Car Insurance Premium Malaysia – One third covering, death or injury is the coverage of major automobile insurance which affects the car or the property of someone else.

A third, a fire and a flight damage the car of the car owner due to the removal of a car from a fire or an owner.

Car Insurance Premium Malaysia

Did you know? With full automobile insurance, your automotive insurance policy will only cover your vehicle during the accident. This means that you have to pay an ambulance or an ambulance at any hospital.

Generali Car Insurance

Consider receiving a personal accident engine supplement (DPA) to protect yourself and your passengers. If you are injured during the accident, the DPA will cover permanent or partial disability, medical costs, hospital income and more.

Did you know? Wind power losses are often cheap to correct and claim against your full car insurance. However, the complaint against your engine policy will reset your discount (NCD), so it is preferable to obtain an additional front glass to repair or replace the glass screen.

Note: February 15 – Until August 14, instead of replacing the glass, you will restore your Sumy insured without an additional reward to correct your glass screen. To choose to repair, you save you time in the seminar and is also environmentally friendly.

When you are in your car and flood waters go up, do not forget these simple actions and make sure your passengers are safe.

How To Buy/renew Your Car Insurance Online In Just 3 Minutes?

To add 24 -hour driving aid and special dangers, contact your insurance consultant or press here to contact.

To find out more about the compulsory surplus and other important things to claim, please contact your insurance consultant or click here to display a video on the refusal of an excessive binding engine.

This is an additional cost for cars with more (5 years and more normal) to pay the difference to replace an old part with something new. It is a general experience in the industry when you make a complaint.

If you are involved in an accident with a vehicle, Knock or ODKFK can find your own loss for the rate of your own, you can save your complaints more easily and maybe NCD!

All You Need To Know About De-tariffication Of Motor Insurance [infographic]

ODKFK allows another part to make a complaint on your own insurance company instead of insurers. This agreement indicates that the treatment of complaints is faster.

Do you know what to do when you have your own loss? It is always good to know the main steps before making a complaint.

The automotive insurance markets have been adjusted with fixed prices structures called previously prices. In 2017, industrial, transport and progressive liberalization, gradually offered more competitive prices and comfort.

Now, we have moved to a more dynamic price system based on risk factors such as driver profile, type of vehicle and historical allegations. This approach encourages competition, innovation and more specific prices.

Zurich Malaysia On X: “need To Renew Your Motor Insurance/takaful Soon? To Ensure Continuity Of Your Motor Coverage, You Can Elect To Renew Your Policy/certificate For 6 Months Or 1 Year. Our

It is important to know the available options, buying for the consumer car insurance. For more information, contact your insurance consultant today!

Immediately, let a police report report immediately, pull your vehicle to the nearest confirmation panel (unable to control).

If you decide to claim. Report your insurance consultant as soon as possible! General complaints can be found here.

Put photos from the accident scene, provide detailed information on your vehicle’s Dash camera images to facilitate and speed up the complaint. First, be calm and compiles and will help you in your leisure.

Car Insurance Rates & Quotes

I wonder why the authorized panel workshop is an intelligent choice to choose? It is simply a question of providing a fluid process, not only a reliable repair.

Annex Motor of Special dangers provides insurance against extensive dangers, including floods, tribes and storms. Click here for more information.

If your car is a zone, you will meet enough compensation for the insurer in the event of accidents, theft or total loss. This means that you perform repair costs to cover you.

No claim (MNT) is a familiar moment between car owners. This is a discount granted by insurers if no claim is made during the coverage period. By performing a free complaint, the NCD ratio increases, resulting in car insurance costs.

Cheap Volkswagen R32 Car Insurance In 2025 (top 10 Companies)

Protection of MNT is a wise strategy of materials which gives safe driving and significant savings at car insurance costs over time.

Thank you for sending your request and your request. We will examine your request and contact you if you are in a short list for an interview. Answer: The two vehicles need valid car insurance to be authorized on the road.

New or second, local or important, if you have a car, must be valid car insurance to drive on the road; It’s so simple.

Anyone who says everyone is different from you is informed or informed or around him or around him.

Tune Protect Launches Payd Benefit

In addition, if you do not have valid car insurance and road tax (you cannot get one or update one without the other in your hands, and if you stop in the police, you can force a traffic call if you are marked by the police.

In 1987, all road transport in the law, all car owners in Malaysia were compulsory for reliable car insurance and road taxes which must be renewed at the annual base of the two.

However, legal requirements are also important to have sufficient car insurance coverage for your vehicle, so you can count on your insurance policy to pay something bad (collisions, natural disasters or even theft).

According to the search for the Malaysian Road Safety Institute, more than 400 traffic accidents in 2020 were nearly 5,000,000 mortals.

A Complete Guide Of Loss Of Use Claim Malaysia 2023

This is enough to buy something appropriate – and wide – it is an insurance policy to cover you as well as your vehicle when you are on the road.

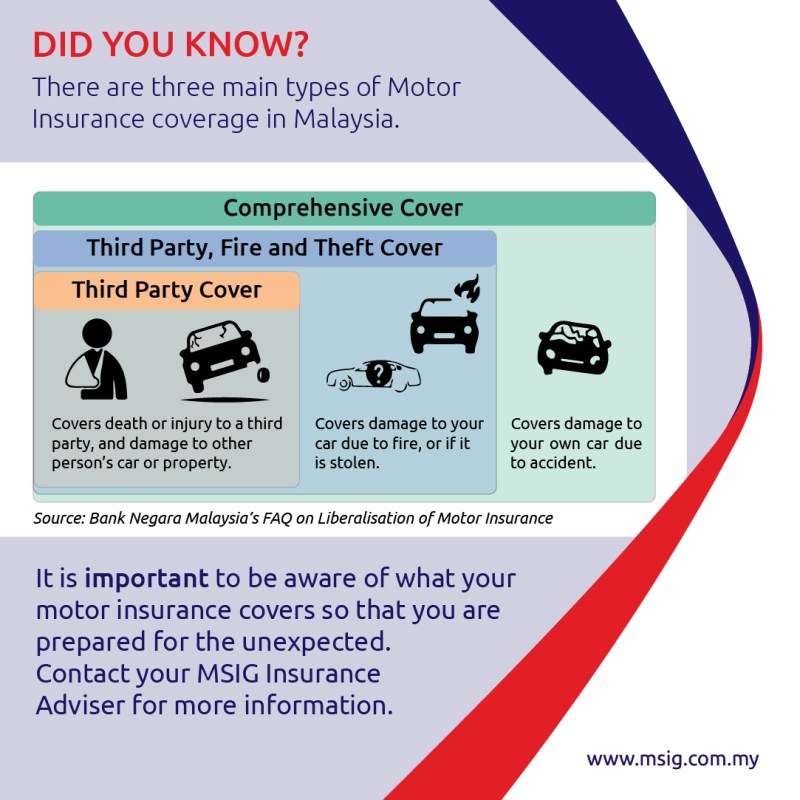

There are three types of car insurers available on the Malaysian market, each being a unique Malaysian market to cover you as well as your / or vehicle.

Thunderstorm coverage is the cheapest among the most basic automobile insurance form that you can generally be offered in Malaysia.

Imagine that it was a rainy night and that you go home after a night late. The road was smooth and suddenly, there are skates in a junction of your car and collide with another motorist. You lacked naughty by giving a chance – but not the same for the person you collide.

9 Factors Affecting Your Car Insurance Premium In Malaysia

To avoid hanging the bills of the hospital, avoiding hooks – not on the repair of vehicles, at least a third, you will need car insurance.

As its name suggests, third -party covering cover complaints against you for deaths that cause insurance policy, bodily injuries or even others (third parties). This includes any loss or damage to vehicles or property.

For the most part, the fire and the flight of the third party work as a third -party cover, with the exception of this policy, if your car suffers from damage caused by fire or is stolen, it allows you to claim.

Please note that this type of coating is damaged due to a fire and a random flight, but do not forget that the accident is not damaged due to itself.

Shopee Car Insurance 2025

This automotive insurance policy covers a larger range of two automotive insurance covers mentioned above.

In addition to providing the coverage of all of the above, this also covers damage to your car!

Complete car insurance, for example, if you cannot replace your savings to buy a new car or use a second car, it is recommended.

For example, the previous time and scenarios you trust in your vehicle are not applied to work, if you have a full coverage that will provide money (current market value), you can get another car.

How To Transfer No Claim Discount (ncd) To Another Car

Automobile insurance is not a science of rockets to decide on the right amount. Insurers aim to make your life easier and determine the reliable amount according to the market value of your car.

Since July 2017, additional factors have been relevant to determine your reward in force. However, the ideal amount guaranteed is really back to the market value of your car.

Simply insurers, technical details of the year of car production, engine size, type of model, power, etc. It can withdraw a database, therefore taking into account the actual walking, the current market value of your car knows the original price of your car.

If you buy a new car worth RM100, 000, the insured amount must be equal to the same amount.

Aig Malaysia Covernote

Original price over the years and yours