Insurance Companies Ranking In Kenya – According to the results of FY’2022 Kenya insurance, the financial service research team analyzed the financial results of insurance companies and the main factors of this sector. “Regular increase in success in improving performance”, in which we are crucial for the development of basic trends and stability in the sector, which contains industries that are important in what insurance companies are the most attractive and stable for investments. As a result, we will solve:

Insurance insurance in Kenya remains low compared to other key economies as Q4’2022. From a global level, less than 7.0%, i.e. the level of penetration from the Swiss Rain Institute, which if necessary depends on the dissemination of the agency and often if necessary. Insurance insurance was registered in 2021 and 2020, registered in 2021 and 2020, at the level of 2022, remained unchanged at level 2022. The following table shows the penetration of Kenya over the past 12 years:

Insurance Companies Ranking In Kenya

The penetration of insurance in Africa was relatively low, mainly mainly, mainly access to the lowest income, mainly access to lower income, such as material distribution channels. The Republic of South Africa remains a leader on the continent, due to the mature and highly competitive market, due to strong institutions and solid and technical environment.

Nielsen Merilis Laporan Periklanan Teratas Untuk Paruh Pertama 2021

In 20122, the country showed a strict economic environment in a global GDP growth rate in 2022, from 2022 to 4.8%, from 7.6% to the central bank of Kenya fell from 7.6% in 2021. However, Q4’2022 is the insurance industry in insurance regulators in the insurance regulators, insurance insurance, insurance, insurance, insurance, insurance insurance sector. Insurance requirements in 2002 amounted to 81.9 trillion KZT. TENGE, 82.9 trillion with KSHS. Tenge increased by 2.4%, i.e. 81.0 billion ten to 20121.

In general, the general insurance business compared 54.5% of the country’s contributions with a deposit of 45.5% of long -term insurance activity. During this period, long -term business bonuses for the KSHs and 140.8 trillion. TENGE with KSHS. In addition, the insurance and health insurance insurance class accounted for 64.4% of total revenues in the general insurance company, which is 64.8% in the total insurance industry, 64.8% in the 2011 budget year. As for the long -term insurance company, the main participants of the total contributions amount to 61.8% compared to 61.8% of investment in investment and “calculating life”.

Our indicator decreased by 23.7% in the 2012 budget year, which fell by 9.5%, which led to the deterioration of the lower insurance sector, because it will deteriorate the lower insurance sector as a result of deterioration of equality. Therefore, the sector still allocation of price, participation in total prices, share of general industry assets, 3.2% in the budget year2022, by 5.5% in the budget year 2021.

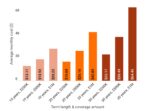

Insured insurance companies trade 0.5x (p / BV) 0.5x (P / BV) than 0.5 years lower than 0.9x than in this banks, but also below 16 years of historical average, respectively and below 1.4 and 1.8x. These two sectors are attractive for long -term investors, support strong economic foundations. The table below shows a price satellite comparison for banking and insurance sectors:

Pdf) Market Orientation And Corporate Performance Of Insurance Firms In Nigeria

Although the use of digital trends is slow, in 2020 the beginning of the Cowid-19 pandemic was required for digital insurance. That is why most insurance companies still use existing digital channels to control growth management and increase insurance in the country. According to the Kenya Q1’2023 industry, mobile subscribers in September 2022 amounted to 48.8 million. 65.5 million TENGE, or 48.8 million. High mobile phones increase mobile phones thanks to the main room and insurance products to distribute consumers that are not given to the younger generation and traditional methods of distribution to these consumers. The process of reviewing and verification of complaints can help examine the legitimacy of requirements for the use of artificial intelligence requirements (AI) and the use of fraud. Examples, digital virtual virtual owners were released by customers through their final purchases and real -time services, which include access to free services in the field of human intervention.

To ensure the benefits of the industry from the global competitive sector of financial services, they cooperated with regulatory submission to solve problems in regulation, as well as problems arising in the industry. Cowid-19 turned out to be difficult, especially the regulatory front, because this is intended to follow the set rules, taking into account the negative impact of residual and pandemic as an insurer. The rules applied in the insurance sector in Kenya are 487 insurance acts as well as the related schedule and rules, pension regulations, 197 and companies. Adaptation in 20122 remained a key aspect of basic topics in the insurance sector and main topics in the regulatory environment;

The transition to the capital adequacy indicator often allowed to attract capital initiatives, often lit the capital of small players in the industry and corresponds to matching funds. Capital has a new basis for assessing the adequacy of capital, capital can be important for ensuring stability and solvency of enterprise management. In May 2022, the Group of Financial Services JSC “African” was created on the IohanneSpyrvian, Allianz SE, from Allianz SE, KSHS and the leading panel-African-African group, KSHS reports $ 243.7. The key to the warning is 100.0% Hubris Holdings, “Hubrist” Holdings 100.0%, which is most insurance and financial services on the Nairobi securities exchange. The main share of the joint undertaking is 60:40, and therefore the alliance was considered limited to the relevant, appropriate, respectively, respectively, respectively. However, taking into account the duration of the contract, we have a joint venture of Sanlam Kenya PLC, Alizna General International Insurance (Most Allianz), their market share, assets and low lines.

The insurance industry is constantly growing over the past decade, as a result of which we expect health management and an increase in insurance premiums and additionally increase the increase in insurance premiums, which strengthens the possibility of supporting crops.

Top Companies In Africa

In 20122, the insurance authority (IRA) received 12 new or re -wrapped insurance products provided by various insurance companies in accordance with the binding of IRA and support. Products collected in new products amounted to 2 or 16.7% of 12 products, which was 8.3% of 12 products, which was 8.3% of 12 products, 8.3% of 12 products and 3-0% different new / re-packaged products.

The table below shows the work of the insurance sector, which reflects several indicators and the main results results.

Based on the insurance account, we are on the future of franchise values and future growth possibilities, future prospects for future growth, and their weight is 60.0%.

In the case of franchise assessment, we introduced operational indicators shown in the table below to carry out revenues and growth rate, as well as the table below:

Equity Bank Leads As Kenya’s Most Valuable Brand With Impressive Resilience And Strategic Growth

Internal assessment is calculated in accordance with the assessment methods, 40.0% according to the discounted cash methods, 35.0% with residual revenues and 25.0% to the comparative assessment. The complete assessment of the FY2022 is shown in the table below:

The insurance industry continued to fight low penetration levels, and also continued the fight against interest rates, high inflation pressure, high inflation pressure and constant cushioning. As a result, one -off income between households has dropped. However, the sector has been damaged by traditional models, mainly a change in digital reconstruction, innovation and regulation