Insurance Company Los Angeles – Copyright © 2025, Los Angeles Times | SERVICE TERMS | Privacy Policy | CA notification of the collection | Do not sell or share my personal information

The Anthem Blue Cross will expand the offer of health insurance in the central valley and return to the central coast, the district of Los Angeles and the inner empire.

Insurance Company Los Angeles

Felicia Morrison wants to find a health plan for next year that costs less than the one who has and includes more medical services that he needs for his chronic autoimmune disease.

Historic Places Los Angeles

Morrison, a solo lawyer in Stockton, buys coverage for him and his twin children through California, the state law on accessible or obamacara care, insurance market. Morrison, 57, receives a federal subsidy to help pay his coverage and said that his monthly cousin of $ 167 is administered. But she spends thousands of dollars a year on deductions, joint payments and attention that are not covered by her plan.

“I would simply like to have health insurance for a change that seems to be worth it and covers its costs,” he said.

Their possibilities are looking for it after legislators in the Sacramento acted to improve California covered by 2020: they added state tax deductions to the federals that help people pay the coverage. And they returned the request that residents had coverage or pay punishments, effort to ensure that enough healthy people remain in insurance pools to compensate for the financial burden of customers with expensive medical problems.

These new policies attract insurers. They responded expanding surgery in the country, improving competition and offering consumers multiple options.

Los Angeles 1906 — Anchor Editions

California here Exchange is not the only benefit of the renewed interest of insurance companies. Other countries are expected to see more insurers next year or return to their markets. This is a critical sign, experts say that markets based in the country, which cover approximately 11 million people, are becoming more robust and less risky for insurers, despite the current political and legal battles around The here.

“It takes more time than expected, partly due to political development, but things seem to be ready for next year,” said Katherine Hempstead, the main policy advisor of the Robert Wood Johnson Foundation. “The ACA market becomes a better place for insurers and consumers.”

Hempsserta said that it is likely that 2020 was the second consecutive year with a net increase in the number of insurers participating and a relatively modest increase in premiums throughout the country.

Integral California said that last month an average increase in the premium of only 0.8% in 2020 was expected, which is well below the increase of this year of almost 9% and the lowest since the agency began the registration of people In October 2013.

Re-post @latimes With More Than 2,000 Structures Already Destroyed By Wildfires That Continue To Rage Out Of Control Around Los Angeles, Homeowners And Business Owners Face A Long Road Ahead To Recoup

Peter Lee included the CEO of California, attributed a thin increase in the next year to the new subsidies for the Premium financial statement and the request for people to ensure.

California is one of the few countries that offers their subsidies to residents, and the first proportionate to people who earn more than the federal threshold of 400% of the federal poverty level. Subsidies are available for people who earn up to 600% of the level of poverty, who are people representing up to $ 75,000 per year, and four families with annual income of up to $ 154, 500. It is expected to help a help Additional to the additional aid of 235, 000 families that have not previously described for federal assistance.

Anthem Blue Cross, which retired from most state markets in 2018, returns. The offers will expand in the Central Valley and return to Center Coast, Los Angeles and the Inner Empire. Anthem Health Plans will be available almost 60% of California next year, California covered.

Donald Trump opened his presidency in January 2017 with a series of salvos aimed at a favorable care law, a signal achievement of the administration of his predecessor.

California Department Of Insurance (cdi)

Blue Shield of California will also expand its HMO plan to parts of the Tulars and Riversida District and add coverage in the districts of Reyes and Fresno. And the Chinese community health plan will be expanded to cover the entire San Mateo district next year.

“Almost all California can choose between two carriers, and 87% will have three or more elections in 2020,” Lee said. He urged people to buy among the plans, including the new ones, to try to reduce their premiums.

Anthem, the second largest health insurer in the country with 40 million registered in 10 countries, also plans to expand its ACA coverage in Virginia next year.

Cenne, which has 12 million records throughout the country, plans to expand to the new market here next year, said the company’s representative. It operates in 20 countries, three of which entered the first time this year.

Sanborn Fire Insurance Map From Los Angeles, Los Angeles County, California.

Two starting followers, launched in recent years, partly to serve ACA markets, are also planning extensions in 2020. Bright Health, based in Minneapolis, announced at the end of July that it would offer ACA plans in six More countries, at the top of four services now. And the Oscar insurer of New York, who offered ACA plans this year in nine countries, including California, plans to enter Colorado, Pennsylvania and Virginia, as well as new areas of New York and Texas.

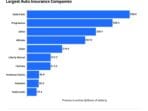

Participation rates are important. A 2017 study by the Urban Institute researcher revealed that the average monthly ACA premium that year was $ 451 in an area with a fuse compared to just over $ 300 in markets with three to five insurers and $ 270 with those with those with Six or six more insurers.

The number of insurance companies that offer plans in ACA markets have been fluttering. From 2014 to 2016, the average number was between five and six, according to the Kaiser Family Foundation. This number decreased to 3.5 last year, after republican threats to shine or replace changes in the administration of ACA and Trump in the market. (Kaiser Health News is a program of the Independent Foundation). Premiums have increased by 20% to 30% in some areas.

But the variability between countries remains significant. Four countries, Alaska, Delaware, Mississippi and Wyoming, have only an ACA insurance this year. On the contrary, seven countries (California, Massachusetts, Michigan, New York, Ohio, Texas and Wisconsin, have eight insurers or more.

Best Car Insurance Rates In California (updated 2023)

“No less than three is a good situation,” said Sabrina Corlette, a professor of research at the University of Georgetown at the University of Washington at the Health Insurance Reform Reform Center. “Markets seem to be stabilized, and what is important for insurers to earn more money in this market now.”

Kelley Turek, director of Commercial Insurance on the United States Health Insurance Plans, the main commercial health insurance group, agreed. “The competition is finally slowing down,” Turek said. “Companies remain and extend to new geographical areas. We agree that the market works better when consumers have more options. ”

However, ACA markets still need more regulatory predictability, and political division still undermines that, Turek said.

The Federal Court of Appeals in New Orleans listened to last month’s testimony about the challenge of the Constitutionality of the ACA, which was presented by Texas and 17 other republican states. The states claim that when Congress eliminated the fiscal sentence for not having insurance, he had canceled the entire law.

How To Claim On Fire Insurance

A broad recording gives you news, analysis and ideas, above all, from currents to production and what all this for the future means. The Golden State Building Mutual Life Insurance is an important 84 -foot (26 m) office building in a modern style later built in 1949 as the headquarters of its homonym company. The building was designed by Paul Revere Williams, a remarkable African -American architect. The building is located in West Adams

In southern Los Angeles, about 3.5 miles southwest of the center of Los Angeles and 2 miles northwest of the exhibition and USC at the Adams Blvd and Western Avue intersection. This was the second building of the company that endured this name, and the first was built in 1928.

Founded in 1925, the Gold State State Society for Muting Life Insurance (GSM) was the largest insurance company in African -American in the west of the United States and was the first to offer a life insurance of all people, regardless of the career. The company divorced in the 1920s and 1930s, serving this previously insecure market.

In 1946, the company of the State Gold Company decided that it had exceeded its second building from 1928 to Ctral Ave (also a historic building) and moved to a new place in the corner of West Adams Boulevard and South Western Ave (1999 West ADAMS) in the West Adams district. At that time, this location was described as “the most attractive business corners outside Los Angeles” for their belief in the main bus lines. The company’s decision to locate the fall of the Avue Ctral district here for the population of the city of African -American here.

Greater Los Angeles Freeway Map

The Paul Williams company ordered the architect with a new building. He designed a steel and concrete structure of five stories (with mesanine and basmta levels) to accommodate more than 300 employees and plan their interior “on the way the company” with 400 seats with the most important audiovisual team, 150, 150 operates, 150 Cafeteria staff, employee hall and the medical department. Geroznis two stories