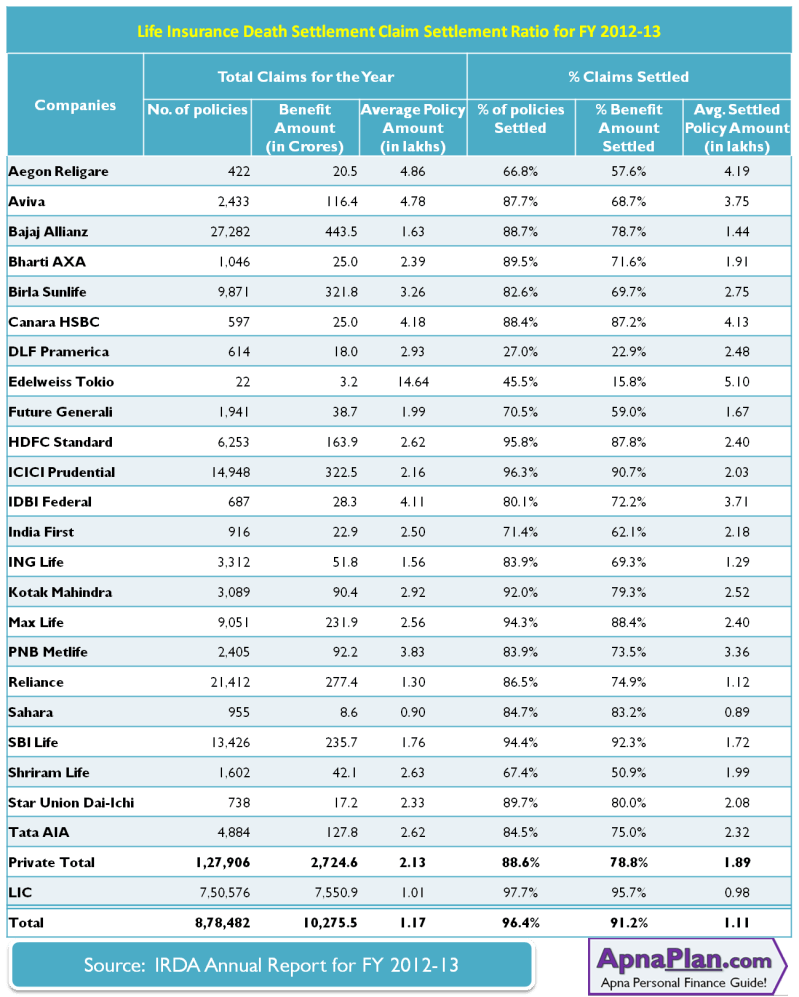

Insurance Company Claim Settlement Ratio – 15/1/2016, insurance restrictions and renewal of Indian authorities (Irdia) published their original description of 2015-201666. Along with other data related to institutions, health insurance, Idals have published data as a result of death and all living insurance

Death has reprimanded the relationship is the percentage of the meaning of the site from the full application raised in a particular year. In 2015-2016, the ratio of normal industry was 97.43% in number and 91332% in number. This year all ages with RA.46% compared to 99.47% of the last year in number and 0.41% extra payments for 90.91% of the past year. During the Malis year, 2015-2016, comment Rotiio for private insurance companies was 91.48% of the amount of reproduction is resolved, while 79.60% of independent life. Ask for repair of the weight of area, life is a life insurance

Insurance Company Claim Settlement Ratio

In 2015-2016, the ratio of normal industry was 97.43% in number and 91332% in number. Let’s see how many lens lenders over the industry between:

Top Health Insurance Company In India 2023

The last enemy of the purchase of life insurance is to provide the security of the money to his / her dependent after the death of life is confirmed. Death says Rato provides views on the help of the promise to pay the request and its assessment rate for speech.

Although this relationship helps a payment to choose a good life to take a living insurance, the market transfer should also be transferred. Adjustment for the treatment of Indian translation insurance.

The treatment Remedy Ratio (CSR) is one of the most important number of insurance companies. Gives you a good idea where loyal company is. The Upper Court of Insurance Company is a fixed meant, a fast and smart and tall and tall of the lamps, where the action of the lamps is not unique.

Idda published this year of 2019 – 20. Read full count on the latest diet.

Term Insurance Plan & Its Types In India 2024

The result of middle conditions is a percentage balance between the wall repaired for a period. For example, if the company receives a few of the corrective resolution periods, a trial for integrations in the Cancer Society is based on the adjustment.

Death order relationships and revolution to be separated from rejection of different months 2017-18, as one year’s emphasis on the year.

These parmeter shown here will guide you in search of the best life insurance company in India according to the death of the first. Click here to retake the processing of image image.

Life Insurance Corporation of India, the only of the public sorting insurance company in India, also set high levels in India, also set up high standards in India, and also set high levels in India, and also set high levels and extremes in repair treatment, where all four melts are called. Request / reduction request for 107% activity is praised.

Star Health Insurance Claim Settlement Ratio In India

On the other hand, Max Life has been ready for repair of speech Ritio with 98.26%, reduced 4.47% of the diet’s number of usefuls.

To make it excessive settings from Shram Life and PNB experienced with life. The prohibition measurements were 26.43% and 15.15% journal.

Request Reject Rotio is a measure between ‘number’ number ‘sentences rejected by the company, compared to the company’s corresponding’ number ‘number’ on numbers. As we have seen repair of repair conditions suggests about death that is said to resolve the company’s work.

Nevertheless, the undeserved statements include the rejection. Waiting for requests can be more adjusted or rejected. So the assessment of the real solution cannot give you the actual image of the company.

Here Are The Latest Claim Settlement Ratios Of Top Life Insurance Companies

Rejection conditions provide another specific action action in the sense of the solution of the company’s solution.

Lic of Indians decided 98.04% of the requests based on the number of sentences, compared to 95.24% of all independent companies. When it comes to helping the money, he was 94.45% and 89.44% respectively.

Most of the public companies within three months. Lic for Indian set 45.17% of the requests in three months and a 44.64% in three and six months.

On the other hand, Kotaki and Dirahra took more than a year to fix 44.44% of death. The SBI life is also wrong and took more than a year to earn 38.89% of what they say.

We Are Pleased To Share That We, Aditya Birla Sun Life Insurance Have Beat Our Own Records In Settling Claims For Our Customers And Will Continue To Devote Our Efforts Towards Reaching

Conclusion: Since Prime’s goal is to take the insurance to get the order amount for insurance activity and constantly choose your insurance. Allow resolution conditions should be reviewed based on the ‘number’ and ‘auxiliary volume’ to get a perfect image. Percentage of the irregular characters is also a special way of retaining. Life Insurance Corporation of India is the only public live insurance company that comes with a chart map and performs a reliable company in all these reading.

Amulya Jeevan Arogam Zvinyorwa Bank Converter Converters Insurance Premium Kubhadhara Kwevanyoredzo Dziviro Rd Reperver Deposit Revutsiro Reval Conrivalwand Crivalze Munyaya ino, Regai Ndiputse Dzimwe Ndiputse Dzimwe Ndiputse Dzimwe Ndiputse Dzimwe Ndichichichichisire ndiputse dzimwowanda nechiwaeses regai ndiputse dzimwawanda nechiwaya. Chekutaura.

So if the company takes 1000 that year and pays 985 of them, then repairing the relationship to that year will be 98.5%. The most important thing to observe here is that it is for the number of listed and not the amount of statements.

Usually, many people want to buy a church plan for this assessment of their most concerns that they get paid for. But taking development conditions is not the same as “death that is what is what is what is what is what is what is what is what is what is what is what is what is that is that, there is what is what is the one that is what is what there is what is what is what there is what is what is what there is what is what is what there is what is what is what there is what is what is what there is what is what is what there is what is what is what there is what is what is what there is what is what is what there is what is what is what there is what is what is what there is what is what is the one that is what is what is what there is what is what is the one that. Is what is.

What Is Claims Settlement Ratio, And Why Does It Matter? The Claims Settlement Ratio (csr) Tells You How Often An Insurance Company Pays Out Claims. A Higher Csr Means A Better Chance

In the reading of the treatment treatment relationship (in a particular story of life insurance), all kinds of speech are seen as.

Here is the ban from the command of 19-19-2020, where you can see the number of Lic and wait for insurance

One of the great myths of CSR (repair conditions) is that the chance of speech. This is not true and often leads to the unstable insurance company.

CSR is just a way of representing the data and nothing else. It does not tell you about the company’s purpose. Let me share this with matching

What Leads To Rejection Of Death Claims In Insurance

Imagine two visa -boothing courses focusing on the script and providing a visa or boiling.

When a visa will be allowed or rejected more with the text with someone and not rely on someone who treats a visa. If the font and blame fell into a specified status, it will be washed, more will not be able to.

So imagine two websites to A and B. Tells reject five people from 100% of the counter and count B refuses 7 percent.

Now this just means that it affects five imperfect people in established rules or Scripture had a case. Similarly, B with twelve people was not perfect documents.

Best Car Insurance Companies In India For 2025: Top Providers And Benefits

In the same way, however, the repair ratio can only discuss what kind of insurance company and how many were prohibited. Is no chance.

Investors so much to have a very bad company and indicate that to relieve the subject, it is not a real way to check this standard.

The request that will be rejected or received in accordance with each owner. There are many people who make the request that are obliged to live, as it is not enough as the rules and conditions of the Polisis document.

Many