Insurance Company Paid Claim Journal Entry – Accounting, claims, compensation, depending on the type of insurance and the nature of the claim. But when the claim has been approved and basic principles when the claim is approved The following is a step. -By the description of accounting methods for the Details of Insurance:

When the assets are lost or damaged, and the company expects to receive compensation from the insurance company involves loss or loss. Then acknowledge the demand.

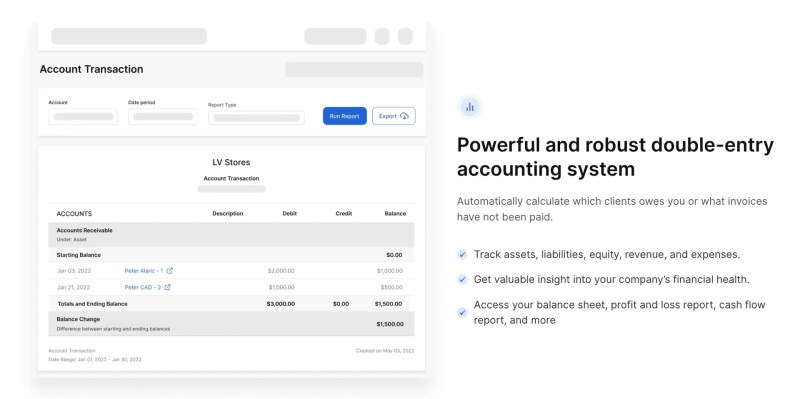

Insurance Company Paid Claim Journal Entry

When receiving a claim for compensation: When the insurance company approves the claim, the item will be received:

Loss Reserves: What They Are And Examples

This record has received insurance companies and recognizing revenue from claims. In the case of some compensation (Less than the asset value) supports only the amount received or approved.

Business intervention insurance will compensate for the missing profits during general operations, such as natural disasters or unusual operations.

Time: This claim should be recognized as income when confident that it receives money.

Some claims: If there is only one part of damage to assets, the company must calculate the non -insurance part.

Journal Entry For Goods Destroyed By Fire And How To Raise An Insurance Claim

Cost: Some insurance claims can only cover repairs or options. In this case, the cost of repairs or options must be recorded.

Suppose the device is $ 50,000, which has been destroyed.

In this case, the company will lose net 000 10, 000, which is not covered with insurance and is still a loss.

The company has time experience. -Time because of the fire and expected to receive 100,000 dollars to cover the lost income.

Question No 27 Chapter No 5

This ensures that the company will definitely recognize the receipt and reflect the actual receipt in financial records.

Accounting for insurance claims depends on the nature of the claim. But usually in accordance with the principles of recognition of revenue when receiving and recording a cash receipt It is important to understand how to calculate various insurance claims. Monica start business with cash. 3, 00, 000, RS 5, 00, 000 and RS 25, 000. 000. Powerback Room Construction RS. 1, 00, 000. III premium payment insurance 15, 000 and RS. 7 000. IV. 25, 000, 20 %. The sixth insurance company paid 80 % in full payment and finally VII. Payment RS 48, 000 and the debt RS 22, 000. VIII provides 10 % construction per year.

13 necessary reporters to improve the following errors: I. RS. RS RS credit sales were posted in Kartak’s account from 1, 700. II sales of RS 1, 700. Posted in Nima III. Prince Old Furniture Credit Sales RS 1, 7, is deposited in the Old Credit Credit Selling. 1, RS 700. 7, 100. V. A checks for RS 640 received from Gauutam, damaged and

The following records are made for transactions and errors. Each transactions will be recorded with debit and appropriate credit. Make sure that the accounting equation is still balanced.

6 Pass Journal Entries For The Following

12 Pass Journal for the following transactions: I. Monica starts business with cash 3, 00, 000, RS 5, 00, 000 and RS 25, 00, 000. II. Powerback Room Construction RS. 1, 000. III. 000, RS TO Commission Insurance Claims Accepting 25, 000, 20 %, Sixth Insurance Company 80 % in full payment, and finally, VII. RS 48, 000 and the debt RS 22, VII. Posted in Kartak’s account from 1, 700. II. RS 1, 700 cash sales were posted on NIMA III. Prince Old Furniture Credit Sales RS. 1, 700 is deposited in the sales of IV. Old furniture. Ronak posts as RS 1, RS 700. Damaged and

दोकपऔऔट Summit कपोंक Sum मcom आपदोनोंकीकीतिबिंबतिबिंबपीछ Springs स Spingy

A collection of qualifications specified in the II program and the relevant geologic principles. The qualifications are: The tendency to understand all the items, even without anyone. The programs that come together seem outstanding from the environment. Continuous components can be seen as part of the sample. The components found together are considered units. For example, the dam error for the car is the loss or accident loss that causes damage insurance.

Normal business processes in order to receive any transactions or responsibilities, there may be a difference between approval of demands and recovery. Therefore, we follow the accumulated concepts to record the transaction.

Mastering Data Extraction From Health Insurance Claim Forms: A Comprehensive Guide

Sometimes it takes time to return to claim compensation. Therefore, the value of all the books of the asset is written as a loss without delay.

Due to the theory of conservative accounting or theory, we may not know the benefits of the future. However, specifying income is a different concept. If there is faith and measurement in terms of business income, it can be recognized. Here, the claim of insurance is not normal income, so the company must be very confident about the feeling before recognizing that it is income.

The claim of insurance is a receipt and under the income group, assuming that the methods are different. (Influence of profit and loss) in accounting

Insurance demands are assets. If the insurance company allows the company to specify the recipient. Therefore, must receive a receipt before recording the assets received.

Examples Of How To Record A Journal Entry For Expenses

The claim for compensation is revenue if the second accounting (Affecting profits and losses) The rules of gold accounting to account slightly, we should use all revenue and benefits. So we will support it

It depends on the situation. Accounting can be done in two ways: one is to pass the transaction by setting targets, bank accounting and insurance revenue, and the second is the assets as specified above.

The insurance business has added wings in many functions such as home insurance. (Thief and theft) Wedding insurance, travel insurance, etc.

:max_bytes(150000):strip_icc()/Balance-Sheet-Reserves_Final_4201025-resized-b426e3a4e56040f29fba29b238f53ec3.jpg?strip=all)

Claiming claims are the recording of entrepreneurship insurance and recovery. There is no new way to follow. Just follow the gold principles of accounting. We have to do assets. Then we will prohibit it to collect funds. Hope that this article will provide good in -depth information about registration of insurance claims.