Car Insurance Quotes Dallas – Best Dallas, Texas Auto Insurance, Best Dallas in 2025 (Find Top 10 Companies) State Farms, GEICO and PRESCRIVE, offers Texas Auto Insurance. Rates start at $53 per month to convene a minimum liability coverage of 30/60/25 in Texas. State Farm Reward Save Drive. Geico offers a 15% military discount, while the advancement name of your price tool can be adapted from the Dallas, Texas budget.

At Home » Cheap Car Insurance in Texas to 2025 (10 companies with lowest interest rates) » Best Car Insurance in Dallas, Dallas, Texas (Top 10 companies found)

Car Insurance Quotes Dallas

Marcus Kuhl holds a professional writing degree from the University of North Carolina. His life began with caring and rehabilitation, creating lifestyle content for doctors, dentists, other caring and holistic developers. In 2018, she began writing to Cannabis Energy. Well-curated news articles and insider interviews with investors and small businesses…

Texas Car Insurance

Jeffrey Manola is an experienced insurance agent founded on topquoteleinsurance.com and nomedicalexamquotes.com. The task of creating these areas is to provide online consumers with the highest prices to find insurance. Not only does it not provide consumers with the best insurance coverage price, but it also hopes to put it into the market to make…

Advertiser Disclosure: We strive to help you make confidence insurance decisions. It’s easy to shop. We are a partner of top insurance providers. This will not affect the content. Our beliefs.

Editorial Guidelines: We are a free online resource who would like to learn more about car insurance. Our completion is an objective tripartite resource, with all auto insurance related to auto insurance. We update our website regularly and all content is reviewed by auto insurance experts.

Thanks to unique savings tools and proven benefits, state farms, GEICO and progressive providers are the best providers of the best auto insurance in Texas.

Best Cheap Car Insurance Rates In Texas (as Low As $33/mo)

National Farms leads can reward low-mile drivers by driving and saving, and offer a 17% discount on car insurance on bundling.

GEICO has an A++ financial strength rating, saving an average of $740 per year. Processive earns your place with your name, your price tools and snapshots and personalizes rates based on real-time driving attitude.

Not sure the best capital insurance provider is your ideal choice? No zip code can see the advantages and disadvantages of the best capital insurance in Dallas, Texas.

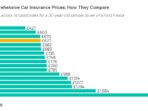

This table shows monthly rates for the highest auto insurance company in Dallas, Texas. GEICO is the lowest coverage fee, $53, and USAA is the cheapest full coverage company for just $103.

Buying Car Insurance Online: How To Do It

The state farm has low full coverage at $105. Mutual Aid and Hartford Freedom’s upper portion exceed $150 to complete the policy.

Credit scores have a great impact on car insurance prices in Dallas, Texas. Pay a lot less leader sincerely. For example, USAA charges only $162, Geico requires $188.

Allstate and American Family have increased their credits by more than $700. Nationally, states at all levels remain stable and progressively stable.

Dallas, Texas, car insurance rates Varian Varian is very dependent on the postal code. For example, the driver’s driver (75222 only needs to pay $488 per month, which is the lowest interest rate listed.

Best Car Insurance In Texas For June 2025

Insurance rates for postal codes near 75287 and 75248 are still below $520. However, in the area with the postal code (7527, jumped to $659). I’ve seen only a few blocks and you can save over $170 a month.

The top Dallas auto insurance companies offer different auto insurance discounts and reward safe driving, bundled services and safety habits. State Farm provides savings for the use of anti-theft equipment and passiveness.

Geico offers advantages for federal employees and driving safely. The procedures as progressive snapshots and passenger intelligence help reduce the rate of tracking how the car is used. Students and military families also unlock major discounts for providers.

To start with lowering premiums in Dallas, Texas, you need to understand where insurance companies offer advantages. Telematics plans are provided as a step-by-step plan for snapshots and passengers’ Intelligibdrive monitoring of safe driving habits and offer you up to 30% off.

Find Cheap Car Insurance In Dallas, Tx From ($137/mo)

Combining auto and home insurance with a company as a public company or independence can give you 17% off or more. If you are a student, GEICO, Allstate and USAA can offer special discounts for good students that can reduce prices every 15% or more.

Military families in Dallas, Texas have the opportunity to receive special discounts with USAA. If you own a hybrid or electric vehicle, you are eligible to lower rates for passengers or nationwide.

Herpes in Dallas men’s mileage is moderate, Texas premium. In fact, driving under 7 or 500 miles a year will usually correct your low mileage discount.

In addition, changing paperless bills, paying all certificates together or signing in the morning can also greatly reduce your expenses. You have more than the stack and less than you pay.

L.a. Insurance, 402 N Carrier Pkwy, Ste 101, Grand Prairie, Tx 75050, Us

Your car insurance premium in Dallas, Texas may be affected by many factors in the area of residence or community.

According to the credit score, car insurance rates vary widely, and drivers with poor credit usually face a much higher premium than sincere ones.

Texas insurance companies prioritize driving violations and high-risk drivers, which can contribute to movie insurance options even if they are poorly recorded. It is very important to understand the most affordable options on the floor.

If New York City experiences many motor vehicle thefts, the cost of auto insurance tends to increase rapidly, for example, which can lead to more claims against insurance providers. Installing anti-theft devices can reduce the risk, reduce theft of insurance costs, and earn discounts from insurance providers.

Texas Insurance Quotes

The top auto insurance companies in Dallas, Texas are known for providing real value and important features. State Farm rewards drivers for safe and safe and safeguarding the plan, and if you don’t mix policies, you’ll get rid of benefits.

GEICO provides very good benefits for military families and federal workers, which helps as a driver of long-term faith. Progressive personal experiences as snapshots and price of your name can help Dallas drivers invent coverage that match driving habits and locations.

When choosing car insurance in Dallas, Texas, check the claim for response time. Quickly claim to exceed the price. For example, some people pay about 48 hours.

The leading auto insurance companies in Dallas, Texas offer reliable service, mainstream rates and flexible options based on your vehicle needs. These companies are ranked number one on your vehicle and need to be in Dallas, Texas, which can help you save money. Enter your zip code now to access cheap car insurance in Dallas, Texas.

Compare Car Insurance In Texas With Jerry

State Farm is often considered the highest draft pick in Dallas, Texas, thanks to its reliable service and bundling options.

Car insurance premiums in Dallas, Texas are severely impacted by age, driving history, credit score, vehicle type and location, high-risk drivers and higher rates.

Low credit scores are a factor in the change in car insurance premiums in Dallas, Texas, usually at a higher cost.

A state company offers the best affordability, bundled with the best balance of discounts and services in Dallas, Texas, making it a comprehensive choice for self-insurance.

Quote Auto Insurance

You can use discounts and compare prices in your postal code to improve your driving record, thus reducing self-quality in Dallas, Texas.

Yes. The best ratings and LOREM complaint levels help you judge the company’s financial reliability and customer service quality.

USAA’s auto insurance coverage for military personnel includes lower interest rates and exclusive benefits for active-duty members and veterans. You can get poor allowances and undergraduate savings through military auto insurance.

Depending on local crime, accident frequency and traffic congestion, your postal code can affect Dallas’ car insurance rates.

Cheap Auto Insurance In 2025 (save With These 10 Companies)

Providers may receive the best full coverage in Texas as a political farm or progressive provider, especially if bundled and qualifying for use-based savings. The monthly rate is estimated to be around $120, based on your postal code and driver history.

You can rely on the highest companies as a strong city, GEICO and USAA to gain financial strength, discounts and digital tools. Everyone offers a strong coverage option for the monthly rates tailored to your profile. Many Weaver compares auto insurance companies to unlock bundled benefits faster.

To get the cheapest car insurance in Dallas, Texas, compare by postal code. Companies like GEICO and National Companies will typically offer prices as low as $53 per month and offer safe drives or bundle discounts.

If you are a senior at Hartford and USAA, special programs are available, including AARP discounts and benefits tailored for advanced driving. If you maintain the world monthly rates to keep a low record.

Average Cost Of Car Insurance (2024)

If you are a young driver, you will help most progressive national companies or nationwide. Check out good discounts, driver Lorem savings and telematics plans to lower monthly premiums.

If you live in Texas and more local agents, Texas Farm Hendrerit is a reliable option. Competitive monthly rates are offered when you need to pay membership fees in your company, especially rural drives.

You can expect that auto insurance in Dallas, Texas pays about $160 per month for $160, based on your zip code, driving history, selected coverage. Find the best way