Car Insurance Quotes For New Drivers – Is it? Why do inexperienced drivers need basic safety skills and good car insurance coverage before getting behind the wheel? Because new drivers, especially between 16 to 19 years, are more likely to be involved in a worse car accident than more than 20 drivers.

Here are three reasons to continue reading about the importance of getting good car insurance for new drivers.

Car Insurance Quotes For New Drivers

At its core, car insurance is a contract between you and an insurance company that protects you financially in the event of an accident, theft or other unexpected events involving your car. Before you get into a nitty gritty, here are the above to remember to understand the car’s insurance:

Best Cheap Car Insurance For Young Drivers (2025 Picks)

Gifts and selfishness: Your reward is what you pay for vaccines, often monthly or annually. The discounts are the ones you pay from your pocket before the insurance starts. Choosing the highest selfishness can reduce the prize, but you pay more in the event of demand. Higher coverage limits mean high awards, but they provide more financial protection in the case of accidents.

Items that affect standards: many factors can affect the cost of your car insurance, including your age, gender, driving record, location, car type and credit history.

Government Requirements: Car Insurance is legally imposed in many states, and the penalty for not following include fines, licensing or claims. For new drivers, you can’t help but get car insurance.

Limitations and discrimination: Vaccines limits refer to the high level of your insurance company paying for covered requirements. Isolation is special events or situations that are not covered by your policy.

Compare Car Insurance Quotes From 120+ Providers

Vehicle insurance policies include a variety of covers designed to provide financial protection in the event of the loss or damage of a policy owner’s vehicle or body damage due to accidents.

There are several types of car insurance, and depending on the nature of the housing, some covers are necessary, while some are optional. Here are the most important types that need to worry about:

Liability insurance pays for body damage and damage to the material it causes to others for errors. It may include medical bills and legal fees if you are charged.

Collision insurance covers the cost of repairing or changing your car if you are involved in a collision, regardless of the error. For inexperienced drivers, it can help reduce anxiety about running.

Temporary Car Insurance For Young Drivers

Private wound protection (alias pip) and medical payment coverage (Medpay) are two types of insurance that help pay for medical costs after the accident. PIP tends to provide more vaccines, as well as lost wages, child care and burial, but costs high payments. Medpay covers effective treatment and is often much cheaper.

Disabled/unrefined driver coverage can pay for medical bills, lost wages and other injuries if involved in an accident with a driver without insurance (insurance) or do not have enough insurance to cover your (low) wounds.

Car ID number (wine): This unique ID helps determine the history of car and insurance standards. It can be found on the head and under the wind barrier in front of the driver’s side.

Garage Street: Where you park or garage your car when not in use can affect insurance rates depending on factors such as crime rates and the risk of theft.

Car Insurance For Graduates

Driver Information: Collect name, date of birth and driving license numbers for all drivers who will be covered by policy, as well as basic and regular users.

Current political information: If you already have a car insurance policy, your new insurance company will want to check your coverage limits, ownership and expiry dates.

Running history: Provide ticket information, accidents or other violations. This helps insurance companies to evaluate your running record and evaluate your risk as a driver.

Payment method: It is best to have an electronic payment method, such as electronic inspection or payment card, to make the first payment start vaccination.

Why Motor Insurance Quotes Differ Widely Between Insurers Explained

In America, if you don’t have a car, your work opportunities can be minimal. If public travel is not an important option, you need a car to open your work opportunities. But car insurance can be expensive, right?

Because each driver is different, insurance companies measure the risks they take to assure someone by looking at a complete list of common things. Here are only a few things that can affect what a new driver can pay for car insurance:

You are new: Since the first car owners have less driving experience, insurance companies can see them as a high risk and give great rewards.

Under 25: Young drivers are paying the highest awards because of the data that shows that they are more likely to be in an accident.

How To Buy Auto Insurance For The First Time

You are a person: when controversy, statistics have shown that young male drivers are more involved in accidents than female drivers, so they get high insurance payments.

Married: Insurance companies usually find married drivers to be the most responsible and less dangerous, so they often get lower insurance rates compared to individual drivers.

You have chosen the lowest dedication: understanding how selfishness affects payment can be difficult for first -car owners, but we can help.

You do not drive a used car: old cars do not require much collision or large insurance, while new cars can cost more to find safety due to the high cost of repair and theft.

Car Insurance Group Rating

You live in a place where you live: urban areas often have high levels because of things like traffic density, more accidents and higher risk of theft or damage.

Your credit history is not the best: at first car owners may have a credit history or no, which can lead to higher awards.

You have not checked the discounts: at first the car owners may not know about the discounts to include policy, having a clean driving record or full driver training courses.

But it takes a lot of time to explore any insurance company, fill out their forms, wait for the offer, and then compare each to make sure you get a better plan. Instead, the Baldwin group can do all the foot work for you.

Compare Young Driver Insurance Quotes Ni

We feel it shouldn’t be a headache to get good car insurance for new drivers. That is why we have made it easy and seamless. Just give us some basic information about yourself and your car and we take care of others. Our team will compare quotations from the best insurance companies and present with the selection of options created by your needs and budgets.

From there, you can certainly choose a policy that should properly match your needs, if you are looking for cheap car insurance for first drivers, cheap coverage or special supplement. With our coordinated process you can ensure your best coverage in minutes, giving you insurance on the road forward.

When working with the Baldwin group, we also consider discounts you probably never knew. Not all insurance companies offer these discounts, but if they do so, new drivers can benefit from them to reduce their insurance payments while still retaining the coverage they need.

A good student discount: young drivers who are students with a GPA of 3.0 or more can graduate this discount.

Best Cheap Car Insurance Rates In Texas (as Low As $33/mo)

Driver Education Discount: The completion of the defensive course tends to reduce the risk of accidents and demand and qualify for new drivers for lower awards.

Multipolitic discounts: Taking a car insurance and closing it with other insurance policies under one insurance company-whether homeowners or tenant insurance can often give you a good discount.

Discounts and low mileage: Insurance companies offer this discount to people who run a few miles every year because they are less likely to have an accident.

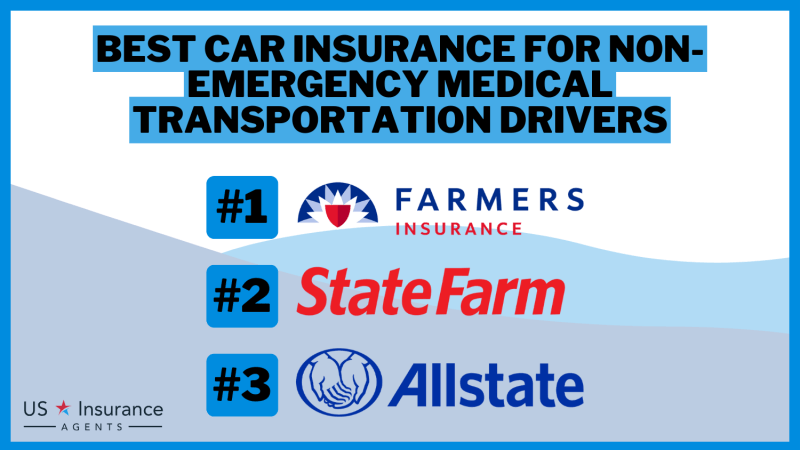

There are many things to consider when purchasing a car insurance as a new driver. Some of our ongoing affiliates, travelers, nationwide, branch, Dairyland, Safeco, National General and Bristol West-are known to help the first car drivers.

Cheap Car Insurance

These partners offer cheap prices, privatized coverage options and customer service. And when they understand the challenges that new drivers face, they make it easier for new drivers to get the insurance they need cheap for many people.

Depending on the rights of the concussion? Consumer and Trustpilot reports collect customer rights and assessments of the satisfaction of the insurance companies listed above by other service providers. Visit these websites and search for special assurance for each insurance company. In addition, the Nerdwallet car insurance inspection for 2024 was released earlier this year, and it is worth reading.

As an insurance broker, the Baldwin group reviews in guiding users through this process, making it easier to evaluate insurance providers and choose the best policy for their status.

Remember, when you get more experience on the road, every time you run responsible, get regular repairs to your car, and make sure you have the right insurance coverage.

Get Personalized Auto Insurance Quotes In Ohio Today!

So if you are a new car owner, a new driver with a used car, or want to change insurance providers, you can start today by calling the Baldwin group to (813) 939-5288 or applying for your free versions.

Our experts monitor your industry and worldly events to provide meaningful insights and help break what you need to know, possible impacts and how to respond.

People are the backbone of the digital infrastructure industry. Their expertise plays an important role in the development of creative strategies and …

As the backbone of modern communication, fiber networks need to be carefully planned, construction and control. Baldwin Group Digitance Exercises Exercises …

8 Simple Steps Reduced My Car Insurance By 57% (in Only 20 Minutes)

The renewable energy industry is facing rapid growth,