Germany Insurance Company Ranking – Germany proudly introduced Germany’s best risk insurance companies to 2022, calculating data and using its excellent artificial intelligence.

The top 3 companies are Delta Director Leben, Leben and Europa Leben Dialog Box. They have 47%, 40%and 22%of the economic capital ratio.

Germany Insurance Company Ranking

They have done better than the rest of the future shareholders’ benefits, risks and other results and the corresponding regional ratio.

A Guide To German Health Insurance For Foreigners

The main difference between life insurance and traditional life insurance is when payment is made. Life insurance risks are paid not only in the event of death, but traditional life insurance is also paid in the event of survival.

There are currently about 8 million life insurance policies working and paying more than 4 billion euros of the annual insurance premium.

The biggest task we do is to provide a fair and independent ranking, participate in professional knowledge and improved artificial intelligence in a beautiful package. This is our AI model and calculates the number of major economic capital ratios.

We are totally biased and only use accountable public data. We are fair and can explain and avoid all the conflicts of interest.

I Compared Some Bmw Prices In The Usa, Germany & Finland

This website uses cookies to improve your web browsing experience. By browsing this website, you agree to use cookies. 2022 can be seen below for German private health insurance. The result is again again this year!

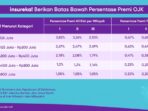

There are 10 major German health insurance companies in 2022, with the top 8 prestigious prize.

R+V Kranken has worked well because of their passive extra. McLenburgische worked well in the passive assessment of Kanken and Arag Kranken.

The largest company of the assets, Debeca Kranken is just 10th, while the smaller company, McLenburgische Kraken, is more economically stronger in second place.

Chart: The Countries With The Best Healthcare Coverage

About 11% of Germans provide a private health insurance policy. You can only register if you come to one of these types:

There are only 40 companies that offer private health insurance and a market of 49 billion euros.

The biggest thing is that we provide a totally fair and independent ranking, collecting professional knowledge with a real improved artificial intelligence. It has an AI model that calculates the number of major economic capital ratios.

We are not 100% bias and use public data only but are accounted for. It can be fair, explained, and above all, we all avoid conflicts of interest.

Azerbaijan Ranks Local Insurance Companies For Payment Volume In Jan. 2025

This website uses cookies to improve your web browsing experience. By browsing this website, you agree to use cookies. For the second consecutive year, McLenburgische took first place in the Kranken ranking. In previous years, it was fourth and second, so a steady improvement could be seen. With the ratio of economic equity (the economic equity for total assets) 30.57%, it exceeds the runner -up, R+V Cranken (ratio of economic ownership equity 15, 05%). The third place in the winning stage is’ Nvivas Kranken (14.74%economic equity ratio).

In its proportion, McLenburgische Kranken has strong risk and other results in the market. Therefore, products with the most technical gain. With high stability of portfolio (low portfolio exit), this leads to a higher expected addition. Policy owners benefit from this through profit participation. The major business is the best health and expect more profit in the future. It strengthens the economic power of McLenburgist. The only downside is the average cost of investment. This may be due to depletion.

This year, too, it has been noted that the quantity is not the only equivalent to more economic power. Many giants of the industry are below the market average: General (18th), AXA (29th), Ergo (30th), Alians (second to the final. 31), DKV (finalist 32).

Market leader Debeca is 28th among 32 health insurance companies. Its economic equity ratio is 7.78 per cent. While Debeca has average investment profits and is on the rise, the future extra is expected to be under pressure in the last two years. This is due to relatively low portfolio stability: only 5.3% of insurers leaving the masses due to the finish or cancellation of the market, in Debeca, the number of this number is 7.9% per year. Furthermore, the equity ratio of Debeca is at the market average. This is a unique example with the belief of policies without a high level of equity to the industry’s Giants. However, there is no bonus for the size of the company in the realrate price model. We see a relative balance sheet structure and therefore make large and small insurance companies compare. It is clear that in particular the ranking of health insurance, small providers specifically have a convenient balance sheet structure.

World’s Most Trustworthy Companies 2023

A total of 32 German health insurance companies have been analyzed and evaluated for their economic power. Two factors are the focal point of high financial energy: the first, the guarantee gain offered in the form of HGB and secondary equity, risks and other results. Furthermore, the company’s stability and investment results also play an important role.

The Realrate price model does not work with fixed weight, but determines the value of a fair financial company using a comprehensive price method. As shown in the graphics, the company’s value and economic equity will form a gradual combination of a number of information from the balance sheet and income reports. Occasional graphics shows that color and quantity affect the factors that lead to the average performance of the health insurance company.

The method of use in artificial intelligence can be described using examples of the ranking of German life insurance companies.