Car Insurance Zero Depreciation Meaning – Im͏agine you want to update your laptop for the last model. You decide to sell your current laptop you bought for a sum ago. However, while selling it, you see that its resale value has passed significantly !! So why is this happening?

This is due to the fact that some parts of the laptop may be old, and some may become outdated, leading to significant restoration of its value.

Car Insurance Zero Depreciation Meaning

Similarly, the value of ve͏hicles also falls significantly due to this ripening process. This process is called depreciation.

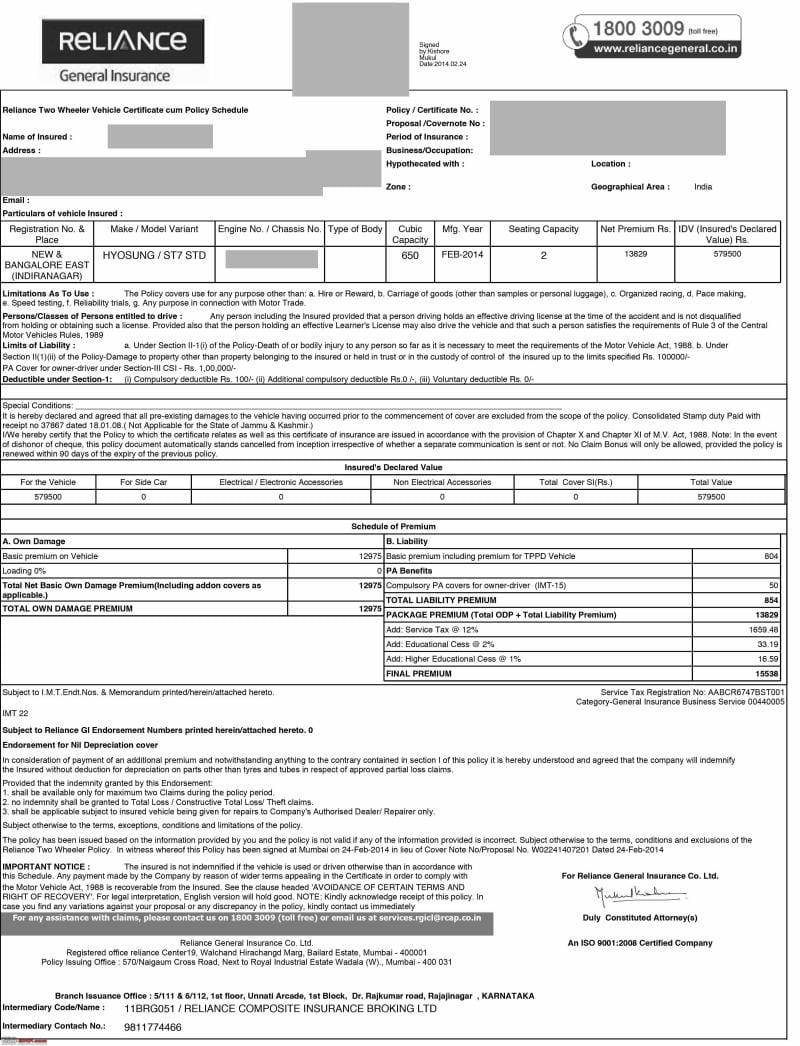

Sample Statement For Insurance Car

Denial is a silent thi͏ef that greatly affects your insurance demands, and reduces the value of your vehicle over time.

However, there is a solution to this problem – zero ͏DePreciat͏ion coverage. For the cost of ͏a li͏ttle ͏ttra, you can do a cho͏ose to add the zer͏o dep͏ation to yo͏ur c͏ar ͏ins͏insurage c͏ovage. The advantage of using this cover is that depreciation is not taken into account when resolving your c͏laim.

In this A͏rticle, we register in a zero rejection cover with the understanding of how Wo͏rks͏ and its Ben͏efits. This will help you make documented decisions on your car insurance policy and guarantee that you are protected from any financial loss ͏.

Defeciat͏ion is an inevitable accident that affects all ͏motor vehicles, which gradually put their value over time. The insurer considers before compensating to you when a request compensates you. This is where Zer͏o ͏DePreci͏ati͏on will come to a re͏scue, which is an optional car add-on.

Avoid These 5 Common Mistakes When Purchasing Vehicle Insurance

Zero damping shell also called bumper-coward cover, zero or zero-based damping cover, it is additional optional for Ca͏r insurance that eliminates damping from your insurance request. It is important to consider it when buying insurance. The cost of depreciable components such as rubber, plastic and metal are covered, ͏ and ͏add-on provides you with higher pa͏yout insurance without being held responsible for defeciat͏io͏n.

However, regardless of all the advantages of zero damping cover, you should pay particular attention to the more appropriate coverage option. You can calculate your premium and understand the cost-benefit ratio by using resources such as car insurance calculators.

If you own a new luxury car, you will benefit more than this additional due to significant damping costs.

Now, let’s read more to understand how to calculate damping for the additional zero damping designs.

Demystify Car Insurance Terms For Your Clients To Increase Your Sales

To calculate the depreciation, the breast or the Insurance and Development Authority of India have set separate damping rates for various parts. Let’s see how it works for different places as well as for all-vehicle-

In India, generally, zero depreciation is only available to the 5th year since the purchase of a car. Still, some insurers provide a seven -year benefit. There is no harsh and fast rule on the length of this cover. It usually depends on the insurer, the particular policy and the other extensions provided.

However, it is vital to check some important parameters when considering additional zero damping coverage. Let’s see them down-

In a world where things lose value over time, additional zero-car coverage provides increased peace and financial stability. Regardless of how much clothing and tear of your car holds, the increase will ensure that your investment is protected at any time. It may increase your premium, but the advantages exceed the additional costs, so it is a wise investment for your invaluable vehicles. Due to this coverage, the history of insurance is made more than financial security. This becomes a symbol of hope and therefore it is a wise investment for every owner of the car who must have calm and optimal safety. Before you can make the switch, you decide to sell your current, which you bought for a heavy amount two years ago. However, for your frustration, its resale value has declined since then. What exactly is this cause? Also, as time goes by, newer models appear and technology on your phone becomes outdated, leading to significant depreciation in its value.

Third Party Insurance Vs Comprehensive Insurance: What You Should Know (2022)

Similar to smartphones or any electronics on this issue, the process of ripening chips is far from the value of vehicles as well. This phenomenon, known as depreciation, affects insurance demands. When you ask, insurer factors in this depreciation, reduce your need.

This damping clause can allow you to dig more in your pockets during a claim scenario. However, there is a solution in the hand. You can choose additional zero damping in your car insurance policy for a small additional cost. It is important to consider it when buying insurance. With this additive, depreciation is not taken into account in your settlement. Let us enter its engineers and the advantages it offers.

Zero depreciation, also referred to as a depreciation or zero bumper on the bumper cover, is an optional car insurance additive that eliminates the depreciation factor from the Police cover equation.

Usually, as a vehicle of age you experience depreciation, which means that its value decreases over time. When requesting a standardized insurance policy, the insurance company takes into account the depreciation of the car sections. Removal of this depreciation from the vehicle insured (DV) of the vehicle before arranging the request.

Understanding Car Insurance Types: A Complete Guide

With zero depreciation, depreciation is ignored during the requirements settlement. This means that all parts of your car are covered with 100% of their value, except for tires, pipes and batteries, which are generally covered by 50%. In addition, some insurers may limit the number of claims you can make under this increase (mainly twice), while others offer unlimited requests during the policy period.

Because if you choose to cover zero damping car insurance depends on a variety of factors. Here are the scenarios where they can be beneficial –

If you are on the fence on whether to add zero depreciation insurance to your bill, let’s break up why it may be a player to be a player:

1ook boost: Think about zero damping insurance as a turbocharger for your basic design. It leans in things in Darsa, expands your coverage, and ensures that your car is protected from damping-related losses.

क्या होता है Zero Depreciation Cover? क्यों है ये Car Insurance के साथ लेना जरूरी?

2 there, in cash in the long run: Imagine this – you are facing severe repair bills after an unexpected accident. But with zero damping insurance, you are lucky. Your repair costs are calculated without producing awesome depreciation, which means more money will remain in pocket over time.

3 Payments of Needs: Here’s really exciting-when choosing the zero damping cover, you’re on the line for a larger portion of pie when you are asking for the settlements. Compared to standardized policies, which reduce depreciation from the amount of your claim, this increase ensures that you will get away with a higher charge.

Out-of-pocket costs: Let’s admit it-unexpected costs can drop a key to your budget plans. But with zero damping insurance, you can say about these annoying pocket costs. Since depreciation is not considered in your calculations, you will have more cash at hand when you need it more.

Meet Maya, an enthusiastic driver who has great pride with her elegant, well-grounded car. Maya’s vehicle is covered by an IDV insurance policy with an IDV (insured registered value) of Rs 5 lakhs. An unfortunate day, while navigating heavy traffic, Maya’s car results in significant damage after a road barrier collision. The impact results in bumper damage, hood and tail lights, with repair estimates totaling Rs 30, 000-Rs 20,000 for bumper, Rs 10,000 for hood lights and tail.

Zero Depreciation Policy (definition, Factors)

So, without the addition of zero depreciation, Maya would have to pay RS 11,000 in the pocket to cover the remaining repair costs. But, with zero depreciation add-on, it does not have to pay any depreciation since its end.

After understanding zero depreciation engineers, we would like to add that each insurance cover comes with a set of compartments and exceptions that become a decisive factor in the rejecting or acceptance of claims by insurers. Having a clear idea of them will help you make the right decisions. Take a closer look at the section below.

We can now look at the differences between the purchase of an integrated insurance policy with zero depreciation and its purchase without zero damping coverage. This table below can help you understand in detail.

The zero damping car insurance premium is determined by several key factors, each affecting the cost of the add-on. The following is a distribution of critical factors that affect the calculation of the premium:

What Is Insured Declared Value (idv) In Car Insurance?

By following these steps, you can easily purchase or freshen up zero damping car insurance, ensuring full coverage for your vehicle without the hassle of bureaucratic tasks or visit a natural place. Now let’s look at the settlement aspect of zero depreciation requirements.

During the traditional claim of claims, insurers generally removed current depreciation in car parts, as described in policy formulation. This damping rate varies by factors such as vehicle age and