Car Insurance Comparison Denmark – In Denmark, providing personal financial security is crucial. Auto insurance plays a vital role in this country by providing mental peace to car owners. Furthermore, it ensures that unforeseen car accidents do not lead to financial damage. Therefore, it is important to understand the cheapest car insurance in Denmark.

Denmark statistics of ownership of vehicles and road safety measures emphasize this topic. In addition, this article focuses on comprehensive and affordable car insurance options. It also studies key factors that affect premiums.

Car Insurance Comparison Denmark

1 of 2022, Denmark has about 2.7 million registered passenger cars, with about one car for each two inhabitants.

Cheap Car Insurance In Denmark

2. Average Danes drive 14,000 kilometers a year, a high mobile company that appreciates flexibility and autonomy.

3. Traffic accident information shows that Denmark recorded three 100 traffic accidents that caused personal injuries to 2021. Therefore, the need for constant protection measures such as car insurance is emphasized.

4. The Danish government reported to 20,000 cases of theft or attempted theft in 2020. Therefore, the need for the protection of theft in the car insurance policy is emphasized.

In a country that depends on most of their daily activities in terms of road traffic, the financial impact of accidents may be large. This factor, together with strict legal requirements, makes car insurance with a practical need. In this case, the finding of the cheapest car insurance has become an important question for the residents of Denmark. Therefore, to achieve the appropriate balance between cost -effectiveness and comprehensive coverage is crucial for personal financial health.

Freight Shipping From Denmark To Equatorial Guinea: Receive Quick Quotes And Instant Shipping Rates

When looking for the cheapest car insurance contracts, it is crucial to understand many factors that affect the premiums of Danish Insurance. They include:

The interaction of these factors shows aspects involved in determining the insurance cost. Therefore, it is crucial for the individual to evaluate his unique situation when looking for economical solutions.

For many dance, finding accessible car insurance is a matter of economic discernment. Therefore, reducing the cost by ensuring the cheapest but appropriate car insurance allows individuals to assign resources elsewhere. Furthermore, digital transformation allows access to tools and information to enable consumers to compare options and adopted decisions.

When you consider how to get the cheapest car insurance in Denmark, it is important to understand the insurance market first. Denmark has a good insurance industry that provides fair practice and protects consumers. In addition, there are more than 50 registered insurance companies in the Danish market. These providers offer a series of insurance products for different customers’ needs and calculations.

Rental Car Insurance In Australia

3. Annual premium for comprehensive policy is 7,500 DKK (approximately 1,000 euros), as reported in 2023.

4. 54% of the market share in the customer sections transfer insurance providers at least every three years. Therefore, dynamic and competitive markets are demonstrated.

To find the cheapest car insurance in Denmark, adopt a smart strategy to connect market knowledge with your personal situation. Here are some practical steps:

– Compare more quotes: Use an internet tool to compare to collecting quotes of different insurance companies. Comparing the quotes side by side, you can determine a competitive price and tailoring capabilities that best fit your needs.

Top 9 Insurance Companies In Denmark For Expats

– Choose a use -based insurance: If you are a safe and frequent driver, consider the shelf that the premiums are associated with your driving habits and mileage. In addition, insurance companies offer shelves based on telematics that reward low -risk drivers with lower costs.

– Package insurance products: If you buy more polis together (eg car, home, health), many providers offer discounts. Furthermore, connection can sometimes save up to 15% on premiums.

– Increase your deductions: by choosing a larger deduction, your insurance premiums can be reduced. So make sure the deduction is accessible when you claim.

Although general strategies can help, concrete proposals adapted to the Danish market can be optimized to find the cheapest car insurance. So consider the following aspects associated with Denmark:

Denmark: Over 80% Of New Private Cars Were Electric In H1/2025

– Take advantage of discounts without requests: If you do not have a history of requests, you may get a significant discount. Some insurance companies offer up to 60% off their records without flawless driving for five years.

– Using a joint negotiations agreement (Kollective Fordle): Some Danes may receive group insurance fees through employment, union or members of the members. This can save a lot of savings for the group.

– Choose the right vehicle: smaller, environmentally friendly cars will often attract lower insurance rates. This is due to reduced risk and tax incentive assessments in accordance with Danish Green Policy.

Finding the cheapest car insurance in Denmark involves more than just payment of the minimum premium. Requires enough covering that meets your specific needs and is in line with legal requirements.

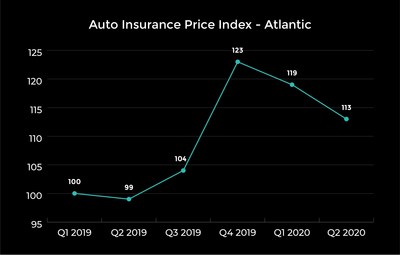

Car Insurance Quotes Jump By A Third In A Year But Worst Could Be Over

Although the savings of the cost is crucial, the Danes are invited to consider a broader insurance policy proposal. These include excellent claims, policy flexibility and other benefits such as road assistance or legal protection.

In addition, as the conditions and prices of politics can vary year by year, car owners should regularly inspect their insurance agreements. Taking time to evaluate annual options can lead to better coverage jobs. You will do this to reflect all changes in driving habits, the use of a vehicle or personal circumstances.

Drivers can achieve a sensitive balance of affordable but reliable coverage while reviewing all aspects and opportunities in the Danish Auto Insurance Market. This provides financial savings and road safety.

Understanding the regulatory frame is crucial when looking for the cheapest car insurance in Denmark. The Danish financial supervisory authority (FSA) manages the insurance industry. Therefore, ensure fair practice and consumer protection. Most importantly, regulations on consumer rights in Denmark are the most powerful in the world. See key regulatory points that affect car insurance below.

Insurance Portal Denmark

1. Insurance of compulsory responsibility: Each car owner must obtain liability insurance for compensation for third -party losses. This request ensures that all motorists have a basic level of protection on Danish roads.

2. Consumer comprehensive protection: Danish consumer Ombudsman performs advertising and contractual righteousness, supporting disputes with insurance companies.

3. Standardization policy overview: Insurers must introduce key facts in the standardized format, simplifying comparisons for potential insured.

4. Cooling period: It takes a 14-day cooling period, and if a new policy holder finds inappropriate policy, a fine may not be canceled.

The Best & Worst Drivers In The World

5. Transparency update guide: Insurers must inform customers of premium changes or changes to the rules before automatic renewal.

A strong regulatory environment promotes transparency, promotes competition and protects consumer interests. Such measures are especially valuable when weighing options for determining the cheapest auto insurance that is in accordance with legal and personal requirements.

The search for the cheapest Denmark car must take into account the wider economic factors that affect the market. For example, the Danish economic sector is characterized by high and tax costs. This can affect the structure of the insurance price and consumer behavior.

– Inflation rate: Despite its stability in recent years, inflation affects the operating costs of the insurer, which affects the premium adjustment. In 2022. The average inflation rate in Denmark increased significantly to 8.5%, compared to about 1.2% in 2020.

How Much Does It Cost To Own A Car In Denmark?

– Competitive power: there is a healthy competitiveness among insurance providers, which is due to the driving force behind the consumer tendency to change shelves often. The convenience of transferring service providers increases the pressure on the market to ensure more cost effective policies.

– Green tax model: Denmark pushes to environmentally friendly practices means that cars with lower emissions often benefit from reduced insurance rates.

These economic parameters suggest that the interaction of competition, regulation and incentives provides constant possibilities, despite the potential for price fluctuations.

Technological progress changes the insurance industry, affecting how the Danes get the cheapest car insurance. Insurtech innovations provide new standards for user interaction, risk assessment and policy management:

Life In Denmark

– Telematics and IoT: Using telematics equipment allows personalized premiums based on driving behavior. These include factors such as speed, braking mode and driving time. Furthermore, such models of data integration can reward a cautious ride with more favorable insurance capabilities.

– Internet platforms and mobile applications: More than 60% of car insurance sales are processed online, providing convenience and improves access to advanced real -time comparisons on platforms.

– AI and Chatbots: Artificial intelligence simplifies the user service and provides an ambulance and personalized adaptation tips for policy adjustment. This improves user experience and potential savings.

Given the technological landscape, consumers are encouraged to explore digital solutions. This is to determine the cheapest car insurance that fits in personal driving habits and life preferences.

Get Denmark’s Most Affordable Car Insurance

Although considering costs are important, the cheapest car insurance in the day should also meet the specific needs of individual drivers. It is crucial to adjust the insurance policy to match these individual situations with the estimated value price:

– Lifetime style and use: Policy should reflect the form of car use. A small number of drivers or drivers who primarily use public transport may benefit from a paid model.

– Additional services: Search for services with value added such as international coverage, given Denmark’s distance from other European countries. This trait is key to those who often cross the border.

Adjusting insurance policies not only saves costs, but also provides appropriate scope for personal needs and peace when driving on Denmark Road.

The Sale Of Esure Could Challenge Admiral As Motor Insurance Market Leader

When looking for the cheapest car insurance in Denmark, drivers must consider a mixture of regulatory, economic and technical factors. This ensures that not only do they receive cost effective policies, but also have appropriate protection. In addition, the Danish insurance market offers many options for consumer identification to ensure favorable transactions.

Key points include the importance of comparison