customers to pay monthly at any additional interest. The avivaplus has a three-stage full protection: Basic with regular and premium versions (water-down version that does not cover a curse or a courtesy car). The premium version provides you with a good courtesy machine and other benefits of high -level cover. Aviva’s average insurance cost is £ 481. Aviva’s average monthly insurance cost is £ 40. Below is Aviva’s Aich Al -A list of Eich Al.

QuotemeHappy is the branded “budget” brand. Quotemehappy is an online car insurance brand that provides cheap references and high quality. Outemehappy provides complete car insurance that does not contain personal transactions, EU cover and some cover elements, including par or glass-only rights. QuotemeHappy online-only and self-service. Customers still have access to an active right service and have the right to amend their policies online. The main purpose of OutemeHappy is to give more flexibility to customers. There are two stages of quotemeHappy