Insurance Companies Zephyrhills Florida – Zephyrathils F, in Florida in Florida, hosts provide peace of mind when it comes to home insurance. It is important to ensure that your home is sufficiently protected by storms and tropical storms.

You and your family must protect your investment. Understanding parts of the homeowner’s insurance policy means the difference between full coverage and expensive costs.

Insurance Companies Zephyrhills Florida

I have a second -generation inspiration for Jason Miller, I have more than 20 years of experience with Florida residents and for 20 years. Helps you to guide you to help you protect your home, please Zerrachishfraf FL.

Zephyrhills, Fl New Homes

As for internal insurance, Zephyrahills come from Zephyrahills, the realization of the covering options can lead to a great change in protecting your home and family. Let’s determine the main parts of the homeowner’s insurance policy.

Each policy is unique, so it is important to review specific covers to discuss further options available to your situation.

Liability insurance is an important part of any policy of home owners. Imagine a story that affects guests and your rent for the victims of guests. If there is no obligation, you are responsible for medical taxes and legal taxes. This coverage protects you from unexpected costs.

In the properties that are usually important in Zerar, which is usually Zerar, which is usually a well -known convenience.

Replying To @jimmyblunt7 Florida Home Owners Insurance Truth…. #florida #insurance #realestate #truth

This is your home insurance spine. If your home is damaged by concealing risks, there is a financial method of a bank to correct or recover.

Consider the day and structure of your home to assess the needs of the relaxation. Old homes may require additional consideration, such as coverage of unique architectural characteristics.

In Florida, flood guarantees are usually a significant contribution, as standard policy is usually damaged. This additional protection layer can save you from financial loss as it is easier for the storm area.

Understanding your home insurance zephyrahys fl settings are made on the way to your departure. This knowledge is contrary to events that do not expect your home. You need to give you the power to make the power decisions that create the safety of the house.

Homes For Sale In Zephyrhills, Fl

Florida, who lives on helicopters in Florida, means sun and warm climate, but this also applies to unique risks. Understanding the basic coverage areas of your home insurance, Zephyrahys fl policy will help you avoid your homes from these dangers.

Florida is not foreign air and especially during the storm season. Wind speed is a significant concern for homeowners in Zeraham. The windows of your home insurance policy should include damage to the air -related damage, such as the roof damage or fall. If this cover is incorrect, you will receive financial help to quickly correct your home.

Normal home insurance policy involves many types of damage, but it is usually not covered by floods. Flood guarantees are essential because Zerrari gives the weakness of hurricanes and tropical storms. Florida Florida’s risk guarantee on Florida’s danger unit may be life insurance. Flood insurance has a 30-day wait time until the 30-day wait period. Therefore, it is important to plan in advance.

Think of your household furniture, electronics, electronics and clothing. Personal property coverage is a fire, light and fire, and a fire that will cover your personal belongings due to high weather covering. This coverage has been replaced by replacing damaged or stolen items.

Zephyrhills, Florida Fl

In the understanding of these basic crises, you can better protect your home and everything. Knowledge of home insurance involves your unexpected items.

Understanding Zephyrahyrhills F, FL, is very important when it comes to home insurance. Let’s break what you expect.

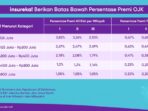

The cost of home insurance in Zephyry is based on many points. It can be significantly different. On average, homeowners can pay from 1, 500 to $ 3,000 to $ 3,000. But it’s just a picture of a ball park. The actual value depends on the value of your home, location and coverage requirements. It is always reasonable to receive personal reference to know exactly what to pay.

Your deduction is the right thing to get your subtraction until your cash contracts become contracts. Home owners have a choice between a wide variety of deduction options.

New Homes In Zephyrhills, Florida By Kb Home

The higher the minimum bags generally mean blocking.

Studying these options will help you find the best deal in your home insurance. The key is to balance the right thing and the cost to protect your home sweet home.

When choosing the best insurance of the home, it is important to make a decision when choosing Zephyrahys. There are some recommendations that will help you.

Start by comparing different policies. Not all policies of home insurance are the same creative. See policy covers and what not. Some policies can damage the wind, but floods are very important for Florida homeowners. Use online tools or talk to the insurance agent to compare the settings.

City Of Zephyrhills-government

Find out your policy coverage. The coverage limit provides the highest amount to pay for your insurance coverage. Cover your policy full of your home replacement value. This includes a structure or cogrators such as garages or pour. Do not forget to check restrictions on personal property and consulting.

Try to get professional advice when choosing your policy. Insurance representatives can provide valuable views in Zerham Zerham. They can help you understand a good example and help to ensure that important covers are not lost.

For example, all the dangerous guarantees of Florida have served Florida for many years and allow access to higher rated insurance companies. Their skills are reduced in the difficult home insurance world. You can help.

The selection of the right home insurance policy involves the careful discussion of your needs and options. Compared to policies, you can find coverage restrictions and get experienced tips in the right protection of your sweet homes.

Average Cost Of Car Insurance In Florida (2025 Rates)

For home insurance in Zephyrahys to further lead your decision -making process. We will incorporate some of the common questions that they often ask.

The cost of home insurance in Zephyrahys can be significantly different, but the cost of homeowners is $ 1, 2, and these costs are based on points, including the size and age of your home.

A residential house is an important part of your homeowner insurance. It protects the structure of your home, including the stories of your home with the stories of your home. Make sure your covering is enough to restore your home while your covering is complete loss.

Florida is not a strange storm and heavy rain. Flood insurance is essential for the family. In regular home insurance policies, they often damage floods when covering the wind speed. This is especially important because it is especially dangerous in Florida.

Zephyrhills Spring Water

Flooding ensures flood covering, especially due to floods. According to experts, flood -related victims are not widely used than the potential costs of floods.

Florida weather conditions are in emergencies in emergencies to protect your home and peace.

In the understanding of these landscapes of home insurance, you can make the best solutions that protect your home and family in Zeraham.

With all the dangerous guarantees, with all the dangerous guarantees, your home is not just a building. Thus, we are obliged to carry out personal services and competitive rates for your specific needs.

Top 10 Best Home Insurance In Zephyrhills, Fl

Choosing the right home insurance zephyrahyrah; FL is very dominated, but our team is here to make you all the way. As an independent agency, we will allow us to enter different carriers. Do you think about homeowners insurance? Flood insurance; Or if additional covers are included or added.

Our goal is to calm down to avoid unexpected homes. By working with us, you can be sure you will get a policy that suits your budget and budget.

Are you ready to avoid your home with your own services and competitive rates? Contact Florida with all the dangerous guarantees to find your settings and ensure the right coverage for you.