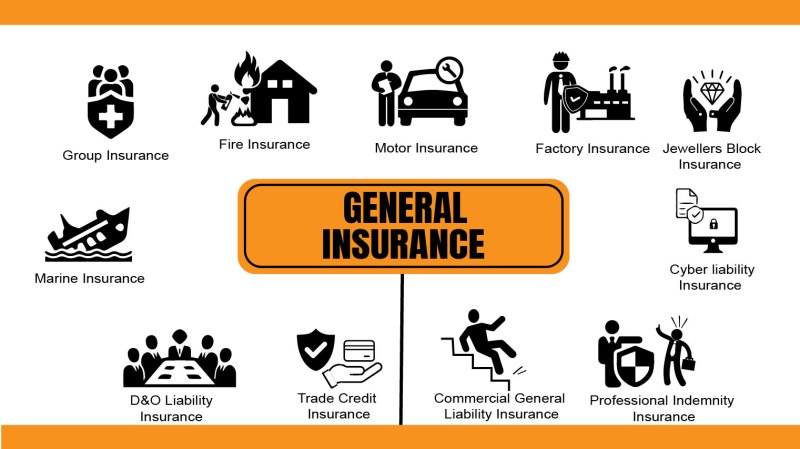

Insurance Aggregate Meaning – The liability of the total total limit refers to the most money that the insurer can be obliged to pay for the insured period. Commercial total commitment (CGL) and professional general liability quotes are explained in detail these common common limits.

The total total limit is recorded in the insurance contract and reflects the number of hidden losses that the insurance will pay. Common restrictions are part of the Commercial General Liability (CGL) and the total overall liability insurance policy. The insurance policy does not limit how much they paid for only one event; However, if the liability limitation is enough to reach the overall limit, then without an effective entry.

Insurance Aggregate Meaning

There may be several different limits of insurance policy. Apply the total total responsibility limit

What Is The Difference Between Per Occurrence And Per Aggregate

Types of responsibility include policies as material damage, body injury, personal and advertising. The permanial limit belongs to all the events that the insured party claims. The limitation of medical expenses will pay the bidder’s medical taxes.

The total total limit is an important term in CGL insurance and is equally critical of Paul’s owner. The total limit, material damage, body injury, medical expenses, court sessions, etc., which may occur during the insurance policy. The coverage will pay any claims, damage and claims, which is involved in the entrance until the pole owner reaches the total limit. After exceeding the total overall limit of Paul, the CGL has not to compensate for compensation, expenses or court claims.

For a job trying to get insurance, the question arises how much insurance is. This is a balanced movement between the worst scenario or the choice of qualifying restrictions where your policy is a potentially exhausted risk. If your policy has been exhausted, you can cover the claims yourself.

The problem for the polygon is enough capital to get restrictions. Thus, if you are insured with a number of employees, it can make sense of extra embella. Like other businessmen, insurance companies also have risks. The purpose of the insurance company is to provide you with the protection you need for your work when restricting risks. The General Section here will help balance the insurer’s insured’s risk with the help of insured protection.

How To Read Your Certificate Of Liability Insurance

If you are a business owner, you can actually help reduce your risks when choosing a higher general insurance policy.

Manufacturers who are productive in mass producers, like dodoxors with potential potential forum moving costume. Doctor’s vocational liability insurance restricts the total limit of $ 1 million and $ 2 million in the incident. If the doctor complains twice and is twice, the doctor is the third of the doctor, the doctor is third, that their policy is a $ 2 million restriction.

The doctor will not have any additional coverage until the next policy. In this way, despite responsibility insurance, Paul protects the owners, it provides an incentive to prevent the costume because of their coverage. These restrictions also protect insurance companies from unlimited damage, which in turn helps to stay in work.

The quotes visible in this table are one of the partnerships that are compensated. This compensation lists can affect how and where it appears. It does not contain all the proposals available in the market.

What Is A Policy Limit?

Payment point: What is, how is it, and an example of the balance sheet, for example, an alternative contract, what is this, how it works, how, works and combined limits: Last schedule of death: What and how, how, how, it works and how it works in the bonus

General Report: How Lloydun Institutions Works and How To Promise and Examples of Property Property Works and Examples of Insurance Property Does: Subject Contression and How Does It Working and What A Benefit? How to work, for example, how to explain CEDING Company: The meaning of the meaning, benefits and types, the point of contracting the insurance company will pay for all allegations during the policy.

The insurance policy usually determines both individual claims and complaints in general. The aggregate is a collection of general claims. If the company’s annual coverage is $ 20 million, the insurance company will pay a total of $ 20 million and claims only $ 25 million in politics.

As noted, the insurance policy is often determined by the amount paid for an individual suit and Paul’s owner.

Adverse Development Cover Agreement By And Between Maiden Reinsurance

For example, there are $ 25,000 in the commitment to a claim in the commitment to a claim of $ 100,000. The total limit is now $ 75.

In the insurance policy can also be “lower limits”. That is, there may be claims of a certain loss of losses such as flood and earthquakes.

As in the above example, health insurance plans often have capital with single taxes and annual claims.

Politics can also contain lower limits that create the amount paid due to certain damage or losses.

Insurance Stand-up: Per Policy, Per Project, Per Location

The family’s dental plan will pay for each filling, cleaning or quantity for the crown. Politics will also stop the family with an annual general limit for allegations. If the family exceeds the annual limit, they must pay the cost of pocket until the next policy period begins.

Some poles are insured specifically to pay for any catastrophic loss that exceeds common limits in ordinary policies. For additional cost, many insurers offer additional plans that cover the overall limit of the main plan. They can be a specific, but higher level or no margin.

Employers financing employees’ health plans can use similar parking insurance to protect catastrophic claims. According to a self-rated plan, employer lifts a claim to the total limit by employees. This Standard policy may leave an employer responsible for paying a pocket for expenses exceeding the total limit.

The employer may accept the suspension of a loss policy that compensates for the amount exceeding the overall limit.

What Is Excess Liability Insurance?

The quotes visible in this table are one of the partnerships that are compensated. This compensation lists can affect how and where it appears. It does not contain all the proposals available in the market.

A perfect balance, for example, a suitable contract, what is, how it works, and how and how the final death schedule is and how it works and works, and how it works,

Combined separate restrictions: definition, sample, benefits, open coverings, significance, reviews, and excessive requirements: Lloyd how Lloyd works for organizations and how and how (NAIFA) and how (NAIFA) and are the insurance premiums. Examination hours are statistics collected by the US Labor Department, a US Labor Department, a year of all employees or a full-time person in a year.

The total hours are statistics collected by the US Department of Labor (DOL). Total hours are people who work in full or working or a year for each year.

First Year’s Application Of Ifrs 17 In The Financial Statements Of European Insurance Companies

Tedol is the level of the US Cabinet of Ministers responsible for fulfilling federal labor standards and promote employee welfare. DOOR broadcasts many different economic information and information in the US labor market. Among the different ingredients this is the amount of all hours working in the industry or all the hours inside or inside.

The department calculates weekly hours of weekly hours, the number of employees announced from each body and then the total number of employees, each of these organizations has its own salaries.

One of the most closest monitoring of DO is weekly general indices

Aggregate meaning, aggregate in insurance, aggregate insurance, aggregate insurance policy, aggregate insurance limits, aggregate insurance coverage, general aggregate meaning, insurance general aggregate, aggregate insurance term, general aggregate insurance meaning, aggregate liability insurance, aggregate insurance meaning