Insurance Brokerage Meaning – 3 minutes can save you hundreds. Enter the postcode below and join the Canadians who rescue car insurance.

It serves as an independent broker between you, authorized financial institutions and experts, without any additional fee for our users. For the sake of transparency, we reveal that we are working with some suppliers we write – listing a lot of financial services without financial earnings. A financial institution or mediation does not work and is reviewed by authorized experts to ensure accuracy. Our unique position means that we do not have a recurrent share in your politics and ensure that our job to help Canadians in a better financial decision, lack of prejudice or discrimination.

Insurance Brokerage Meaning

They are often found in the same category, but there are significant differences between insurance brokers and insurance agents. Both brokers and agents help you find the best insurance policy, but they do it in different ways. According to your needs, you can take advantage of each other.

How These Insurance Logos Attract More Clients

An insurance agent is a person selling insurance policies for a particular company. They usually know everything about insurance offers from an appropriate company and can answer any questions about them. Agents can also offer you insurance packages, such as a home and car package to help you save money.

Insurance agents are independent contractors or employees working in the company. They are part of the staff so they can access special offers or discounts that mediates cannot receive.

Do you need an insurance agent to buy insurance? An agent is not needed, but they can be of great help. They can close the insurance company themselves and faster and easier shelves.

Choosing if you work with agents or intermediaries means that you need to get to know the pros and cons. Here are the benefits and benefits of cooperation with insurance agents:

Insurance Agent Vs. Broker: The Differences And How To Find The Right One

An insurance broker is someone to assist you in insurance but is not connected to any insurance company. There are independent insurance experts who find the best offers for insurance. In fact, they are asked by law to act in the interest of their clients.

Insurance brokers work with you to find out what you need from the shelf. You do not have to sell shelves with a particular company so they can find an insurance policy that meets your needs. This freedom of selecting and selecting shelves from different companies gives intermediaries priority over insurance agents.

Better, brokerage services are free for customers. Insurance companies pay a commission if they manage to sell the insurance policy.

Some believe that agents and intermediaries are basically the same things, but they are not. How are different insurance brokers and insurance agents? Here are three basic differences between them:

What Is An Insurance Broker, What Do They Charge And How Do They Work?

Insurance agents work for a particular insurance company. This means that I’m here to sell insurance policies and first set up a business. They can help you find the best insurance policy, but they still have the best insurance companies.

Meanwhile, insurance brokers focus on the best interests of their customers. They are legally obliged to offer you the best insurance policy they can access. They receive commissions from insurance companies, but a good broker should first set your interests so that they do not recommend incorrect insurance policy.

Insurance agents can only recommend shelves from the company they are working for. You could know a lot about what their businesses offer, but the choice could be limited. You may need to change insurance companies if the agent cannot help find what you need.

In contrast, insurance brokers can look for a shelf in the entire market that is suitable for you. That being said, good brokers make research laws and policies before recommending them.

Exit Your Insurance Business

Insurance representatives can complete a self -taught transaction as they operate directly for the insurance company. This means that you can close the policy faster.

Insurance brokers do not work for any insurance company, so they cannot conclude only transactions. They must contact the insurance company to complete the sale, which means that the insurance process may take longer.

Agents and brokers are here to answer your questions about their abilities. But first you need to know what to ask. Here are questions that you can ask insurance agents and brokers:

Whether you choose an agent or intermediary, you need to choose the one that best suits your needs. If you have already used a particular insurance company, the agent could better suit your needs. The broker is better when you do not know which company to buy insurance.

What’s The Difference Between A Securities Broker, Advisor, And Representative, And An Insurance Producer, Agent, Or Broker?

If you want to import a car in Canada, be prepared for unique insurance challenges. Find out what it means to protect the imported car.

PLPD insurance is the minimum value of coverage that you should lawfully run in Ontario. Exactly find out what PLDP insurance covers.

Does your car share your information without your consent? Find out how car manufacturers collect your personal information and best practices to protect your privacy. Insurance Broker, an expert who acts as an intermediary between consumer and anismal society and is the first to help find a policy that best suits their needs. Insurance brokers refer to consumers, notinsurcecompanies; Therefore, on behalf of the insurance company, they cannot connect the coverage. This is the role of insurance agents who represent insurance companies and can complete the sale of insurance.

The insurance mediator earns money from the sale of insurance to individuals or businesses. Most fees are 2% to 8% of bonuses, depending on state regulations. Interviews sell all types of insurance, including health insurance, household owners, accidents, life insurance and summer years.

What Is A Brokerage Account? Definition, How To Choose, And Types

The main way the insurance mediator earns money is from the commissions and taxes obtained on the policies sold. These commissions are usually the percentage of the first annual policy. Aninsurance premiuis the amount of money paid by an individual or company for insurance.

When he won, he is the first insurance company. It also represents a responsibility that the insurance company must ensure coverage of the claims against the Rules. Insurance companies use bonuses to cover the obligations related to the policies they are ordered. I can also consider the first who created greater returns and compensated some of the insurance insurance costs, which can help the insurance company maintain competitive prices.

Insurance companies invest premiums in assets with different levels of liquidity and return, but are asked to maintain a certain level of liquidity. The regulatory authorities for state insurance have established the number of liquid assets needed to provide an insurance application.

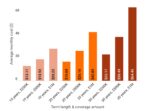

A broker or insurance agent will often earn a percentage of a flat rate compared to the first year of the policy I sell, and then with a lower annual payment, but during the annual remaining revenue throughout the life of the policy.

Mgi Brokerage (@mgibrokerage) • Instagram Photos And Videos

Interversions also earn money and offer customers consulting and consultative services for payment. In certain circumstances, transaction taxes may be charged. For example, brokers can charge taxes to start changes and to help the deposit in the deposit.

Countries regulate how and when brokers can charge taxes. When permitted, taxes must meet certain criteria, for example, reasonable and agree to the customer and the intermediary.

Disputed, some insurance companies encourage brokers who are well behaved by paying larger bonuses or fees. The compensation is often based on previous performance and is used as a motivation to continue certain behaviors that generate income.

However, because – at the best of interest of their customers – intermediaries are not a special business, this method of victory of commissions often frightens.

What Is A Wholesale Insurance Broker?

The broker is employed to represent the higher interests of his clients. Part of a long intermediary is to understand the situation, needs and wishes of clients to find the best insurance policy in their budget. Choosing the right insurance plan can be complicated and studies show that many people choose less than an optimal plan when based only on their own judgment.

In addition to the fact that they are well acquainted with the offers of all insurance companies, intermediaries should not affect any particular company. As a result, intermediaries pay a commission instead of receiving payment from insurance companies, as the latter could create negative incentives that damage confidence between the mediator and the client.

The broker has an important responsibility to help people navigate between insurance plans, many of which have subtle differences. In addition to connecting clients with the correct rules, the broker continues to have obligations to his clients.

The intermediary offers consultative services to help customers submit debts and receive benefits, in addition to determining whether policies need to be changed.

Video From The Owner Of Catalli Insurance Brokers

In order to be aware of the change of regulations and ensure that they continue to perform their tasks, intermediaries are authorized by the state insurance agencies. Their permission needs to be reserved in most countries. Interversions must regularly meet with their clients and examine how their current policies meet their needs.

Like insurance agents, insurance brokers also need a diploma, frequent sale or strong interpersonal and research skills. Since insurance brokers have to examine the contracts on behalf of their clients, they need to pay attention to details in the contracts and comfort in the analysis of the conditions and conditions to succeed.

Although insurance brokers can cope with so many types of insurance