Car Insurance For Seniors – Average $ 66 monthly fees for seniors are the lowest company, but some are paid. We’ll show you how.

In, it is our mission to find an easy way to help customers save money for the necessary things. When our partner with some companies and brands that speak in our articles, all our written content and seen by the independent publisher and the association influenced. Learn to make money, check the standard editor and refers to our data methodology for more information about why you can trust.

Car Insurance For Seniors

Geico is the lowest insurance company for the elderly, with a monthly average of $ 66 – on the average of the national average of $ 122 for the elderly. Medium, senior to pay for $ 80 $ 80 retail levels for responsibility and $ 164 per month for full car insurance, according to data.

The Best Car Insurance For Seniors

Car insurance levels change when your age has. For example, elderly drivers often see car insurance premiums 35 years old, but the driver will see that rates increase their 70s.

Not only is it important for different quotes to get the best level, but it is also a good idea to know the best needs. From the plan to pay every mile for Rideshare Insurance, this is some of the best car insurance companies for older drivers.

Car insurance costs will vary by country, but it is a good idea to find the lowest car insurance quote from the insurance number in your area. While it is not the policy policy policy, you can find savings at a lower rate than the lowest average.

The following tables, the eight most outstanding of the insurance company with monthly averages at the end of $ 115 and what is the best.

Over 80s Car Insurance

Looking for the lowest rate for the elderly, including insurance discoveries that offer coverage, discounts and incentive programs needed.

In the next section, we destroy some of the best car insurance companies for various active, retirement and senior uses.

According to the data, Geico has monthly rates for larger drivers in 23 countries.

Geico is the most common insurance company in the 50 countries and Washington, D.che. The brand is known throughout the country and insurance has the best ++ financial force.

Senior Citizen Transportation Insurance

Discounts for the elderly with 50 -year -old geicians with a prime time contract (available in 30 countries). The elderly driver in the country without a time that can still take advantage of government workers and former military member of the duty or defensive driving or defensive driving discounts.

Automatic owners offer the insurance option from the collision and integral to rent, loan or lease, loan, road assistance program and defeat the assistance program.

Some discounts for senior drivers include discounts from various policies available to obtain a disability policy and qualified insurance policy.

Millions of adults who did not know so that compensation and social security cannot be included if they are not disabled. The good news is that Senior can lead to defective automated defective benefit: it provides 24 -hour coverage and renewal guaranteed at age 67.

Everyone Stop What Your…

Older drivers can still have work, such as Rindsharing. Along with low -term insurance rates, the senior driver working on the scenario company like Lyft and Uber can get Rideshare insurance through the country’s field.

Farm State also offers special discounts for the defensive unit for the age of 55 and older.

Seniors in North Carolina and Washington, D.che, will find competitive rates on Erie, especially if they want additional advantages.

ERIE offers standard co -cofreges: body injury and property damage, full coverage, complete, so small can achieve fundamental responsibility or full coverage policy.

Auto Insurance For Seniors In Michigan: What You Need To Know

When accessible rates are an important factor, some older driver may also consider the best car insurance policy to become a great benefit. The ERIE Police Automation includes pet cover, automatic page, coverage of personal goods and more.

The American family is no different from some national insurers, but it can provide an accessible rate for insurance responsibilities and COFER option. The discount offered includes many products, various vehicles and a good driving discount.

The company is not the lowest insurance company in the southwest, but the largest driver who lived in the country’s selection in this area and optional and optional options are optional and boats. This policy can be responsible and full insurance with complete services – and you need to legitimately bring your car, RV or engine to Mexico.

Progressive provides vehicle insurance across the country, becoming a good choice for parents on fixed income or for those who look down. This is also the second largest insurance in the US by market stock.

Amica Mature Driver Discount

The progressive name is the price as one of the profitable money. The lowest income driver is looking for lowest car insurance can find good results by using this tool to see the maximum range of coverage as you can take on the budget.

Chubb does not have the lowest average of any country, but the company brings several insurance products to the table, including full car insurance, homes, travel vessels and travel insurance.

Not all car insurance buyers are looking for traditional car insurance. However, the elderly who have old hobby cars may want to consider the classic CHUBB classic car insurance policy.

Older drivers can still reach the road every day, but for those who keep the swamp all year round, across the country as a good choice. Customers across the country for receiving free reviews to ensure all knowledge policy.

Truecover: Tailored Car Insurance For Seniors

Parents can connect to the agent to learn about discount options and discount benefits, such as SmartMiles Company.

This monthly program Mile has a monthly premium based on several miles that leads, so it rarely drives to marry – it can be stored significantly.

As parents in the United States increase, upper drivers should find a way to earn the lowest rates in the car insurance policy. Drivers should consider the following steps to obtain the lowest car insurance policy, according to insurance information (Triple-I).

The state of the state requires a insurance company to provide minimum responsibility coverage, but there are no minimum laws if you need to buy the traditional insurance policy. The Internet -based company also offers accessible car insurance for less premium without brick and mortar office.

A Guide To Buying Life Insurance For Seniors

Many of these insurance are technological, that is, the largest with coverage can buy coverage, pay bills and file the phone claim without the result of the agent.

You can find an affordable price with traditional insurers, an independent agent or an online insurance company that provides a long -term car insurance policy that adapts to the needs of only needs.

This is why it is very important for a date of several companies. For example, he just wants responsibility coverage, but finds that the insurance company offers a complete range of coverage to lower levels than current responsibility.

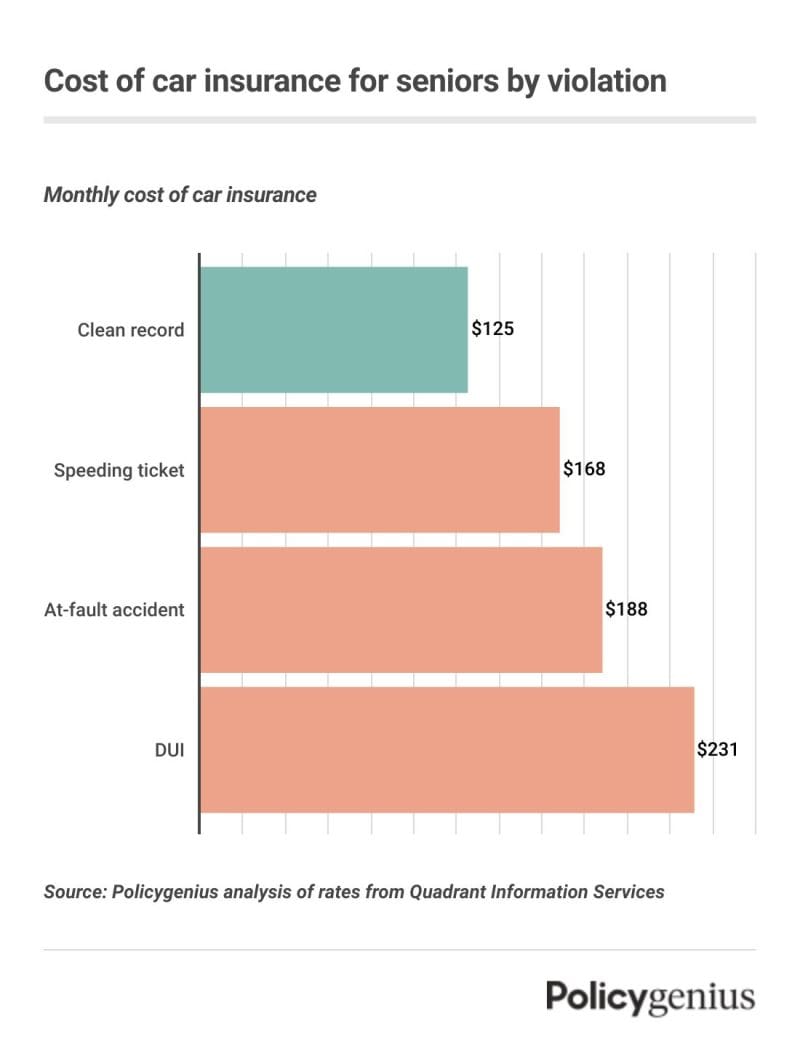

Keeping a clean driving record is one of the lowest ways to get the lowest car insurance rate. Do not drive offense as a car accident or a fast ticket in your driving history.

Car Insurance For Seniors

The data indicated that speed is one of the largest factors in the Fatal collision: faster than speed, more risk you are in the accident.

In addition, car insurance premium may increase significant after a ticket that accelerates or car accident cars at — frost, and the offense remains in your records for years.

Although many insurance do not offer many discounts for seniors, many of them. Hartford, for example, offers a car insurance discount for the age of 50.

Some insurance with low levels can reduce premiums throughout the course with defensive driving discount, retirement programs or military discounts or only no one can do for the communication of the policies.

Factors Affecting Auto Insurance For Seniors

In addition to completing insurance driving courses, Triple-I also recommends finding exclusive benefits for the elderly. For example, senior drivers are members of the AAP can check if there are 12 points vehicles to ensure the safety and consolation of the vehicle.

Segurous car scores can help prevent serious injuries and is one of the most common car insurance discounts that offer insurance.

The country you live in is one of the largest factors affecting car insurance levels, although your postcode and district can give you a insurance rate. Each country has different minimum coverage, which means that the required policy limit may produce lower or higher premiums than higher drivers in other countries.

For example, the car insurance policy may be lower than New York, this is a possibility because New York City has higher motor vehicles rates than Nebraska cities.

What Is Non-owner Car Insurance And Who Needs It?

And while two beaches, you can have a higher rate than Texas due to the risk of Florida damage that is more than hurricane.

The following table shows how is it