Car Insurance Natural Disaster Malaysia – Special danger is the additional coverage that the driver can choose to cover from the loss or damage caused by natural disasters such as floods, storms, earthquakes, landslides and others. The real policy formula is:

“In the more premium point of view you pay for us, for this approval, we accept that the insurance provided in the A part of this insurance will cover the loss or damage to your car caused by floods, storms, storms, volcanic eruptions, earthquakes.

Car Insurance Natural Disaster Malaysia

The recording rate for special processing continuously increases from 11% to 22% according to general insurance.

Bad Weather Results In Fallen Trees

One of the reasons for the higher recording rates were caused by a major flood in December 2021, which many car drivers were arrested and witnesses that their vehicles were damaged by floods. Secondly, now the driver is more happy to increase the special step due to premium decline. Special danger is reduced by more than 50% due to the rate of 0.5% of the sum insured up to 0.2%. Therefore, the vehicle that covers RM80,000 premiums that includes special dangers is 160 ringgit.

Many times the driver will choose the cheapest insurance premiums without considering any additional coverage, without knowing that there are certain events that the standard insurance is not comprehensive. When there is a storm or heavy rain and the use of your car is damaged because the falling tree will not cover under your standard insurance unless you have more danger.

Therefore, by reducing premium rates for special dangers, it is recommended to supplement your insurance. If you just renew your car insurance and need a special dietary supplement, you can now contact your representative to help you approve BMW 3 Series updates in Malaysia in 2025, update 330i M Sport and New 320i Sport starting at RM290K, RM319K.

Honda Malaysia invites 87, 490 vehicles through the problem of fuel pumps, jazz, HR-V, BR-V, CR-V, ACCORD, CIVIC among those affected.

Private Car Insurance & Available Add Ons

This “reliable dealer” has a history that has been proven to maintain the best car sales guidelines that have been certified by

Living in the country in tropical weather is up and down. While we can reach the sun all year round But there is a famous Malaysian rainfall, which is sometimes translated into lightning currents that do not show from anywhere, which makes our vehicles risk of destruction.

It does not reject the fact that it is very important to make sure that our vehicles are well protected and covered by floods and other natural disasters.

While some of us are aware of this truth and buy a special natural flood and natural disaster through our insurance suppliers. Many cars do not know this risk and do not protect their vehicles from floods and other natural disasters.

Key Benefits Of Directasia Car Insurance » Surer

Therefore, if your vehicle is not protected from natural disasters, Etiqa is here to record the date with a spacious private car insurance provided:

The top of all of the car insurance of ETIQA also has a complete comprehensive coverage, such as OTO 360, personal protection, glass protection, front of the car, cash relief, new spare parts that have no additional fees, private rental, and most importantly the coverage of damage caused by the weather and sculpture.

When you are added about your vehicle, ETIQA will allow your car to cover the loss or damage caused by floods, thunderstorms, landslides, or other natural disasters for that matter.

Therefore, with extensive supplements and insurance vehicle insurance, it is safe to say that fixing and in order to return your vehicle to work in the event of flooding or natural disasters are well maintained. Thank you ETIQA.

Malaysian Family Flood Aid: Everything You Need To Know

When talking about your car insurance renewal, this method is quite normal and traditional. The car owner must communicate …

Malaysia’s first insurance and TAKULY coverage for EV Home Chargers is offered by ETIQA for free for …

A simple manual about how to choose and buy online car insurance in Malaysia. If you own a car in Malaysia or other places for that …

*Important: Your car price is appreciated according to the information you gave. Estimated price for reference only and endless You may need more than standard engine insurance to protect your vehicles. In Malaysia, natural disasters such as floods and landslides can cause serious damage to your car and must not cover the standard policy. That is why the special step is very important.

Falling Tree On Car: 1 Secret You Must Know To Claim Insurance

Post this blog will explain the benefits of special steps. You learn what you get and the real situation that will benefit you.

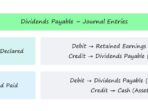

Special dangers are the supplementary part of the standard engine that provides additional benefits and protection for automotive. Special dangers are designed to cover injury or loss caused by natural disasters or other special dangers that are not covered by standard engine insurance such as floods, landslides, earthquakes and other cramps.

Every vehicle owner who lives in an area with high risks or often is likely to cause natural disasters, should consider the protection of special dangers.

For example, living in a flooded area allows you to be at risk so your insurance company can compensate you if you have special danger protection. The compensation can cover the damages of damage from the floods and spare parts for your car, depending on your insurance plan. The repair of the flood vehicle may be expensive. Therefore, this coverage can help facilitate financial burden.

Blaze Victims’ Insurance Claims Being Expedited, Says Group

Floods and landslides often occur during the Monson season in Malaysia. However, many Malaysian cars are not sufficiently protected from these natural disasters.

Destroyed floods in December 2021 made us realize that it was more important than we had been protected by the floods for our cars. The Malaysian statistical department reported that the loss of vehicles only due to the flooding of 1 billion Ringkit.

Due to this incident, the Malaysian General Insurance Association (PIAM) advises all vehicles to check their insurance and certify additional coverage for natural disasters. The good news is that more people are becoming aware of the importance of this coverage, and then PIAM reported that people bought in 2022 more than 2021.

Special dangers covering only the cramps of nature. Therefore, other events such as stopping, riots and civil rebellions are not comprehensive.

Protecting Your Vehicle From Nature’s Fury

Insurance coverage may vary depending on the insurance company and the insurance you choose. Read and understand the policy information to know what your special curriculum covers.

Depending on your insurance company, you can add a special danger for your car insurance for premiums, approximately 0.2% to 0.5% of the vehicle’s insurance. This means that if the sum insurer of your car is 50,000 Ringkit, you will only pay the RM100 to RM250 special insurance premiums, as well as the standard engine tax insurance of the small government, often used with insurance curriculum.

If you are a customer, you will get a highly competitive interest rate for a special danger when you renew our car insurance. In addition, you can choose a full coverage (100% of vehicle insurance) or some of the minimum coverage options at 20% of the combined vehicle. However, it is recommended to cover (100% of the number of vehicles) because the damage from the flood may be very expensive.

First of all, decide whether your current engine insurance company proposes a special step as your existing policy. Commercial, coverage may be called a special danger of nature or flood insurance.

5 Natural Disasters That Hit Malaysia (and How To Better Prepare For It)

If your current insurance provider does not offer special dangers or if you are not satisfied with their plans and benefits, you can compare insurance plans from other insurance companies.

Comparison of coverage means considering the coverage and price level. You want to make sure you get the most extensive coverage. Make a data decision by reading and comparing details, covering the exceptions and conditions proposed by different suppliers.

Many Malaysian insurance companies provide this protection or addition. In addition, car insurance that covers your standards instead of independence. Therefore, when you renew the car insurance, this is the time that you can choose a supplement when you decide on your main car insurance plan.

Whether you are still new or a customer you can have, you can smoothly increase the special step during the insurance renewal and select the percentage of the sum insured you want. When you increase your premium special processing, your final adjustment will automatically adjust.

Protect Your Car With Special Perils Coverage 🌧️ The Recent Storm And Flash Floods In Penang Show How Quickly Weather Can Change. From Fallen Trees To Floods, Your Car Can Face Serious

Please note that if you have selected our Premier policy that covers our Auto365, called Perial Perils Supplement as a “scrambles by Nature”.

In general, special danger claims are the same as the general car claim. But may vary for different insurance companies Don’t forget to read the policy information and understand how the process of working before you buy the policy.

You have to make a damage to your insurance company, then your insurance company will do so.