Insurance Brokers In Indonesia – Alliance Insurance – Extraordinary Reader Trial, how are you? As we often write before this, one of the important tasks of an insurance brokerage firm is to help clients make claims for accidents.

Frankly, claims are the most important part of insurance transactions because for very simple reasons, claims can be rejected by insurance.

Insurance Brokers In Indonesia

The success of a claim settlement is not easy because it is a result carrier that combines the results of understanding the terms and conditions of insurance policy, selection of appropriate insurers, technical aspects, negotiation skills, relationships and good communication and loss regulators.

Pt Rajawali Insurance Brokers

This time, we will explain the success of one of the L&G Insurance Brokerage Brokerage Brokers who have just completed a heavy insurance claim value for the RPG claim. Rs 66 billion. Claim value is very good for a heavy equipment crash.

We hope this article helps you understand the importance of insurance guarantee, especially for heavy equipment and the benefits of experienced brokerage insurance companies. If you are interested in this article, please share it with your colleagues to get to know you immediately.

The accident occurred on May 16, 2019 in the coal mine area of Sikalimantan, North Kalimantan. Inside the mining area owned by PT Victor Dua Tiga Mega.

The accident occurred in unit B60E of truck articulated trucks (ADTs) for RPGs. 9. Due to slippery road conditions, $5 billion was an accident. The ADT slides in reverse at the top. According to the report, road conditions preferred to slip because it rained for several hours. Due to this accident, the truck operator was trapped and then saved. The ADT is still in new conditions, only a few months. Most trucks are damaged.

Pendapatan Premi Melonjak Hingga Rp 1,56 Triliun, Indotekno Raih Penghargaan “insurance Market Leaders Award 2024”

As the mining company has managed well the health and environmental safety (HSE) according to coal industry standards, it is possible to handle crashes correctly. The victim can be removed from the truck, which is immediately taken to a clinic owned by a mining company not far from the scene of the accident. Then, for more treatment, the victims were under the nearest hospital and moved to the best hospital in the area. Then knowing that the operator’s life has survived, his condition is improving now.

On the same day, L&G Insurance, as a broker, received a client notification for the accident. After checking the policy, the status of the premium payment and other returnees were abandoned, L&G immediately told the guaranteed insurer’s accident report, namely PT Tugu Pratama Indonesia TBK. (TPI). TPI confirmed that they received and recorded a claim report and requested more information about the accident.

Additionally, L&G, as an insurance brokerage firm, began to serve as an advocate and attorney to file claims. L&G immediately proactively interacts with the assurance in Jakarta and the on-site to get the information needed to resolve the claim immediately.

In addition to the guarantee of operating ADT, L&G also communicates with the rental companies that fund the unit. For leasing companies, this incident is of course a high risk of financing, as they cannot expect to pay in the remaining installments.

Pani Insurance Brokers (@pani_brokers) · Jakarta

Because the value is claimed at the TPI mlarens. In addition, L&G communicated with McLarens. For L&G, this collaboration is the time when communication has been established.

If you see this accident on the plains, it seems that the part that is suffering huge damage is the head. But to prove the real damage, McLarens should be required to remove the damaged parts.

With the approval of the loss regulator, subsequently agreed to use the PT Hexindo Adipkasa TBK’s service for investigation and estimate damage. As we all know, Jiduo is the official publisher of ADT Bell in Indonesia.

Shennordo’s findings show that the unit’s maintenance costs exceed the new costs. Of course, things are a particular problem with the loss regulator, as it means that the condition may be total loss or exact constructive loss.

Bank Mandiri Lepas Saham Axa Insurance Ke Bos Talisman Insurance Brokers

To prove that the defects proposed by many describe the current situation, the loss regulator requires a total removal of the units performed so that the elements can be noticed completely damaged and repaired.

For your information, one of the challenges in determining the value of a heavy equipment insurance claim is “repair” or “replacement.” Repair costs are low. While replacing with new value elements, it will definitely be higher. In this case, technical skills and support experts need to decide.

As the mine has limited equipment, the equipment can be lifted and damaged, it is agreed that the unit should be moved to Banjarmasin’s nearest Hexindo workshop. In order to move it, it takes the right time to wait for the proper river to pass through the conditions.

While waiting for the right time to move troops to the workshop in Six Mountains, suddenly, the Covid-19 disaster happened. Limitations of distance and activities including the transportation sector are restrictive. As a result, the transfer process was delayed for a period of time.

Indonesia Rendezvous: Home

Eventually, the unit arrived at the Hexindo workshop in Banjarmasin. After the demolition, it turned out that the estimated damage that occurred more often was not much different. Repair costs are far from insurance funds.

Based on L&G as a direct insurance broker coordinated with McLarens’ direct insurance broker to be able to obtain advice from Hexindo and subsequently approve claims in the form of total losses.

As a result, on June 8, 2021, the claim payment was achieved. The claim payment is provided to PT Hexa Finance, Indonesia under the terms of the lease term as a lease company for the unit’s lease company.

Both operators and leasing companies know that collateral must be important equipment. Frankly, as brokers, we still find many clients in the heavy non-priority insurance guarantee equipment field. They said: “We are professional, we are always careful, we are experienced operators, our mining is safe, and there are many other reasons.

Pt Talisman Insurance Brokers

Due to high risks, such as this accident, not many insurance companies are interested in ensuring heavy equipment. Usually only a few insurance companies are willing to guarantee, and often have business considerations, a large number of transactions, good relationships and future business potential. In this case, it is very suitable to use PT tugu Pratama Indonesia TBK. TPI is one of the largest insurance companies in Indonesia, public (public), high-level and strong professionals.

An important factor in claim completion is the use of the loss regulator company’s services that control risks. Especially for heavy equipment assurance, there are not many loss regulators that can rely on them, one of which is Mlarens. Multinational corporations have been operating in Indonesia for decades and have completed many major propositions. The choice of loss regulator is the right of the carrier, but can be guaranteed to be recommended by the broker in the form of a nominated loss regulator clause.

To take care of such complex and large insurance claims, as an insurance lawyer, the existence of an insurance broker is required. It’s not easy to understand what the policy is, but for guarantee brokers, it’s the “general” knowledge they discuss every day. Coordinating between insurance benefits and warranty is a difficult task for an insurance broker based on what the insurance covers (terms and conditions). It is difficult to find an agreement if it is not a bridge for the broker. In this statement, both PT Victor Dua Tiga Mega and PT Hexa Finance Indonesia chose L&G Assurance as capable and experienced carriers in the field of heavy equipment insurance. L&G has successfully completed hundreds of heavy equipment insurance claims. Even for PT Hexa Finance Indonesia itself, L&G successfully filed a claim of 1 million, i.e. a total loss claim of 1 million EX1200 excavator units.

We hope this article reminds owners of heavy equipment, operators, heavy equipment financing companies, contractors, plantations and other businesses that use heavy equipment that may occur anytime, anywhere. Always ensure your unit guarantee insurance.

Kami Segenap Jajaran Komisaris, Direksi Dan Karyawan Pt Indonesia Insurance Brokers Mengucapkan Selamat Dan Sukses Otoritas Jasa Keuangan Yang Ke 13 Semoga Semakin Sukses Dan Selalu Memberikan Yang Terbaik Dalam Mengatur, Mengawasi,

Taufik Arifin has more than 30 years of experience in the insurance brokerage industry. It has a CIP and certified Indonesian insurance certificate from Australia New Zealand Insurance and Financial Institutions (ANZIF SNR.ASSOC). Follow the author’s Instagram to get to know him better: @taufik.arifin.31 This report covers top operators in Indonesia, the marketplace through quality assurance (third-party liability and completeness) and distribution channels (agents, brokers, Broker,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,, ( Agents, brokers, brokers, brokers, brokers, brokers, agents, Trienstals Diless) (agents) are divided into banks and brokers for the purpose of subdivision. , online and other distribution channels). The value of all the above-mentioned segments (million) provides market size and forecast.

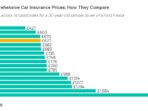

Comparison of market size and growth in Indonesia’s auto insurance market and financial services and industry investment intelligence

Indonesia’s auto insurance market is expected to grow by less than 6% during the forecast period.

The effects of Covid-19 on engine insurance are mixed together. Indonesian banks have lowered their recorded interest rates to a record of 3.50% of the economic impact on the pandemic, and are expected to remain at this level for the foreseeable future. Interest rate risk is the concern of insurers due to increased investment, product warranty and underwriting options. Obligation methods are stronger than well insurers exposed to convex liabilities, and when interest rates fall, their prices are less than other benefits, and they are more susceptible to these changes. Indonesia General Association or AAUI,