IndoBeritaTerkini.site – The best car insurance rate for 23 -Year -old drivers at the United Kingdom Car Insurance is an important expense for all drivers, especially for young drivers who are considered at high risk for their age and lack of experience in experience. The car insurance rate for 23 -Year -old depends on several variables, including driver records, vehicles, the amount of protection purchased and the selected insurance provider. Car insurance for 23 -year -old drivers in the United Kingdom costs between £ 772 and £ 330 a year, depending on the level of coverage and insurance selection. Drivers up to 23 years old are usually considered high by insurance companies, which make it difficult to find affordable car insurance. However, there are options for protection at affordable prices that protect drivers and vehicles. It’s a good idea to buy and compare insurance rates to make sure drivers accept the best deals, whether it’s a new driver or being behind the steering wheel for a while.

The 23 -year -old driver is considered a higher risk by the insurance company. It leads to older premiums for car insurance. This is due to the potential of the driver to enter the accident, given the lack of driving experience. There are ways to reduce the cost of car insurance. One reduces car insurance premiums to buy multiple supplier policies, take defense management courses, add experienced drivers as drivers named in policy and select cars in lower insurance categories.

Car Insurance Young Driver Uk

The average insurance cost for a 23-year-old driver in the United Kingdom varies from £ 1,000- £ 1, 500 a year. It is a typical rate that new drivers in the United Kingdom are under 25 and have not reached the age of 25, they hope to pay for car insurance. The most appropriate method for estimating car insurance rates is to request donations from various insurance companies and then study the differences between the various levels of coverage provided by each company.

Car Insurance For Young Drivers

A study by money and based on information obtained from monysupermarket found that the average annual insurance cost for cars with manual delivery was £ 465.94. Meanwhile, automatic vehicles often have a cost of almost 20%, reaching an average of £ 560.01 over a year. It is recommended that new drivers buy and get many excerpts from different insurance providers to get cheaper car insurance rates.

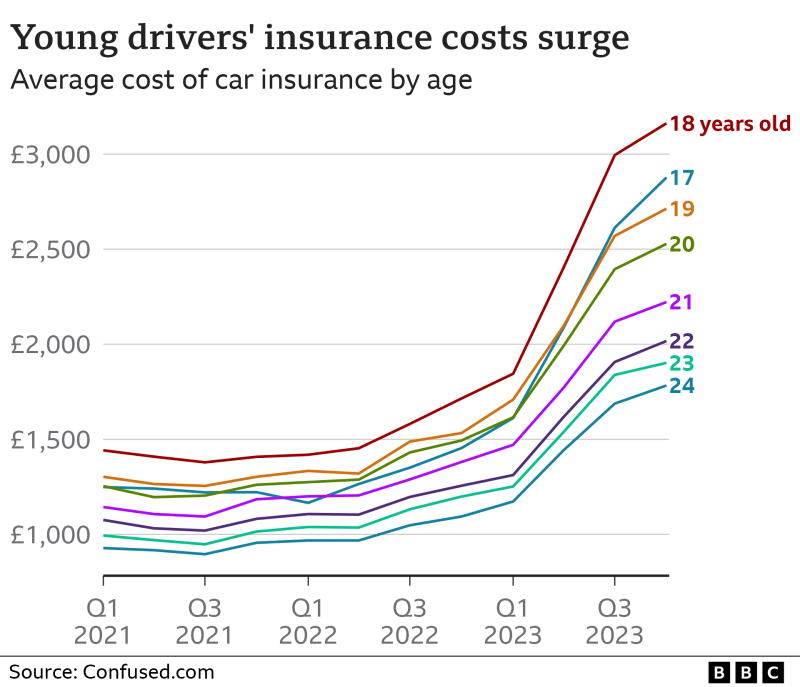

Expensive car insurance for 23 -Year -old drivers in the United Kingdom is about £ 1, 200 a year. Established in comprehensive insurance coverage with at least one driver with a valid driver’s license in the United Kingdom. The data was obtained by monysupermarkets in July and September 2022. Car insurance premiums for teen conductors are traditionally the highest in the industry; People between the ages of 20 and 24 now spend more than £ 1, 200 a year. Young drivers are usually subjected to higher premiums for car insurance because of their larger probability of participating in road accidents. On the other hand, the oldest driver with more knowledge of how to pay a much lower premium.

A company based in the United Kingdom that offers car insurance coverage options. It was established in 1993 and delivered third -party important fires and theft and third insurance options only for its customers. Some examples of additional coverage include personal accidents, key coverage and non -claiming discount protection. The average annual rate for good drivers with admiraral car insurance is around £ 650, around £ 700 for moderate risk drivers and about £ 1, 200 for new drivers. He received a 4 -star 5 star score based on customer reviews. The average number of complaints received by the company is relatively low.

There are several main reasons why Admiral is still considered one of the best insurance companies. First, they offer insurance policies from several cars, allowing customers to ensure several vehicles under one policy, which can cause discounts on insurance premiums. Second, the company offers a wide range of car insurance options, which includes only third -party fires and thefts, and comprehensive coverage, which provides customers with the flexibility of choosing the coverage that best suits their needs. Finally, it is famous for competitive prices, so it’s a great choice for those looking for the cheapest car insurance for 23 -Year -old.

Young Drivers Warned: Lie About Your Insurance And Lose Your Car|young Drivers Warned: Lie About Your Insurance And Lose Your Car|young Drivers Warned: Lie About Your Insurance And Lose Your Car

RAC Car Insurance is a company located in the United Kingdom that offers several coverage options for car insurance. The business was first established in 1897. Customers choose to have insurance coverage for comprehensive losses, fire and third theft, or just a third party responsibility. Additional coverage comes in the form of things as a discounted discount protection, personal injury coverage and damage coverage. RAC offers car insurance with premiums about 550 a year for safe and £ 650 a year for drivers with average risk level. Cost is about £ 900 for new drivers each year. Customers give a RAC four out of five stars as possible when evaluating experience with the company. The company receives a relatively small amount of complaints daily, on average.

RAC provides comprehensive car insurance coverage that includes theft, fire and accidental damage. RAC offers competitive rates for car insurance, which makes it profitable, especially for 23 -Year -olds looking for cheaper car insurance options. RAC offers one of the cheapest car insurance options for 23 years. RAC offers simple services such as online donations, online policy management and 24/7 customer service.

RAC offers two coverage options with unique value or major advantages; Road help and no claim discount. Road assistance services are available 24 hours a day, 7 days a week to assist drivers in the event of fractions or emergencies, providing peace and protection. Discounts that are not offered to customers who do not make any claims within a certain period of time, encourage safe driving and good behavior are rewarded on the road.

More than Smart Wheels car insurance is an insurance company based in the United Kingdom established in 1997. They offer a wide variety of insurance coverage, including car insurance, such as integral protection, third parties and fire and third theft. The average annual rate for good drivers varies by several factors, but more than smart wheels offer competitive prices. There are limited qualifications and complaints available to more than smart wheels, but are known for their incredible customer service and financial stability.

Young Driver Insurance Northern Ireland

More than Smart Wheels is recognized for incredible customer service, with the aim of offering a positive experience to its customers. The company has a history of stability and longevity in the insurance market, which guarantees financial security for its customers. Offering competitive prices, even for 23 -Year -Oolds looking for the best car insurance options, more than smart wheels provide two unique coverage options. Integral protection offers high protection for vehicles, even against theft, fire and accidental damage. Third -party fire cover and theft provides coverage caused by other driver vehicles and damage to theft or fire to the vehicle itself, which makes it a profitable option for those who do not require full comprehensive coverage.

The United Kingdom -based car insurance provider provides insurance coverage for individual drivers and vehicle owners. It was established in 1905. They offer coverage options, including comprehensive car insurance, third fire and robbery insurance, and third insurance. The average annual rate for good drivers depends on individual factors such as vehicle brands and models, driver’s age and operating history. The average rate for moderate risk drivers is higher, while new drivers pay higher premiums due to limited drainage knowledge. AA car insurance generally receives positive qualifications and reviews. However, the company has received an average of 1-2 complaints for each 100 policies, considered to be a low number in the industry.

AA car insurance companies are known for their comprehensive coverage options, competitive prices and financial stability, so it’s a great prestigious choice on the market. The company prioritizes giving its customers the best value, which makes it a better choice for 23 -Year -Oolds looking for the cheapest car insurance options. Both coverage options offered by AA car insurance include comprehensive coverage, which offers protection for vehicles in the event of robbery, fire or accidental damage, and third -party fire cover and theft, which protects damage caused by other vehicles as well as theft or theft Fire damage on one vehicle. This option makes AA car insurance reliable and profitable for those looking for quality car insurance.

Compare the best car insurance coverage for 23 -Year -old Young Drives involves following a set of guidelines. The use of comparative websites such as money.co.uk or moneyupermarket provides an overview of some car insurance companies and their offers and costs. It is important to confirm excess rates and find discounts to ensure economic insurance rates after reviewing the policy features of each company. The insurance company offers lower rates to complete more courses or black box installations. Payment mode affects premium rates, with some