Car Insurance Los Angeles – California is known for rigid car insurance laws to protect drivers and passengers on the road. Each state has minimal car insurance requirements. These minimum requirements may have a great impact on all the requirements provided for a car accident. In this blog, we will investigate the additional laws and rules governed by car insurance in California, and we will investigate some recommendations on your car insurance needs in California.

First of all, it is important to understand that California is wrong. This means that the Thedriver, which is responsible for a car accident, is responsible for the payment of crash related expenses. These costs can be things like medical documents due to physical injuries. In addition, material damage to the victims of the accident. The victim of the car accident can submit the driver’s insurance or sometimes insurance claim.

Car Insurance Los Angeles

Each state will have its own laws on low-car insurance. If you live outside California, remember that your minimum car insurance will probably be different.

California Car Insurance Premiums Are Rising. Here’s Why

Another factor of California’s car insurance law, which all drivers have the opportunity to cover the coverage of unsecured drivers. If you are engaged in an accident with a driver without this coverage insurance, you will be damaged and injured. The minimum limit for the coverage of non-insurance drivers is $ 15,000 per person and $ 30,000 per person per person.

In addition to the California Car Insurance Law, the drivers have optional prizes that drivers can receive in California. These include the following.

If a car accident occurs in a California collision, it will damage his car.

California will cover damage caused by clamps, theft, vandalism or natural disasters.

Seniors: “cheap” Auto Insurance Could Cost You Thousands

It is important to understand that there is a car accident and another person is injured, then this minimum car insurance in California is not enough to pay for damage in a serious accident. Therefore, it is recommended that you only receive minimum insurance requirements. If your minimum insurance does not pay the value of injuries and damage, the other party may sue the expenses of the insurance coverage.

When it comes to finding the best car insurance in California, it is important to shop around and compare quotes from various insurance companies. Just make sure you take into account the protection of car insurance in California, but also to take into account the company’s reputation and financial stability.

There are several ways you can lower California insurance premiums. All insurance companies will not offer discounts. However, look to see if any of the following programs have reduced your exchange rate.

Taking the course of defense, you can probably save insurance premiums. Usually, these courses are online and are easy to complete.

California Dmv Must Release Waymo’s Robot Car Insurance Details, Says Consumer Watchdog

If you have some drivers in your family in your family, you can get a mass discount on insurance premiums.

If you can prove that you have a good credit story and prove your accounts on time, some companies will look at you with less risk for your rewards and offer a small discount.

This can be open. A good driving story means less risk for your insurance company. There are some companies to “reward” for a good driving history by minimizing prices.

California’s Engineering Department will suspend the registration of a vehicle required by insurance proofs and the vehicle cannot be placed on or placed on the highway until the vehicle insurance is obtained.

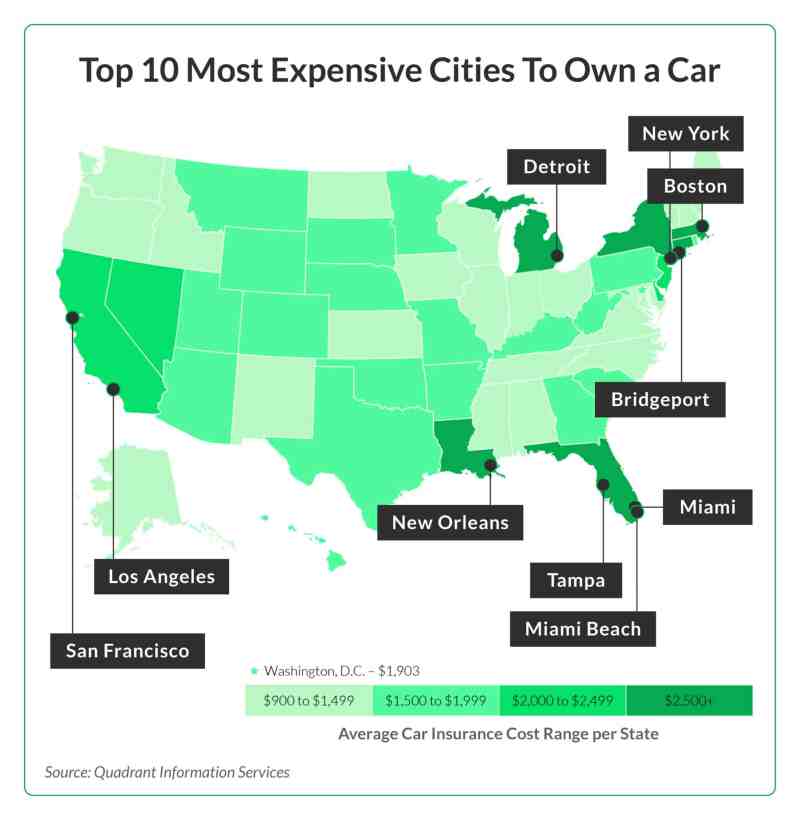

Top 10 Most Expensive Cities To Own A Car

If you have been in a car accident in California, you can think of what your next steps are. If you are injured as a driver, passenger or pedestrian, you have the opportunity. There is a compensation for your losses, including damage, medical documents, lost income, material damage and emotional distress.

Depending on your decision to protect insurance, you can submit a claim for your insurance testification.

If you have been in an accident and can prove “failure” against another driver, you will be able to claim their insurance.

If you participated in a car accident and in a car injured car, you are advised to hire a lawyer in car accidents. Most car accidents are working on the response fee, so you will not usually take any costs in front of it.

Los Angeles Car Insurance Rates, Quotes & Agents Reviews & Research In California

If you have participated in a car accident in Los Angeles, do not hesitate to reach a very valuable lawyer in Los Angeles. B | B Law Groupis, Group of Invincious lawyers in Los Angeles who can provide your legal rights and receive compensation you deserve.

Horse b | The legal group is simple to our goal: to maintain and maintain the legal rights of the population of Southern California. The award group of our lawyers is personal injuries, business law and law, and this is our role to give our customers best legal representative.

If your business fails we have responsibility for you to pay nothing. There are no secret fees, costs or conditions – this is our word.

Recently injured in a serious accident in California and are interested in compensating? Do you think there may be preconditions for an emotional claim? To teach yourself about different types of benefits …

Surging Auto Insurance Rates Squeeze Drivers, Fuel Inflation

If you are engaged in the opening of a devastating accident, it may seem confused and excessive to calculate what to do first. You can now get acquainted with the financial effects of your life, but these figures are only back in California for basic car insurers, California Market Square to be safe to be safe.

Car crashes came and some insurance companies say they pay more money than they took. However, the insurance manager does not support the claims of the facts.

In the 2020, in 2020, the car insurance increased by 25%, the US Real Estate Insurance Organization increased by only 4.5%. The ratio and severity of car accidents are like the cost of covering them as well as.

“The cost of leasing a car increased by 33% and the value of a new car increased by 11%,” he said.

Best Los Angeles, Ca Auto Insurance In 2025 (compare The Top 10 Companies)

In California, some insurers did not increase in insurance managers for more than 3 years.

“What we see, is the presence of insurers who pay more in allegations than they receive. This is not a sustainable business model,” he said.

California is a lot of consumers – a friend is a state and insurers should increase growth. The State Farm, Allstate and Farmer asks about 7% of the African Department of the California Departit. Progress asks more than 19%. An agent says that insurers are now becoming more difficult to get a new car policy for drivers.

“They were able to ask you to pay a full payment instead of a payment. Now, all the carriers I can think of the limitations.

Wilshire Insurance Services

“The State Settlement, you can no longer get quotes by calling them. You must go to the agent office,” Siliban said

Insurance company spokesman “If insurance companies are aimed at increasing prices, the department is aimed at the protection of drivers and help them receive the most values of the awards they paid.”

Office pointed to $ 2.4 billion in the height of the General Secretary of Covid, which won $ 2.4 billion in the height of the cavid.

Insurance cannot refuse to cover the Californians because things called the “Take the whole market”, agents say that when the customers need to go with less, fewer.