Car Insurance Comparison Offers – If you want to obtain an automotive insurance offer or rebuild your shelf, you may be wondering how best it is to get the cheapest rate and lock your price.

There are many theories on optimal time to obtain an automotive insurance offer. Many believe that the purchase of your policy or near the departure date means that you pay much more. Although obtaining the offer before the start date can be financially useful.

Car Insurance Comparison Offers

The idea is that if you buy your police very close to the start date, the insurance companies will know that you must cover immediately and increase their prices accordingly.

Should I Purchase Extra Insurance

Unlike this, if you are quoted a few weeks before you need insurance, insurers reduce your prices because they believe that you still have enough time to buy and you want to lock yourself as a customer.

It should be said that insurance companies have not revealed the best time to buy your car insurance, and none of them recognized the change in the rate they offer you according to the start date. However, many major places of comparison have been analyzed by quotes made on their own systems and have obtained their own results. The problem is that their conclusions are slightly different depending on the place of comparison.

We have examined all this analysis and displayed a graphic that shows where each condition of places to compare is the best time to buy, as well as the total average of the results. According to our analysis, it seems that the total average for the best time for the purchase of 23 days (rounded 22.5 days) before the start / date of renewal date.

Each comparison has calculated its best time to buy on the basis of quotes made via its own system. Here is what each of them says:

Cheap Car Insurance In Los Angeles: (2025 Cost Guide)

Confus says: “We believe that the best time to buy car insurance is about 3 weeks before renovation.”

Gocompare says: “Our customers have saved more than 55% on average by buying automobile insurance 27 days before the date of renovation, compared to this renewal of the day.”

Moneyspermarket gives a range between 15 and 29 days, an average of 22 days. In our analysis and our graph, we used a 22 -day figure, including a monyprmarket.

Let’s say on their website “you can save on average £ 306 simply by changing 20 days before the renovation date”

Full Coverage Auto Insurance (2025)

They believe that the rules become cheaper when approaching the date of renovation, even at a point where £ 90 are even cheaper to change on average the day before.

Our analysis shows that the average of all these websites in comparison leaves in 23 days before the date of insurance renewal. However, this can be a good idea when you get quotes from each comparison, to use their own individual analysis.

Remember that all websites do not necessarily offer the same rates, even for the same insurer. Each page can have its own negotiation rates with sole proprietorships. It is also true that some comparisons include insurers or products that others do not have.

Many websites can keep the price cited by a certain period, such as 30 days. However, if you bring a change of quote, it could be converted using the latest prices and you will lose this price. So, if you get a 3 -week offer from your start date with which you are satisfied, it could be a good idea to buy a shelf rather than waiting for you to get closer to the start date and that you run the risk of losing the price. In 2024. Automobile insurance is more expensive than ever. It is therefore more important than ever to find the cheapest car insurance for you earlier. Insurance in the United Kingdom is compulsory. No one should use public roads without insurance on the vehicle it drives. If you do it, it could be sentenced to a significant amount. In some cases, the car could even lose. The only time you may not have automotive insurance is if it has been declared out of the road.

Average Cost Of Car Insurance (2024)

This means that it is not used and therefore cannot be provided. There is a wide range of automotive insurance, and all have different insurance quotes, from the most popular to the cheapest. The price range for the lowest car insurance quotes is between £ 281 and 333 per year. Different factors affect the quote that each individual will receive. It is important that you compare more insurance quote from different companies before deciding.

The biggest advantage of obtaining cheaper automobile insurance is that it saves money. One of the factors that affects the quantity of your insurance is the insurance provider. Another factor that affects the cost of your insurance is an insurance group to your car. The car model affects the amount of insurance you pay. There are different types of cars and depending on the group they are, they have different insurance costs. The cheapest car insurance will be the one that will be published for a lower group. This means that the insurance company will spend less in insurance. It is believed that cars in lower groups are at low risk and cheaper to repair or replace, as is the case. Cars in higher groups cost more insurance. Indeed, they are considered a high risk, they can also have expensive spare parts and the cost to replace them is high. Group A author belongs to many factors. For example, damage, replacement parts, repair costs, repair time, price of new cars, performance, brakes and safety. There are only three basic automotive insurance levels that people choose. First, it is completely complete insurance which is the highest level of coverage available for the car. It protects against all kinds of damage and protects the driver and other third parties. Completely complete insurance costs around £ 555 on average. The second type of coverage is the coverage of a third party, fire and theft. These policies provide coverage only to third parties involved in the accident. Covering a third side, fire and flight. Also protect your car in the event of theft or damage caused by fire. Covering a third side, fire and flight. It costs around £ 841 on average. The third level of basic insurance you can get for the car is third -party coverage. This is a minimum legal demand that you must drive a public route and is generally the most expensive type, especially for new drivers. Tierce coverage offers coverage to other people affected by accidents, as well as their cars and goods. Third -part coverage costs around £ 1, 157. Three best national companies offering excellent services and cheap automobile insurance quotes include AXA, Direct Line and LV =. The real price you pay will vary depending on the factors such as your location, a type of car, driving stories and more. Among the three, the cheapest is AXA (Swiftcover), and the average quote costs up to £ 281. It is around 18% cheaper than a direct line (privilege), which costs around £ 299 on average, and more than 30% cheaper than LV = with an average offer of £ 333. In addition to AXA, LV = and direct lines, there are seven other insurance suppliers known for their service and excellent service.

Swiftcover was created in 2005. Swiftcover started as insurance company only for a virtual company and aimed to provide insurance to customers with good value. According to reports, Swiftcover is the first British company to allow its customers to print car insurance certificates instead of sending them by mail. The swiftcover acquired AXA in 2007 and has since remained a subsidiary. AXA (Swiftcover) is located in Cobham in Surrey and has a number of call centers dispersed throughout the United Kingdom. Swiftcover specializes in two automotive insurance levels. One is a complete complete cover, and the other is the third side, fire and theft. Swiftcover offers two types of coverage: standard and more. The standard and more generally cover two levels of insurance. The Switchcover Plus also offers accessories such as misconduct of bad fuel, the stolen keys cover and the search for passenger cover. Many consider a business of the cheapest insurance supplier, with an average monthly cost of 23 pounds and an annual cost of £ 281. AXA offers major discounts on automotive insurance, including an option that allows you to save by paying in advance.

Switch Cover is popular with young pilots who appreciate its excellent service. Guaranteed switching automotive insurance professionals are listed below.

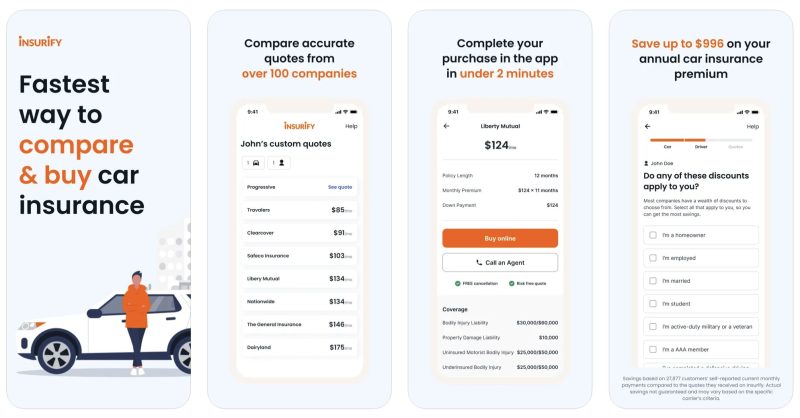

Get Car Insurance Quotes

Direct Line Group is one of the best rated insurance providers and is the third largest vehicle insurance company in the United Kingdom. Direct Line Group launched Peter Wood as a telephone insurance service provider in 1985. Users and functionalities of the direct direct lines make it a leading choice for British residents. Some of the good features that the company offers on its full car insurance cover includes a windshield coverage, a kind car and a long guarantee on repaired products. Blanket