Insurance Company Broker – Aninsurance Brokeris is a professional who acts as a mediator between consumers and insurance companies, who help the first to find the policy that best suits their needs. Consumers of insurance brokers, notinsuranCompanies; Therefore, they cannot bind the scope on behalf of the insurance company. That is the role of insurance agents, which represent insurance companies and can complete insurance sales.

Insurance brokers make money for commissions from insurance sales to individuals or business. Most commissions are 2% to 8% of premiums, depending on state regulations. Brokers sell all types of insurance, including health insurance, home -owned insurance, accident insurance, life insurance, and annuity.

Insurance Company Broker

The main way of insurance broker is to get money is from the commission and the costs obtained in the policies sold. This commission is usually a percentage of the total annual policy premium. Premium Aninsurance is the amount of money paid by individuals or businesses for insurance policies.

Auto Insurance Company Vs. Broker: Differences Explained In 2025 (key Points Outlined)

When obtained, the premium is for insurance companies. This is also a responsibility, because the insurance company must provide space for claims made to the policy. The guarantor uses a premium to cover up the responsibilities related to the rules they write. They can also adjust to premiums to produce higher returns and offset some costs to provide insurance range, which will help insurance companies maintain competitive prices.

The guarantor has invested premiums in property with various levels of liquidity and return, but they need to maintain a certain level of liquidity. The State insurance regulator sets the amount of liquid assets needed to ensure that insurance can pay the claim.

Brokers or insurance agents often get a percentage of the whole premium of the first year of a policy they sell and then payment of smaller but sustainable annual residues from income in policy life.

Brokers also get money by providing consultation and advisory services to clients at a certain cost. In some cases, transactional costs can be charged. For example, brokers can charge costs to start change and help submit claims.

J&c Insurance Now Officially Operates As Insurance Brokers!

The state manages how and when the broker can be charged. When permitted, costs must meet certain criteria, such as rational and clients and brokers.

Controversial, some insurance companies show brokers who perform either by paying bonuses or increasing commissions. Payment is often based on past performance and is used as a motivation to continue with some income that shapes income.

However, because – for the best interests of their clients – the broker does not represent certain companies, this income commission method often frowns.

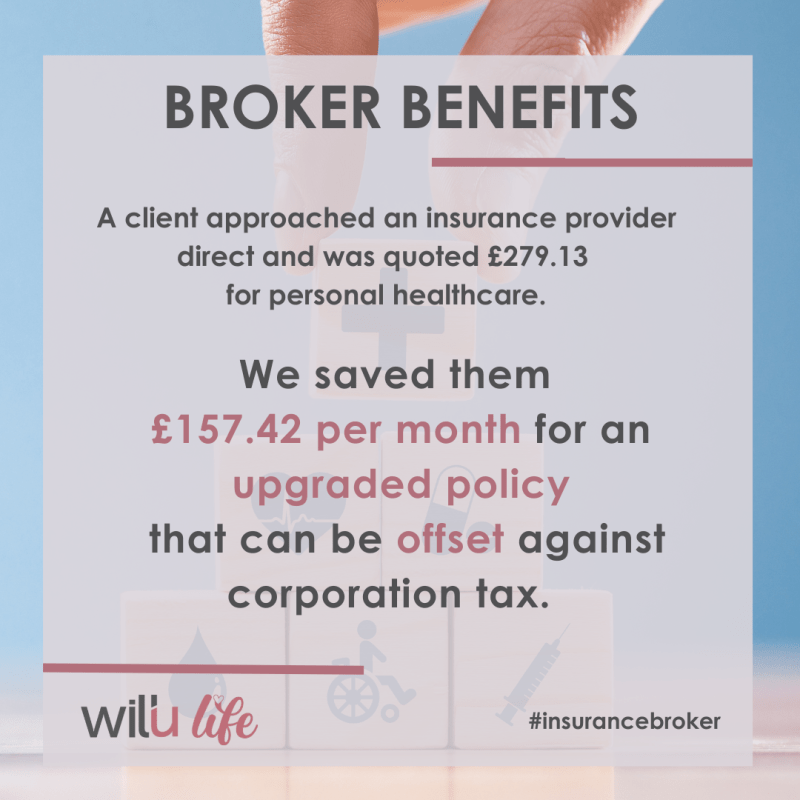

Brokers work to represent the best interests of their clients. Part of the broker’s role is to understand the situation, client’s needs, and want to find the best insurance policy in their budget. Choosing the right insurance plan can be complicated, and research has shown that many people choose less than optimal plans when they only rely on their own wisdom.

The Advantages Of Using An Independent Health Insurance Broker

Besides being good at bids from all insurance companies, brokers may not support certain companies. As a result, brokers are paid by the commission rather than receiving payments from insurance companies, because the latter can create negative incentives that damage the trust between brokers and clients.

A broker has an important responsibility to help people navigate insurance plans, many of which have soft differences. In addition to connecting clients with the right policy, the broker continues to have an obligation to their clients.

A broker provides a consultation service to help clients submit claims and receive benefits, in addition to determining whether the rule must change.

To continue to get the latest information about changes in regulations and ensure that they continue to fulfill their duties, the broker is licensed by the State Regulation Institute. Their licenses must be changed in biennals in most states. Brokers must regularly meet their clients and evaluate how their current policies meet their needs.

Brokerage General Agent: What It Is, How It Works

Like insurance agents, insurance brokers require a bachelor’s degree, often sales or business background, and strong interpersonal skills and research. Because the insurance broker must review the contract on behalf of their client, attention to the details on the contract and comfort in evaluating the terms and conditions needed to succeed in this career path.

Although insurance brokers can handle many types of insurance because they are comfortable to sell, being an expert in one can be useful.

Brokers must be licensed in the state where they practice and pass the 6 and 7 series of Authority Regulatory Financial Industries (Finra). Maintaining up to date with changes in insurance laws is a good way to maintain trust in clients as well.

According to PayScale, until July 17, 2022, medium -level insurance insurance is around $ 75,000 a year. However, this number often increases as experience of having an insurance broker and gathering clients.

The Insurance Broker Ltd

Brokers represent and work on behalf of consumers, and agents represent and work for insurance companies. Brokers cannot complete insurance sales, unlike agents.

You cannot get insurance through a broker, but the insurance broker will help you find a policy that suits your needs. When a broker has done all their research and shows their clients with options, the chosen policy must depend on insurance agents or companies. The broker does not complete the transaction.

Insurance companies sell insurance, and brokers aim to find the insurance policy that is most in harmony with the needs and objectives of the client.

You cannot buy insurance from an insurance broker, but they can help you find the best and achieve the most policies.

Insurance Brokers License

Insurance brokers in the UK are similar to insurance brokers in the United States. They act as a relationship between clients and their insurance companies.

There are many types of insurance and insurance companies that may be difficult to do enough research to make smart choices for your needs and budget. Insurance brokers are responsible for research and help guide their clients to make the right choice, get a commission in the process. While the insurance broker cannot sell your insurance, they work on behalf of their clients to find the best options for their needs.

The author is needed to use basic resources to support their work. This includes white paper, government data, original reporting, and interviews with industrial experts. We also identify original research from other honorable publishers that apply. You can find out more about the standards we follow in creating accurate content and not in favor of our editorial policy.

Best Full Life Insurance Company For July 2025 10 Best Life Insurance Companies for July 2025 Best Jewelry Insurance for 2025 4 Best Children’s Life Insurance Companies for July 2025 The Best Life Insurance Company

Best Insurance Brokers

This is what is missing from life insurance that you get from your job, what are the opportunities to die every year? How to Determine the Best Small Business Insurance for July 2025 The Best Professional Insurance Professional Policy Policy Policy Policy Policy Policy -Owners are expected to rise this tag -HEAT -ITEX Insurance Insurance for Your Vacation Funds ‘I hope I don’t know’: How far you will save car insurance? This simple HSA transfer can increase your eternal savings in the size of the global insurance brokerage market worth USD 314.00 billion in 2024, growing in USD 342.92 billion in 2025 and is expected to cost around USD 757.80 billion in 2034, registering solid CAGR in 9.21% between 2024 and 2034.

Last Updated: 04 Nov 2024 | Report Code: 5199 | Category: ICT | Format: pdf / ppt / excel

Ang men ng ng Merkado ng global insurance Ay Kinakalkula SA USD 314.00 Bilyon Noong 2024 in Inaasahang Matumbok Sa Paligid NG USD 757.80 Bilyon Sa Pamamagitan Ng 2034, Na Lumalawak Sa Fi 9.21% Init 2024444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444444chsis foundation DPs seguro tuma tuma dahl dahl kamalays consumer, digitalization Pasadg dahil SA)

The size of the United States insurance brokerage market was evaluated in USD 80.07 billion in 2024 and is expected to reach around USD 197.39 billion in 2034, growing on CAGR 9.42% from 2024 to 2034.

What Is An Insurance Broker? Definition, Types And What Do They Do?

North America led the global insurance brokerage market in 2023. This facilitates technological requirements, high insurance density, and a good legal environment in the region. The United States insurance market is highly developed, and there is high competition among the brokers. Therefore, helping to provide better services and encourage the use of hi-tech solutions.

Asia Pacific is expected to host the fastest growth market of the entire estimated period. The growth of awareness is equipped with an increase in the density of life and life insurance products. The emergence of the market is mainly caused by an insurance broker who actively informs prospective buyers and helps them choose the appropriate insurance package.

Insurance brokers are businesses that act as mediators between insurance companies and customers. Insurance products provided by brokers include health insurance, property insurance and casual, and health insurance. The development of the insurance brokerage market is driven by conditions such as awareness of current insurance products, risk management, and changes