Car Insurance Excess – It might have a big influence when it’s time to claim your car insurance. How many efforts are spent to worry about car insurance.

Francis is the most experienced writer to simplify complex information and many of the auction becomes a reality when coming to insurance. So he fulfilled his mission to help customer experience increase.

Car Insurance Excess

Editor in Chief Laura will lead our editorial team. If he does not consider a copy of the website, read, run, and G & TS.

What Is Excess In Car Insurance?

Toby Hungon – Author, Editor, Editor, and Author, Car, and Automotive Sector. This can divide the jargon and marketing of Gypini and his doctoral holder and easily digested.

Our goal is to help you make better decisions. Therefore, S is available according to our facts and editorial office inspection.

Simply put, car insurance will exceed the amount spent on payment when you claim to pay payments.

For example, your default surplus is $ 500 and you carry around $ 2000. You will complete pay $ 500, your insurance company will pay $ 1500. If your car is turned off, then reject the usual from the final payment you get.

Car Insurance: Compulsory And Voluntary Excess Explained

If you cause an accident or covered with your policy, you will drive your car and make an accident. If your car is not damaged or not in accordance with the responsible side, it is still valid.

If the other side endangers your car and guilty, insurance must cover a full price of your improvement and you should not pay anything from your pocket.

They are the first part of insurance. Besides, aren’t you easy to get policies that you don’t have to pay too much?

This can be true, keep in mind that insurance companies also want to reduce their risk. In excessive policies, they can claim every small zero and police police.

Motor Excess Protector

Thus, how to share their risks. This ends the part of the excess payment of the number of Soviet owners and this creates a claim that spends more than excessive amount.

But that is not only for the benefit of insurance companies. Excessive burden can help car insurance cheaper. The higher level for this customer, because insurance companies are a higher level for insurance companies because they are less dangerous to politicians and they need less policies to cover this risk.

If you claim to be lower than the advantage, you will not pay an insurance company. For example, if your standard is $ 500 and you need $ 250 transd, then you have to pay $ 250.

This is an advantage that you have to pay for all claims – if the policy is not displayed differently. It might be different depending on the provider, machine, your policy, and other factors.

Zero Excess Liability & Eri Explained

But the advantages of other things can also discuss your policy. This may be the following (but not limited):

Thus, a good idea to compare and consider your policies and regularly consider your current standard level.

It depends on your insurance company and your policy conditions. However, Ano ComptononcaspensPacacapacapapappens is experiencing.

Your fault. Conversely, it is another driver’s mistake or someone else. However, your insurance company also needs someone’s full name, residential address, and car registration number as part of the process.

What Is Car Insurance Excess?

Of course, you still need to check the specific details of the product details of your insurance company (PDS). In some cases, you must pay the standard (and optional excess) for certain claims, but do not pay extra excess. It all depends on the provisions of your policy.

Do you want to claim at all with small improvements? You pay and the factory after the history of your claim, the time that leads to an increase in policy in the future.

Remember that this is the reason why you want to make payments to make payments.

How much do you pay for the excess cover, depending on the excess amount you choose. How high than higher you can pay less in prizes and vice versa.

What Is A Car Insurance Excess?

Of course, a very excessive amount, if you need to claim you will pay more than your pocket. If you are a safe drive with a clean driving history, plus high higher for you. On the other hand, if you can prefer to pay more than your prize, especially if you are a less experienced driver, especially fewer.

End is your decision. Consider all the evidence of every corner before you want.

Some insurance companies allow you to reduce or reproduce excessive standard time at any time. When considering capacity, you can experience various experiences with various levels to see how you touch you until you find the lid with your budget.

Here we need to explain how to reduce the suggestions you need to make decisions about your car insurance, including the high cost of car insurance.

Phased Liberalisation Of Motor Insurance

General PTTY LTD (ABN 90 131 798 126. AFAN 334115) Market Comparison (ABN 83 117 323 378). AFSL 422926. AFSL 422926. All policies in the market are also compared and not all policies or special offers for all customers.

The number of participants on behalf of automatic and general insurance companies on behalf of automatic and general insurance companies is 111,586 303. Our relationship with these companies does not affect the integrity of our comparison services. Click here to see services.

Any consultation with the general nature, any suggestions that do not take into account your financial goals, situations or needs. You need to consider any general information or suggestions, to pay attention to your personal condition or pay attention to your personal condition, depending on your personal condition. You must consider financial service guidelines that provide information about our services and your customer rights. This is the percentage of commissions or apartments for every policy sold. Ask us more information before providing any service. Mitululida is not aware of mistakes and is often wrongly wrong and often the idea of paying a number of claims for any claim. Thus, car insurance is that when you succeed in the insurance policy, the amount you need to pay for the Plaintiff. The amount has the amount set by the insurance company, each and insurance company to pay each and each claim for each claim, and the first. The last is the optional excess to choose how much money. If you choose to pay for a high amount of optional amount, it reduces the number of your prizes. But we need to choose the excess of voluntary that can achieve this. Thus, overdrawn forced will bind and optional.

This cannot be negotiated in a plus forced claim. Overtime (eg. Opened excess to voluntarily paying) The number of prizes will be reduced during this period.

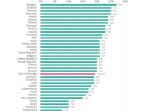

Compulsory Vs Voluntary Excess Explained: Saving On Car Insurance In South Africa

Changes in excess optional costs depend on the type of vehicle, changes according to driving experience. If you are an amateur or inexperienced, if you are a voluntary agraf property, and if you are a specialist driving and more mandatory, you can be excessively forced. All of this is the best for goods that lift vehicles with risky vehicles. Usually, your insurance company policy is an addition to your policy.

So, if you have to participate in an accident and claim to claim this excess amount, you must pay before your claim processing.

If you choose 300 £ 300 voluntarily and regulate the amount of £ 200 £ 1