Insurance Company Of Usa – How is the insurance market in the United States? Which company has controlled the industry? Our new feature of our appearance provides a sense of attention to think about the assessment of the insurance company based on direct services.

We have received information about our views in the Insurance Institute (III). We want to understand how much money on all these companies all the insurance industries and break into different parts. Our video circles are equivalent to the number of direct fees listed in 2020, while colors show that the percentage of relatives in the market shareholder. We have added any signs of a company to make it easier even if the biggest success in each part.

Insurance Company Of Usa

:max_bytes(150000):strip_icc()/Life-Insurance-a8aee8e3024145a8b454ea19df030418.png?strip=all)

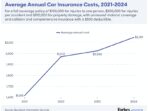

Our appearance shows that some parts of insurance are heavier than other parts. MetLife clearly managed his life / anniversary last year, with a payment of $ 103.3 million. Life insurance is difficult, but that means about 13% of the whole market. The landlord and car insurance are also heavy, with the garden of the area in the highest position. But comparison is compensation or business insurance of employees, where some companies control very little slices. In fact, tourists and Hartford are the only two companies with more than 5% of the market ratio “Compon (7% and 5.9%).

[usa J1 Intern Recruitment] , About The Company

There are a number of things in our insurance policy. First, our opinion does not consider reversing, this happens when the company produces policy and then turns to lower risks of other companies. Different types of insurance must also follow different market situations. For example, the largest fall can eliminate a large part of the country and private companies / companies that are losing a lot of money. In addition, the disaster – 19 polluted in 19 lungs was contaminated with plans for life expectations, not the name of the worker. In other words, because the company has a lot of income including income, does not mean explaining.

If you are looking for any type of insurance, we have strict instructions to spend to help you start today.

They will be purchased early. We will send you an e-mail when we are ready, just throw it into your box.

If you want to use our books, magazines, educational resources, etc., these companies have produced billions of dollars (USD) directly.

Top 5 Best Health Insurance Companies In Usa 2024

Many people in the United States still believe in life insurance still use these items. According to investment, living insurance is a contract between living insurance company and policy owners. The insurance policy ensures that the insurance is paid to pay one or more beneficiaries when the insurance is reduced by the insurance policy. Finally, it serves as a financial security, provides protection and mental peace and to ensure that people are financially in political cases.

All data published by the Life / National Insurance Union in 2023 (NAIC), a non -profit organization with the provision of US insurance policies and regulations. However, the National Insurance Union (NAIC) is the state organization that runs the 50 -year -old Columbia data organization, Columbia and the five Americans in history, NAIC was established in 1871. This is the class of the largest insurance companies25. The class rankings are organized based on direct fees issued by insurance companies by insurance companies of insurance companies

A new life began his business and work in 1845. Activities, the office of building the life of New York, New York, the United States.

Culture, 2023, compared to the annual report card, the total number of New York’s life insurance guidelines has reached 231 billion dong of 20 billion dollars. Based on the business operations of 2023, the company received a total USD income from $ 0.02 billion. In addition, according to Nair’s 2023 stock market data, New York Life Insurance has received a direct fee of $ 13, 287, 777, 787, 787 life insurance.

Usa Insurance Companies With The Best Diversity And Inclusion Programs

Northwest Mutual was founded in 1857 and was grown in one of the world’s largest insurance companies in the world insurance industry. Northwest has not yet become one of the most reliable companies in life insurance policy has some good reviews from some financial assessments. Since 2023, Northwest two North + S&P Global, AAA from Fitch smoke and A ++ from A.M.

The economy, according to the 2023 annual report, the Northwest developed a total USD assets with US $ 358 billion to share a total of US $ 320 billion. In addition, in 2023, based on trade efficiency in 2023, the Northwest total income of US $ 36.1 billion was 1.71 billion. Intaas Waxaa Sii Dheer, Sida Uu Sheeegay Warbixinta Xogta Saamiyada Ee SUUQA EE NAIC EE 2023, WaQooyi-Galbeed Ayaa Helay Ee Caymiska Ee Marekanka.

MetLife Inc is one of the oldest companies and the largest insurance companies in the world. Historically, the company was established on March 24, 1868. In the case of operation, the company has a office of MetLife Construction Headquarters, USA. With 153 years of experience and the presence of all 40 global markets, MetLife is still one of the financial services based on the world, employment and management allowances. Since 2023, financially in 2023, the company has a total assets of about US $ 687 billion and usually around US $ 657 billion. Based on her business in 2023, the company had a positive benefit with 66.9 billion USD and a net cash income of about 1.6 billion. According to the Nairic Market Information Report, MetLife has been successfully collected 12 USD, 284, 718, 024, 024 on the US market market.

Strong Financial, Inc. This is an American insurance company established in 1875. The financial parties in 2023 compared to its annual report is about 721 billion to share the total 691 billion USD ‘. Regarding trade in business in 2023, the company has a total income of 53.9 billion and successfully earned a income of 2.5 billion dollars. In addition, according to the NAIC report, reasonable financial finance earns 10, 923, 713, 601 directly on the US Life Insurance (USA).

25 Largest Life Insurance Companies In Usa

Massachusetts Insurance Company, called an insurance company, is called an insurance company, is an insurance company established in 1851. A seminar, publicity, the United States. Insurance company, psychiatrist provides financial assessments from a number of agencies including ++ from A.M. The best company, AA + of Fitwation, AA3 from the mood service of Destors and AH AA at the standard & poor level. Finance, according to 2023, total assets of $ 335 billion out of $ 30 billion. Based on direct fees, according to the NAIC report in 2023, the population of the insurance market 9, 204, 566, 734 of the United States.

Lincoln National Agency or Lincoln fund group is a management company established in 1905 Perry Randall. Life Insurance industry, Lincoln Life instructed two products including temporary life and permanent life. Based on financial evaluation, Lincoln is the best (A), acne (A +), Moody (A1) and S&P (A +). Based on business, Lincoln, the country has lost nearly -2 billion USD. Xogta Ka Soo Baxay Ururka Qaranka Ee Sharciga Caymiska (NAIC) EE 2023-KII) EE 2023-KII Uu Muujiyey Ee Mareykanka (Mareykanka).

The general insurance company nationwide is one of the largest US daily -life companies in the United States (USA). Historically, nationwide was founded in 1920, the Center for Agriculture Office and after 1955, this name was changed to insurance nationwide. Positive, this company is a center for the whole country, Columbus, Ohio, USA. In addition, the best, A1 of Moody, and level + Last & Mind.

In particular, according to the annual report in 2023, the country’s public insurance company issued a total income of US $ 6.3 billion in $ 2.3 billion. Based on the report report