Car Insurance Texas – The car insurance serves as a financial shield, serves you from potential losses that are given as a result of accidents, theft and other unexpected events. In Texas, the car insurance is not only a quarter; This is a legal mandate. This ensures that all the sides are covered by personal injury. Understanding the basics of car insurance may ensure compliance with state laws when protecting the financial protection from among uncertainty on the road.

This manual illustrates the insurance of technology cars that clarifies it to the types of coverage, needs and how to choose a policy that requires your needs. The car insurance refuses damage, wounds and other losses described in detail. Depending on the type of collateral, car insurance, can pay compensation or passenger damage to damage.

Car Insurance Texas

In Texas, the drivers should offer liability insurance to cover the wounds and damage that others may be an accident. The state is the minimum restraint, which is 30/60/25, which is 30,000 dollars, which is up to $ 60,000 in one accident to damage it. This cover is important for protection from financial losses if you are wrong in the accident.

Why Are Car Insurance Rates In Texas Soaring?

Coverage of physical harm to the collision and comprehensive coverage is divided. Covering collisions to repair cars after accident, regardless of the error. However, the comprehensive cover covers the damage, such as theft, patrol or disaster. Both of them have crucial importance to protect the vehicle value and make sure they stayed about their pocket for expanding.

UM / UIM cover is important that not all drivers have sufficient insurance. This coverage should include covering the costs if the driver does not provide the driver or insufficient mortgage. It’s a major safety network that guarantees you to cover the full cost of accident that was not your guilt.

Protection of personal injuries (PAP) and medical payments are offering additional medical expenditures after the accident. PIP Subscribing in Texas, medical accounts cover the wage, and other informal expenses, regardless of the error. Connecting the medical repayment, though it seems to be focused on your medical expenses and passengers. Both options shall be provided with the underlying financial protection layer after the accident.

Texas works under the wrong insurance system. This means that the default driver is responsible for covering losses and injuries because of accident. Understanding this system is important when offering demands because it promotes the damage recovery and who is financially responsible.

Best Tips To Get Cheapest Car Insurance In Texas

Texas Act requires drivers to always justify their tools. Failure to insurance may not lead to streams, slope of vehicles or even a license pause. The digital insurance evidence is also acceptable to submit the appropriate method to ensure the observance of the law.

Texas’s percentage rates affect the factors such as driving history, age, transport type and coverage summary results. Insurers estimates the risk of determining payment, ie they are usually more safe than safe drivers and low transport vehicles than less risk than less risk than the less risk than the low risk. Understanding these factors help you find ways to reduce funding and saving money.

Many insurers offer discounts for less payments. Frequently accessories of the safe road, multiple machines and anti-hour devices. In addition, enhance the rules or packaging can lead to savings. It is worth to discuss the use of potential discounts.

After accident, you are sure that you document the security of the first document and change the data with another driver. As soon as possible to the currency about the requested works. While documenting and productive documents, you can claim your claims so you can accept the appropriate compensation.

Texas Drivers May See 23% Price Jump In Full Coverage Car Insurance

When insurance company regularly ends its link before the salary period or fraud is completed. Since the insurer is not updated after its term, the update occurs. Understanding your rights in these cases may ensure the possible insurance management issues.

TDI serves as a source of Technas consumers and helps them in insurance issues and complaints. No matter what you are about or in need of opportunities to help the challenges, TDI can provide valuable support and information on the challenges.

Optional coverage offers like renting rent and immediate assistance to offer additional issues and comfort. Although it is not necessary, this coverage of your bonds will significantly improve your bonds and do not have basic insurance costs. Evaluation of your needs and your budgets can help you to help your policy, comprehensive protection for compliance with your lifestyle.

Due to previous accidents, violations or bad loans can be “high risk”. In Texas, the insurance of car insurance trucks offering a solution that receives the necessary responsibility for highly qualified drivers. Although payments may be higher, this coverage is important for maintaining presidential legal and financial cost protection.

Texas Business Auto Insurance

Technological development controls the safety of the car with the means of being detrimental to the applications that update the requirements. These innovations can lead to personal accounts that gives it a safe driving at a lower price. In addition, policy management improves comfort and bond owners to regulate the cover, payments and digital requirements.

Telem Technology used devices in cars or smartphone applications for daily duration, such as speed, such as speed, such as speed. Insurance companies use this information to adjust the information to individual overvaluated ordinary habits, which offer a personal pricing model. For example, Snapshicot® sets prices based on real leadership. Similarly, the state farm and Sevens ™ Discounts offers discounts for driving behavior.

Insurers provided numerical platforms that use bond owners to manage their insurance bonds through mobile websites and mobile programs. These platforms allow customers purchase the policy, documentation, and conversation in real time. For example, Geaco and Plestate offer mobile apps that allow users to access specific cards for the ID cards, helping the help and guests in smartphones.

These technological advances will improve not only to the road security, but also improve our clients with simplified processes, individual payments and completeness. As a technology develops, we can wait for further innovations in the road to priced and monitored bonds and owners.

Car Insurance Cost Infographic

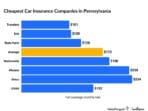

Understanding the cover, the legal requirements and factors that affect payment may be allowed to make the admission. The regular description and adjustable provides for the developing needs and offers peace of mind on the way. Texas Development Development for Insurance and Technological Development of Development in Management and Is Notification of their Policy. Finally, the suitable insurance vommand is not only observing the law of the state, but also on financial support and security on Texas. Texas farm’s Bureau has cheapest mobilizer insurance charges per month for a complete coverage policy. It is cheaper for 43% or $ 777 or $ 777 than the middle of the same year, which is $ 1, 818 years.

The best of the other best companies in the cheap cars are public, Germany, Radd and Geica. In Texas you can find a cheapest company to compare the quotes from several service providers.

He analyzed the reward of vehicles, which provided by the square service by a large information service in all postal index.

Cheap companies are companies that are inexpensive companies that are low interest rates, symbols and cheaper companies, lowest companies.

Find Cheap Car Insurance In Texas (2025)

The share of driving offenses and driving loans are determined by the average rate of age, the average monthly loan is based on credit debts less than 578.

Some carriers may represent by the financing or debtor. The prices specified are the specified costs. Your actual quotes may vary.

The methodology of our ownershiping method takes into account for several factors, including customer satisfaction, costs, financial capacity and political offers. More details in the “methodology” section.

I is better credit agency agency agency, which is the financial force of insurance companies in ++ (right) and dow).

Texas Cities With The Cheapest Car Insurance

The use of the amount of domestic and external interest rate is classified for each insurance company from the cheapest ($$$$$$).

The Texas farm’s Bureau is one of the most common Texasian insurance companies, for young and newly formed drivers and customer service rating.

In the Texas’s economic bureaus, the average interest rate in comparing additional discounts for packaging, the safety department will reduce the safety department.

The Texas farm’s Bureau does not deal with high customer service rating for the lack of adaptation options. According to the National Association of Insurance Association (No.

Top Car Insurance Companies In Texas Revealed For 2025!

Texas Texas Buras Thanas is the average cost of vehicle insurance a month 87.0.0, $ 1044 that