Indonesia Insurance Landscape – The Insurtech sector in Southeast Asia goes through the transformation phase guided by new models and categories. Recent regulatory changes insert the way for innovative business models that improve the interactions with customers while reducing service costs. This week’s newsletter explores how Insurtech focus on making income and achieving profitability and how they change the exciting path in this development. Please read!

1. In a funds collection campaign, Insurtechs Southeast Asia strategically changes its focus from aggressive expansion to sustainable profitability, exploring innovative business models and geographical expansion.

Indonesia Insurance Landscape

There is a significant potential for the growth of the emergence market in Southeast Asia, especially Indonesia, Thailand and Malaysia. However, players understand the need for innovative insurance products, customer satisfaction and need to install insurance into their daily activities for cheaper distribution solutions. For example, the latest innovation of passarpolis, TAP partners aiming outside the merchant’s network to easily offer built -in insurance and tailors industry trends to improve customer travel and digital platforms.

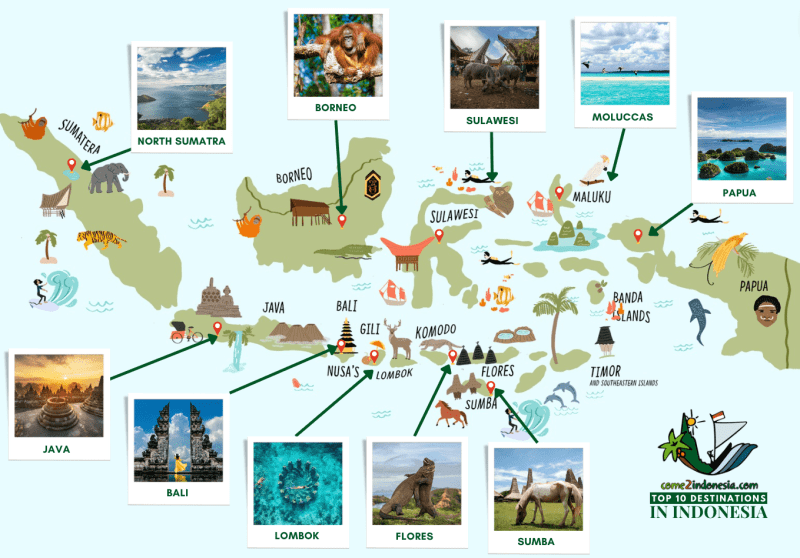

Top 10 Destinations In Indonesia 🌴 Must-visit Places For Travelers

2. Singapore aggressive regulatory support and investment in technological infrastructure are positioned as the main center for Insurtech startups

The purpose of the Sandbox regulations is to promote innovation among companies with authentic values proposals, while providing a controlled environment for their spreads to spread in a larger market. Singapore is at the forefront of Fintech regulation, setting a significant precedent by actively supporting the startups, further explaining the leadership that initiates innovation in various financial sectors.

Although Vietnam has taken steps to establish a fintech regulatory sand boxes in its banking sector, it is important to enable Fintech Innovation to expand beyond banks, including areas such as Insurtech. In order to fully accept the options of Fintech, Vietnam may need to expand its regulatory frame to adapt to a variety of financial subsectors range. Countries like Indonesia, Philippines and Thailand have already opened the way to opening sandy insurance players, promoting an environment that encourages new business models in the insurance sector.

3. Insurtech must be addressed by low insurance literacy, strengthen digital infrastructure, innovate risk assessment and progress in a high claim ratio

Dari Desa Ke Panggung Global

Outlook insurance requires fundamental changes to resolve key challenges that emphasize the need for robust educational initiatives, such as low insurance literacy among consumers. In addition, there is an urgent need to improve the possibilities of digital infrastructure for effectively spreading reach. In addition, Insurtech industry must solve the high claims, requires innovative risk assessment models and improve insurance insurance practices, ensuring long -term sustainability and competitiveness in the Insurtech sector.

4. Adoption AI enhanced by complementary measures such as synthesis integration could help Insurtech reduced costs and improvement of audience selection

As AI integration is deepened in the industry, insurance managers must understand the impact on demands, distribution, insurance, skills, technology, culture adaptation and employment for future success. In the users’ service, AI-Ground Chatboti provide effective 24-hour insurers support. Algorithms to detect frames with AI facility improve safety by identifying potential fraud and fraud. To process the payment, the AI simplifies and accelerates the payment process and reduces the overhead directing costs. This transformative technology also helps in better insurance, adjusting insurance contracts to fit the needs of individual customers. The US lemonade, based in the US, is continuously used by AI to reduce costs and promote savings, and also uses the same to Insurtechs in Southeast Asia to reduce costs in the long run.

5. Low loss rates and high -tech efficiency are intended to provide path to profitability and long -term sustainability for Insurtech players.

Tag: Online Travel

Using advanced data analytics and understanding of consumer behavior, Insurtechs can better predict and manage risks, reducing the payment of bills and loss rates. In addition, simplified digital processes lead to increased operational efficiency and reduced management costs. Not only does this improve risk management and cost control, which makes it more profitable, but also increases customers’ satisfaction with faster claims and adapted insurance solutions. Ultimately, this approach focused on technology sets an Insurtech sustainable insurance growing company. The Indonesian industry for the KE-28 (AUUI) X-ray are in the form of international exchange. Mengusung theme: “ensuring stability and resolving the illumination of risk affecting insurance situations”, Perhelatan Tahunan Ini Diharapkan Dapat Menjadi Wadah Betemunya Ide -de Dan Practic Menbak Mendorong Penngemann Industrin

Bali (Antarah) – Indonesian Randwaus Ke -28 Yang Diinisiasi Oleh Asurani (Aaui) Kembali Menjada ayang Pentring Bagi Polo Industrial Perasure Internal. Menongusung Theme: “Providing stability and detecting risk that affects the insurance situation”, Perhelatan Tahunan ini Diharapkan Dapat Menjadi Wadah Betemunya goes the day of the PRACTICT TERBAIK Guna Mendorong Penngembanan, Masandan, Masazranski in Di-Masangan.

Acara Yang Diadakan di Nusa Dua, Bali, Ini Dihadiri Oleh Lebih Dari 700 Pesert, Termesuk Practicals Dari 15 Negara, Indonesia, India, Malaysia, Korea Seltan, Ingisgga, Inggris, Inggris, Inggris, Hinggg, Hinggga Sebagai Phorthing Dicusi Global.

Sejalan dengan hangs pt grief resources indonnery (mourning) Unduk mendukun tercipantanaya bisnis yang berkelanutan, mournful kembali menjada sponsor dalam indesenea rendevous24. Dukungganini Merupakan Bagian Komian Komian Indonesia Meral Keteruribatan Acto Dharam Belbabagi initiative Pening.

10 Top Insurance Companies In Indonesia

“Tugure to the village of Berupaya Untuk Berkontribus Dalam Kemajuan Indurani, ITULAH Sebabnya CCAMS MEMBERS DUKUNGAN Penuh Terhadap Indonesia Rendevous”

Dalam Kesepatan Indonesia Ke-28 Ini, Tugure South Menggelar Pertemuan Exclusif Denman Mitra Bisnis Melalui Tugure Lounge, Sebuah Wadah Untuk Mepererat Kerje Sam chemitraan. Selain ITU, Tugura Mengadakan Acara Tugura Jagaddhita BalineSa Culture, Sebagai Bentuk Apressiai Terhadap Budaya Bali Sekaligus Sarana Memperkuat Jejaring Antar Pelak Industra Assurani.

Buffs strategy is to be in the middle of the world

![]()

“Industra Asurani Saat Ini Mengadapi Banyak Tantangan, Baik Dari Factor EXRNAL MAUPUN Inside. Perhelatansepertindonesia Rendezvous Rendevous Rendeviken Kesemampatan without Menngexploras Berbagai Peluan Poluan

Family Package #8

Dalam Rangkaian Acara, Direktur Operanaionsal Tugur, Erwin Basri, Turut Berpartisipasi Sebagai Salah hour pembbier daalah hour hour hour for Forum Discusses Yang Tentang Compurry Computative Adcrtiable (Mtpleableable Aublroomabilbil.

Erwin Memaparkan Bahwa MtPl Saat Ini Topik Yang Lidang Hangatnya di Indonesia. Adapun portfolio redurani untuk jenis arranggungan ini masses of the relative Rendah, Dengan Porsi Hanya Sekitar 0, 36% of the war-war dalam tujuh tujuh tuhun Tahun terakhir. I’m not a fan of my life.

Menangapi Rinkana Oik Yang Akan Mewajibkan Aslansi Tangang Jawab Ketiga (MtPl), Irwin Menyoroti Potensi Akmurashiyan Visa Bisa Tayadi Ketics Bebelap

“Asmiggasi Risiko ini dapat Memic volalitas, as well as asurani, as well as the Asurani, and the jealous Elwin.

Seameo Recfon On X: “on This National Health Day, Let’s Explore The Evolving Landscape Of Health In Indonesia. Discover The Tools Shaping The Future, We’re On A Journey Of Positive Change. #harikesehatannasional #

Lebih chain, erwin menambahkan bahwa daalam situation seperti ini, Peran Resurani Menjadi Krusial Dalam Menstabilkan Pasar Dengan Menyerap Ampergasi Risiko Tersebut. I am not a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man a man who has a man who has a man who Has a man A man Who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has a man who has

Harapanenya, Collarrashiyan Quat Antara Aslansi Dan Parsachian La Dapat Mendololong Tercipaya Bisnis Jan Leviv Stabil Dan Berkeranutan, Celta Mengadirkan Sori Yang Levik Baggie

Dilalang Keras Mengambil Konten, Melacukan Crawling Atau Pengyndexan Otomatis Untuk Ai di Situs Web Ini Tanpa Izin Tertulis Dari Cantor Berita Antara.

BANGN PUBLIC DAY AMONIA HIJAU TERBESAL DENGAN DENGAN ENERGY ENERGY TERBALKAN YANG BELOPERASHI Sekara Mandiriflu Bali are ancient volcanoes, cultural center of Jakarte, and Indonesian islands are a living place. Therefore, if you are planning to move, it is important to understand the health system because it is different from your western colleagues.

Health Insurance For Expats In Indonesia

It consists of about 17,000 islands (many of which are without stored), and the health sector is divided into private and public. The first is extremely high quality and is reflected in price. In the public sector, the Indonesian government implemented the Universal Health Care Program, JKN (better known as BPJS Kesehatan or BPJS Ketenagakerjaan). However, the entry is slow and the medical resources of the island are rare. Many health institutions in the area are equipped only by basic supply and treatment facilities. Most hospitals do not meet Western standards and often requires proof of insurance or advance payment. Many companies provide medical assistance to their employees in the form of health plans, but this is not a legal request.

Most Western governments recommend comprehensive health insurance for foreigners who want to move to Indonesia. Reports on medical evacuation and repatriation are often considered key, as complex operations and emergencies can take place in neighboring countries.

The next section will provide a detailed explanation of the Indonesian health system and provide information on the personal coverage of foreigners who want to move.

JKN (Jaminean Keshatan Nasianal), better known as BPJS Kesehatan or BPJS Ketenagakerjaan, is a national health program of Indonesia. As a member of the BPJS, medical care is available for free or for low costs. The system is at an early stage and is funded by national taxation.

The Crucial Role Of Funeral Insurance In Indonesia

Below the Public Hospital is the community health center known as “Puskesmasma”. Pukesmas is a major health care provider in many rural areas, and is often accompanied by “Posyand”. There are two types of dogs.