Car Insurance Edmonton – 3 minutes can save you hundreds. Enter your postal code below and join thousands of Canadians who save car insurance.

Serve as an independent intermediary between you, financial institutions and approved professionals at no additional cost for our users. In an interest in transparency, we reveal that we work with some of the suppliers on which we write – we also list many financial services without any financial profit. Do not exploit a financial institution or a broker and to ensure accuracy, our content is examined by approved professionals. Our unique position means that we have no repetitive interest in your policy and we ensure that our mission to help Canadians make better financial decisions is free from prejudice or discrimination.

Car Insurance Edmonton

Alberta has some of the highest car insurance rates in Canada, but insurers are withdrawing from the market – why? Higher insurance rates generally mean good deals for businesses, especially in a free trade system. Suppliers such as Sonnet Insurance Company and Aviva always popular always remove their Alberta branches.

Commercial Auto Insurance Calgary

If you are an Alberta resident who asks you what can become your car insurance, you are not alone. This is what you and the other drivers can wait then.

The short version of the automotive insurance crisis in Alberta is that the rate of the province of 3.7%, which is implemented in January 2023, causes subscription losses for insurance companies.

In July 2024, Aviva Canada announced its departure from the Alberta market: “We had to make the decision difficult to get out, because the current environment in Alberta does not promote growth.” Aviva’s sudden release comes a few weeks after Alberta sonnet insurance. In his declaration, Sonnet said that his decision results from limited growth possibilities and the affordability crisis. According to the Insurance Office of Canada (IBC), the Alberta has the second highest complaint ($ 12, 309) in the country, only second in Ontario.

Automobile insurance in Alberta is almost identical to those of other Canadian provinces. The government requires that all of the Albertan engines have automotive insurance, covering accident services and third -part -part bonds.

Aviva And Sonnet Ending Auto Insurance Coverage In Alberta

Insurance companies calculate complaints -discoveries according to whom was the blame. The injured parties that are not wrong can continue those who are offset. Managers can obtain additional protection by buying additions, such as full insurance.

Although there is nothing intrinsically bad with the automotive insurance system in Alberta, insurers become not profitable due to the course and consumers probably cannot afford a radical increase in premiums. The increase in repair costs, car theft, environmental loss and high values of complaints are factors that cause these problems for the insurance market in Alberta.

Clear freezing is a superficial solution because it cannot compete with the increase in the cost of everything else. Unlike neighboring provinces, Alberta has no public car insurance system. Instead, it is a private delivery model which is often too expensive, even for the most established insurers in the country.

Alberta has the second highest automobile insurance premiums in the country due to the greatest number of accidents, a less competitive regulatory framework and now the departure of numerous insurance companies.

South Edmonton Insurance

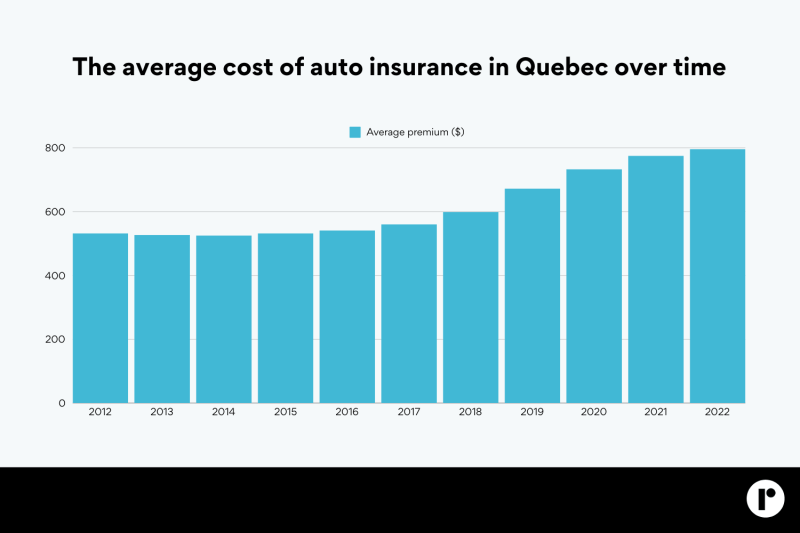

Based on the internal data of Alberta, Alberta has an average annual premium of $ 1204. This is how the other provinces compare themselves from September 2024:

Although the automotive insurance premium crisis in Alberta does not improve considerably in 2024, these solutions and an alternative progressive positive change can attract.

Alberta is one of the rare Canadian states without an error -free insurance model. Thus, any person involved in a collision can prosecute the engine insurance supplier for errors, which obliges the company to cover the losses.

The implementation of error -free insurance models can reduce legal costs and considerably reduce premiums. Despite these advantages proposed, some are not opposed to any error insurance because they “reward” the bad engines by eliminating the legal right to continue.

Auto Insurance & Postal Code Discrimination

Albertan managers can only receive compensation by the direct compensation system for material damage (DCPD) if they are not mistaken.

Admittedly, the transition to public insurance seems unlikely, but the reports awarded by the government show that the adoption of the insurance premiums of the public insurance accused can reduce $ 732 per year. Why would Alberta not adopt as a profitable decision?

According to Prime Minister Danielle Smith, the construction of a new provincial insurance company would cost around $ 3 billion, which the government is not able to finance.

To meet the increase in legal costs, the IBC has proposed a hybrid system which allows managers to continue another driver for minor injuries. According to the IBC, the plan will save about $ 325 on annual premiums.

Car Insurance Rates Are Going Up Due To Theft. Here’s What To Know

However, criticisms rejected the proposal and compared it to a system that is not errors, which would lead to a minimum of savings.

Obviously, the Albertans have a ballot of voting on what they want from their car insurance suppliers. Although the opinion of long -term changes may not happen soon, the city of Alberta has opened an online commitment survey as part of the Alberta automotive insurance reform to residents in order to provide comments on automotive insurance systems in the region.

PLPD insurance is the minimum coverage you need to legally lead to Ontario. Read exactly the covering of PLDP insurance.

Does your car share your data without your consent? Find out how car manufacturers collect your personal information and best practices to protect your privacy.

Edmonton Car Insurance Rewrite2

Toyota and Honda are two of the most reliable Japanese car brands in the world. Learning which Japanese car church is the best for Canadian drivers. By continuing to join or register, you accept the User Agreement, the Privacy Policy and the Cookie Policy.

Edmonton drivers applaud! Reliefs can be on the way for high automotive insurance costs. Recent provincial reforms cause changes that can considerably affect your premiums. Let’s examine the details and examine how these updates can affect you.

Here is an explanation of recent changes in Edmonton automotive insurance, which are all focused on more affordable coverage:

Premium caps for responsible managers: goods for good managers: this new political sheep increases for those who have a clean management file, which guarantees that your prices remain predictable. Stronger price supervision: more power for consumers: the automotive insurance rate council obtains more authorization to regulate insurance companies. This can lead to fairer prices and potentially reduced rates for all managers. Flexible payment options: Cost distribution: Fighting with preparations? New reforms provide for the distribution of your premium payments, which make car insurance more manageable. Answer and future considerations in industry: the approach of underlying problems: although these changes aim to relieve, there is a constant discussion on the fight against the causes of high premiums, such as car flight rates.

Armour Insurance Blog

A. Driver without accidents in error in the past 6 years, no violation of the Criminal Code in the past four years and minimum minor traffic offenses in the past 3 years.

A. The increased authority of the Council could lead to greater supervision and possibly a drop in rates in the future, but the exact impact has not yet been observed.

Question: Can I still buy better prices? Absolutely! It is always recommended to compare quotes from different insurers to get the best price.

A. What if I did not qualify for the right hood of the driver? Focus on maintaining a clean management file to take advantage of the ceiling in the future. Discover options such as increasing your deductible amount or taking defensive management courses to reduce your premiums.

Reliant Insurance (@reliantinsurancebrokers) • Instagram Photos And Videos

The complete impact of these reforms has not yet been seen, but it offers a step towards a more affordable car insurance landscape in Edmonton. Keep a trace of these changes by reading this newsletter and by exploring your options to find the best cover at a fair price.

Do not forget, a clean line record and some research can make a long way to reduce your premiums! Why not see how much you can save with recent reforms?

Get a free quote from Insurance, a reliable supplier in Edmonton. He can help you understand your options and find the best cover for your needs. Finding affordable automotive insurance in Edmonton can be a difficult task, but with the right approach, you can guarantee a font that corresponds to your budget without compromising the coverage. This extended guide offers five essential tips to help EDMONTONIENS effectively navigate the insurance market and find the cheapest car insurance rates. Ready to find the cheapest car insurance in Edmonton? Discover the competitive rates with insurance today!

If you are looking for cheap automobile insurance in Edmonton, it is crucial to compare quotes from various insurers. Insurance premiums may vary considerably between companies, therefore obtaining quotes from different insurers can identify the most competitive prices for your specific circumstances.

The 5 Best Motorcycle Insurance In Edmonton [2025 ]

Insurance companies use various factors to calculate premiums, including your driving file, age, type of vehicle and where you live in Edmonton. Each insurer weighs these factors differently, leading to variations in quotes. By comparing several quotes, you make sure not to pay too much for the coverage and to find the best price.

Start using online comparison tools such as Catespermarket, Insurancehotline or direct platforms of the main insurers such as TD insurance or intact insurance. These tools require basic information on your vehicle and management history to provide initial quotes. Make sure the details you provide are correct for most estimates.

Also plan to consult local insurance brokers who have access to a wide range of insurance products. Brokers can offer personal advice and negotiate on your behalf to guarantee better prices or discounts that may not be available online.

Although affordability is crucial, it is essential to assess