Car Insurance Rate Comparison Tool – Are you looking for a car financing computer or to compare the car on the side? This car equation calculator helps you visualize how much you pay for your current car and what the financing of a future car can look like. You can also use this car comparison tool to decide whether to rent or buy a car. Connect your loan payment to calculate your monthly car financing.

Buying a new or used car always has many questions. Is it worth buying another car? Is a used car or a new car financially better work? How can I tell if I can afford another car?

Car Insurance Rate Comparison Tool

This budget calculator helps answer these questions so you can have more confidence in your decision to buy a car or not buy a car. With this budget table you can compare more vehicles. Enter the price, mileage, loan information and repair costs to evaluate the total cost and monthly maintenance.

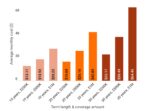

Find Out Which States Have The Most Expensive Car Insurance Rates In 2018

Representation of the distance of responsibility: We do not guarantee the results or applicability of this budget table or content on this page in your unique financial situation. You must hold the advice of qualified professionals on financial decisions.

Customize the car template you want to compare. You can compare to your current car and/or more different cars.

To get the maximum out of this budget table, try to enter your information as accurately as possible. If you are not sure about the answer, many specifications can be found on Google with a simple car search, model and year. For other fields you cannot find the right answer, you may need to evaluate. Try different values to see how the entrance affects the result.

If you do not know how many miles/miles you drive per month, you can use the calculator “Estimated Mile/Kilometer per month” in this template under the “results” section. Enter the estimate at a distance in the right cell in the budget saving portion. This part of the job list is not obliged and is designed to evaluate the value. Your usual amounts (half, complete, empty, etc.) of the car tank.

Californians Say Car Insurance Harder To Get

This budget table is designed to facilitate the comparison of more cars between more cars, including your current, with the most important decision factor, was an estimated monthly cost of ownership. Some of the questions that need to be taken into account are:

Some of the most important factors that affect this type of decision (except that you just want a new look) may include the mileage of gas, maintenance costs and financing costs. Another more subjective consideration has to do with confidence or how long you expect the car to last. You may feel forced to get a new car that suits your growing family, but comparing the cost of your current vehicle may still be important because you usually know much more about the cost of your current vehicle, which can help you have a reference value for comparison. If you want to calculate the details of the car loan purchased with the purchase of a car, see our car computer.

Although car rental cars are usually more expensive than being used and sometimes more expensive than buying new ones, comparing the cost of rental car can provide a useful measure. Car rental is usually a short -term solution and may have other disadvantages, such as mileage restrictions, hidden fees or contracts (fines for the early abolition of the contract).

If you can find a good used car, it will almost always be a better financial decision (lower monthly and total cost) to get a used car. Although this budget table does not show the effect of buying new 10-30 years, the total purchase costs and total financing costs in the long run will usually be much higher for a whole new vehicle. If you are considering buying a new one, do not underestimate the maintenance costs. If you can’t buy lemons, you can get a few years with only routine maintenance costs, but it won’t take long for new tires, new brakes, etc.

Car Insurance Costs Are Down 18% Year-on-year. So Even If Your Renewal Price Is 10% Cheaper, You Can Probably Still Beat It… 🚗 ⬇️

If your new vs. Use or new to the maintenance of your current car, it may be important to consider how long it will take until you need to make the next purchase of the vehicle. Maybe your current car lasts for another ten years, or maybe just another year. A used car may not be like brand new.

Adjustable Mortgage Loan (ARM) Canadian Lot Calculator Additional Payments Calculator Home Calculator Home Capital Loan Calculator Home Costs Calculator Computer Computer Computer Loan for Hydrooto mortal

Automatic loan computer loan computer ballon loan basic calculator loan for interest simple interest -calculator

Snowball Salt 401k Calculator Calculator Computer Faculty Calculator Calculator Cable Computer Net Value Calculator Calculator Calculator Calculator Calculator Retirement Calculator Calculator Calculator Calculator Calculator Calculator Calculator Calculator Calculator Calculator Calculator