Cgl Insurance Adalah – Business General Liability (CGL) insurance is a type of protection that provides a protection for business injury, personal injury and business business and property damage arising from products or wounds.

Business General Responsibility Insurance is considered a comprehensive commercial insurance, although it does not compensate for all responsibilities that can face business.

Cgl Insurance Adalah

Business general accountability policies are coverage at various levels. A policy can contain campus coverage, which protects the business from the body claims during regular professional operations. This includes physical injury and protection of property damage, which is the result of a finished product or service done in another.

Buy Insurance For Defective Construction Book Online At Low Prices In India

Business insurance companies also sell highly accountability, which can be purchased to compensate for claims that violate the CGL policy. Some commercial general accountability policies may be discounts that control whether actions include. For example, a policy does not compensate for the costs associated with the memory of a product.

When purchasing business public accountability insurance, it is important to differentiate between the policy ready for business and an event policy.

Even though the claim program was held, even if claimed that it is claimed, whenever claimed. Even if the policy is now old, an incident includes an incident policy where the claim incident occurred during the policy.

In addition to business general accountability, businesses can also buy policies that provide protection for other business risks.

What Damages Are Covered By A Cgl Policy?

For example, employment processes can be purchased responsible for business to protect themselves from claims related to sexual harassment, misconduct and discrimination. Data violations and similar attacks protect cyber insurance businesses from financial losses. It can be purchased to compensate the errors and complaints made in financial reporting reports and compensate for the security of its directors and officials.

A general business general insurance policy includes accidental damage or injuries, but does not heal wounds that may be intentional or expected to be.

Depending on its business requirements, a company may have to name other companies or individuals under its business accountability insurance policy. This is common when business enters a contract with another company.

For example, if an automobile repair garage is recorded in a contract with ABC CO, then later the cleaning services should be provided for its convenience, ABC company garage owners should include ABC CO as “additional insurer” in their commercial general accountability policy.

Commercial General Liability Insurance (cgl)

In each event, business can compensate for the cost of solving claims or claims to employ lawyers to protect the general accountability agency. If a business has frequent claims against CGL insurance, the premium cost of the insurance policy can be increased.

Business General Responsibility Insurance includes injuries in a person or property damage that occurs in a business premises. CGL policies include claims such as property damage, personal injury (such as defamation or slander), physical injury and advertising injuries.

Most CGL policies do not compensate for deliberate or expected damage by the insurer. Drugs (alcohol -related businesses), pollution, vehicle or other vehicles, can damage the work of a business or damage to additional responsibilities that insurers can take. A business that is included in this type of risks will have to purchase additional insurance to completely hide it.

The cost of the general accountability of the business depends on the amount of business, the risk of its business operations and the necessary security level. Some insurers say that their customers pay $ 300 to $ 600 for one million dollars insurance. Others say that their customers can pay up to $ 1,000.

Asuransi Tanggung Jawab Umum Komersial: Panduan Bisnis

The insurance contract includes the insurer (eg a person or business) mentioned in the contract. The designated insurer is usually a policyholder. The owner of the policy can also be named additional insurer (eg contractor) and additional labels insurers (such as co -malik).

By purchasing a business general accountability policy, you will be able to protect your business from various risks, including the risk of the case arising out of daily business activities. CGL policies include property damage, physical injury and other types of claims. This security will help in paying a lawyer fee or settlement cost in case of a case. Errors and disadvantages, excessive responsibility or employment procedures can increase your coverage with responsibility related extensions.

You cannot guess what will happen in the future, but you can hide your business and reduce your risk with CGL policy.

Investopedia writers should use primary sources to support their functions. These include white documents, government data, original reporting and interviews with professionals. We refer to original research from other famous publishers in appropriate places. In our editorial policy, we will learn more about the standards that we follow in making an accurate, side -off -sharing material.

Commercial General Liability (cgl): Protecting Your Business From Unexpected Risks

The proposals appearing in this table are in coordination with Intestopedia compensation. These compensation lists can affect how and where they appear. Not all offers are available in the market in Investopia.

Best Small Business Insurance Best Professional Responsibility Insurance for July 2025 Best Business Owner’s Policy Insurance Best Business Property Insurance

Sector: What is the possibility of examples of dying and insurance every year? How to determine what is the indirect authority? The definition, how it works, and the example of the death table: definition, type, type and bio -life analysis: What is the benefit, good business insurance companies 2025 Best Handiman Insurance Companies 2025 Best Food Truck Insurance Companies 2025 If you consider the risk management strategy for your business, it is one of the commercial public responsibility (CGL) in Vocational Insurance Insurance.

Whether you are a beginning, a small business or a well -business, understand the nuances of CGL insurance can be a sports change. In this blog, we will understand the mandatory CGL insurance, which will help in making informed decisions to protect the future of your business.

Commercial General Liability

Business General Responsibility (CGL) is a type of business insurance that provides necessary protection against various claims that can arise from regular operations. This type of vocational insurance is important as it protects businesses from significant financial deficit, which relates to business complex or injuries during business complex or business operations related to legal fees, immigration and medical expenses.

This feature of coverage provides insurance for the third -trunk injuries or property damage caused by business activities. For example, if a customer comes to a commercial place, CGL policy will compensate for medical expenses and any legal fee if you decide to sue the customer business.

This coverage protects businesses against personal and advertising injuries, condemnation, condemnation and false advertisements. For example, if a contestant sues a business to make false claims in his advertisement, CGL insurance policy will offer legal cost and any solution.

This part of the policy pays for immediate medical expenses for the injured third party. If a visitor is injured in a commercial complex, a CGL insurance policy can quickly compensate for medical expenses, which helps to avoid potential cases and maintain good customer relationship.

General Liability Insurance — Cover My Risk Insurance

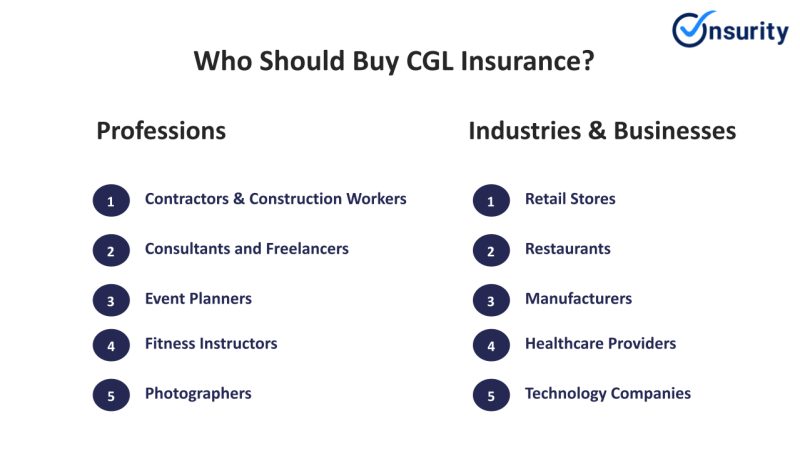

Every professional or business providing business should prioritize the Business General Responsibility (CGL) insurance policy. There are some major industries and companies here which can benefit especially from CGL coverage:

Physical injury: This involves the cost related to physical damage to third party (not employee) due to your business activities or campus. For example, if a customer slipped into your store, CGL insurance would compensate their medical expenses.

Property damage: This feature involves damage to someone else’s property due to your business activities or products. For example, if your equipment is damaged by the customer’s property during a service, CGL will offset the cost of insurance repair.

Advertisement injury: This prevents claims of defamation, slander, slander, copyright violations and other false advertisements arising from your marketing activities.

Cgl Acord25 1 190302111955687

Personal injury: Non -exclusive injuries such as misleading, privacy invasion and your business activities include similar claims.

CGL policies usually compensate for legal protection including lawyer fees, court expenses, settlements and decisions. Although a case is baseless, the policy can compensate for the costs of protecting your business.

Responsibility of products: Your business that causes damage or injury to consumers, prevents claims related to products related to products.

Complete operation: Your business includes claims related to finishing services such as wrong repair or establishment that causes damage or damage when service is completed.

Asuransi Tanggung Jawab Umum Komersial (cgl)

If a third party is injured in your business complex, or due to your business activities, fault involves medical expenses. This security is usually defined and is