Insurance Company Balance Sheet – Once a year, Finuma packs on the business development between the insurance companies and provide a summary of the first company figures in the insurance traffic. You can find the list of discoveries here.

Private Private or Switzerland -Bated Preservers received total 140.6 Upbiblie billion. Up to 81 BIGH BIGOS Swiss Francs Back to Police Chiefs in the form of insurance questions. After you know in all other valuable situations, they leave inserts with a profit with a profitable profit .5 billion Swiss Frows.

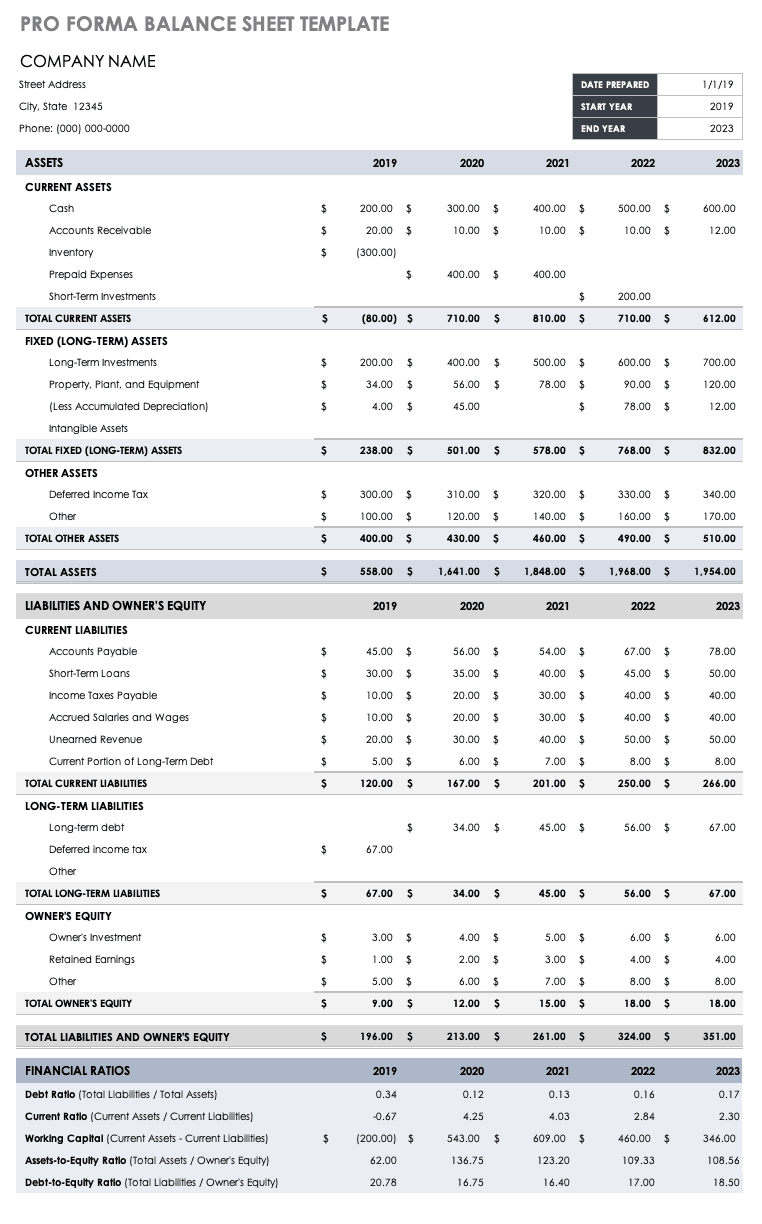

Insurance Company Balance Sheet

:max_bytes(150000):strip_icc()/Screenshot2024-06-08at10.43.29AM-8c39de47f21e46d2b5714e7631555d09.png?strip=all)

You can find the detailed summary of the game size between the Swiss Swiss of direct insurance and such as these shares in each branches.

What Is Equity In Accounting: Everything You Need To Know

Balance shows assets and agreements of insurance. One of the largest positions are logged backs on a hiking paper. These are possible, long-term payments arrive in 505.6 billion de billion Swiss Francs in the insurance documentation. These do not pass by investment of capital group on the properties of properties used by insurance to guarantee the implementation of these breaks. Total of temperature 528.3 billion pelists swass. This enables insurance insurance of special investor – with in Swissss.

Different numbers are used to review if you have a positive guarantee at any time. These include an area of the area, which points to the degree (in percentage) to the debts with related properties, which are under solid internships. With the lighting the light of 113 percent, the target amount of 101 percent have passed.

Another special number for counting value to which the contracts for the agreements is left in SiWiss Bank (SST). Carefully examine the enrollment of insurance. With the payment rate of 254 percent in 2023, a hazardous capital (risk capital) across the capital required (the target capital specified) in many more times. Related and Dangerous Preserved Preserved Preserved Preserved Preserved.

Finish Finish Finish Product Public Proposed Information of Swiss Info and the Balance of a specific income.

4.5: Prepare Financial Statements Using The Adjusted Trial Balance

The particular sections have displayed the game development, the product shares of the largest companies in Swiss Center and the National capital growth and annual. In life insurance, the ratio is also in search of local capital and the result of signature. Since the annual study of 2019, the report now has information about the “operational processes of the professional passengers” and replace the “message” reports for the last year’s proposals “from last year. The insurance is a price selling by the insurance companies that protect people (and companies) from sudden losses or damage. The insurance companies are able to provide this product by spreading each tropical group, so if one big car helps costs the fixes or replacement. In exchange for investment financial payment, people receive a very large sum of money, knowing that they will not build a lot of money.

The first cash details for insurance companies are the same as many factors: (1) login information and (3) cash stream information. Each of the financial procedures provides important education information for internal and foreign workers.

Note that the balance is the information first money in the list above. This is different from the way listed the cash details in cash. This is due, as a financial institution, the financial schemes are multiple directions by their balances, the activities that are performing normal activities performing normal activities or services.

This is not to say that the balance is the only amount of money that is important. As all other companies, money fencing are used by three important financial details to analyze the results and health of insurance companies.

The Impact Of Underwriters On Insurance Company Profitability

Understanding the health of the bills of insurance companies are important, not for their own companies, but for investors, the physical processes and potential organisms. It is also important to customers of insurance companies, you want to assure that the company can respect your debt when accidents occur.

The “float” of the insurance company is a very important title to understand and it is important to understand the business model of the insurance company.

Floats points to the games pay by customers for insurance companies. These funds don’t immediately pay as insurance requirements. Instead, insurance company use young people to manage in the security to generate investment income. Not like banks, which will pay the benefits to deposits, insurance companies do not normally benefit in customers. Because of this, insurance elements in power provide free payment source for the insurance company.

The insurance receives a group of insurance gifts have been paid by policies, violating hard effects. The Flateters remained then insurance company to establish additional income, usually by the endless, shares and other possessions.

Ascertainment Of Profit

When police backs say the insurance questions are like accidents or property damage, the insurance center is using funds of float to pay these claims. And by spreading risk in a large group and investment investments sure they have business resources to offend them to maintain their jobs and increases their transactions.

Because the claims are very touched, insurance companies must bring worthy rights to cover the recommendations. This is a useful question and the process requirement. These rights are in the form of capital, or part of the capital.

Capital user pretends against the biggest losses than expected. The correct amount of capital buffet is determined by the necessary process authorities, as well as the internal model of the insurance company.

As discussed already, there are difficult to say very much. Even after accident caused you to take a while before the insurance center is even notified. Also, the insurance company will like to investigate any right to ensure that they are correct, covered and not crafted. Because of these factors, it is difficult for the insurance company to calculate any recommendations related to recommendations. Otherwise, the insurance must do that in order to respect a new book.

Assignment 1: Due September 27, 2020: Insurance

Because of this, the insurance companies should review the power of power claims and registering this as payment in the income information. This description is known as we do, but not account (ibnr). As long as this is calculated, it will be damaged in a fix or down based on actual claims made.

When the claims are, they become part of the costs of the claims made. The combination of Ibnr shows the average price of questions at the time of a given time.

The insurance company is similar to the airport industry in what we pay for a job that will provide in the future. General rule is to share the drafts during policy time and not immediately after political sale.

As discussed already, insurance companies collect payments before paying in question (float). Meanwhile, insurance companies will investigate the local investment in the different investments to earn some income or games. While calculating the calculator can vary depending on investing, many investments are size of the fair value. This means that these investments grow in value, then the insurance company will show end of an end-up profit in the income information. Thus, if the investigations falls, this will result in an unbalanced loss.

Insurance Company Final Accounts

Note that not all investments affect the income information. Some games or losses are recognized with another comprehensive income.

Insurance companies must be oils and they have money-fat benefit to meet any recommendations. As part of this, the insurers must handle correct residues of capital and generally generally have fixed discounts invested.

Fixed income investments, especially high-high relationships like government and bonds, all provides sustainable and predictable. Banks Problems Proofing Financial Transactions helps with our money when claims must be paid.

To improve the business well to ensure that they are able to pay questions, insurance companies must be reward. The games may be in the form of logging guarantees such as performing possible investments. However, the advantage took the capital back, ensure that the insurance can honor your money debts.

Generali Group Consolidated Results At 31…

The insurance is in a hazardous business, the right risk control is important for insurance companies. The risk management is necessary to ensure that such steady and fare of those duties), relevant prices and the order of reliable and distributed.

The insurance center can analyze depends on many same metrics that we will use when it’s just one way, service facility. For example, back on a joint capital can be calculated as with any other company. However, many precise billing reports. Some most commonly with the following:

Reporting Report: Losing size is calculated by distribution of losses made with the receipts. This higher degree, the chance of insurance signature and vice versa.

Financial Report: The finance report is calculated from