Insurance Company Profit Margins – Divide this page on Facebook (open in the new tab) Divide this page on x (open in the new tab) Divide this page (open in the new tab) This page

The epidemic and the resulting economic crisis have emerged from any expectations on what health costs, the further financial results of the use and insurance companies like this year. In the spring, the unique fall in medical care costs has led to many margins and profit increase in profit companies. This summer and autumn, expenditures and maintenance of service returned when patients returned to everyday life, both selective care, and the cost of testing and treatment of treatment. Loss of work and financial instability have been raised to the Care of Medicaid’s width and Medicaid, but so far you have made modest modest changes in registration.

Insurance Company Profit Margins

Within this short frame, we analyze the data from 2018 to 2020 to investigate how insurance markets are financially focused on the end of September, as the epidemic continues, and the use of healthcare has risen to previous levels. Vi Brukeronomiske Data Rapportert AV ForsikringssselsKaper Til National Association of Insurance Commission (Mikidubia) og Farrahsnittlige Medisinske TapSforest og for the winner. The data of the third quarter are from January 1 to 30 today. September. A more detailed description of each market is included in the appendix.

3 Surefire Ways To Measure Profitability

In late September, the middle margins through these four markets remained relatively high (and the conditions of losses relatively low or smooth) compared to the same point in recent years. These discoveries suggest that many insurance companies have remained profitable, although in the third quarter of the third quarter have increased all the alleged and non-enlightenment. Year according to the availability of the law (ACA) medical loss conditions. The use of risk exchange schemes for Medicaid, which has a lot of states on the spot, will eventually reduce common margins calculated in quarterly data.

One of the financial results of the insurance company is an average gross mobilization of one member per month or the average amount that Premium income exceeds the costs of each registration requirements for each registration. Gross margins are an indicator of financial results, but positive margins do not have to be translated into profitability, as they are not responsible for administrative costs. However, the sharp rise in mooners from one year to another, without prominent growth of administrative costs, will show that these health insurance markets have become more profitable during the epidemic.

Insurance companies are still required to cover all Coronavi Rusting costs, and many have continued to voluntarily renounce coronary virus pocket costs. Still insurance companies have seen their demands fall and margins increase compared to 2019.

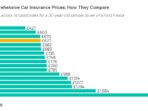

In the last 2020, the average gross margins were among the plans of the individual market and crowded group market, respectively, by 21% and 24% higher than at the same time last year. Among Medicare’s advantage plans, the gross margin has been 35% in the third quarter of 2019. Higher average costs).

Capping Health Insurers’ Profit Margins

Medium glued margins in Medicaid Medica Medical market are more than twice as high as the third quarter, as they have passed in the third quarter of 2019 (109% growth). Compared to other markets, the margins in the MEDICAID MCO market are lower, as the prices must be an actuarial voice, dosage payment pace are lower than other markets. Terms usually use a number of mechanisms to regulate the risk of the plan, promote promotion and payments are not too large or very low, including different options to change the level of capitulation or risk exchange mechanisms. CMS provided guidelines to regulate MCOS payments during the epidemic, as states and programs cannot predict that changes have taken place in operation and expenditures. Many of these adjustments, which states can do, can occur in a retrospective, and cannot be reflected in quarterly endings.

Another method of assessing the financial results of the insurance company has viewed medical loss or premium income that insurance companies pay in the form of medical requirements. In general, low medical loss conditions mean that insurance companies have been more income to pay medical expenses or as a profit for the use of administrative costs. Each health insurance market has different administrative needs and costs, the less loss of the market does not mean that the market is more profitable than another market. However, in the given market, the administrative costs of which have been very permanent for a year, the decline in medical losses will mean that the plans are becoming more beneficial.

Relationships between medical losses are used in a number of ways to regulate state and federal insurance. Insurance companies in commercial insurance (individual and group) markets must leave discounts to individuals and companies whose loss conditions are unable to reach minimum standards set by ACA. Medicare’s advantage insurance companies are required to report to the level of damage. They are also required to provide discounts to the Federal Government if their MLRs do not reach the necessary levels and are subject to further punishment if they do not meet in a row in a row. For Medicaid MCOs, CMS requires CMS to develop capitulation interest rates for MLR for at least 85%. No federal requirements for Medicaid plans are transferring transfers if they do not meet MLR threshold, most other states, which are always demanding transfers or in some cases.

The medical loss of the medical loss is different from the CMS Medicaid’s CMS Medicaid’s final rule of care by Medicaid, making certain adjustments for quality improvement and taxes. The diagram below shows simple medical loss conditions or the proportion of premium revenues that insurance companies pay in demand without any changes (Fig. 2). Medica’s average loss rate in the first nine months of the MEDICA 85% at least even without explaining possible adjustments. The loss of the group market has decreased by three percentage points on the same point last year.

Insurance Metrics & Kpis: Examples & Templates

The average loss of the individual market reduced the four percentage points in 2020 compared to the third quarter of the previous year. In each market, the terms of touch were quite low, and in the market insurance companies recently provided record discounts on consumers based on their experience in 2017, 2018 and 2019.

Just as we found in our middle, however, health insurance companies have become quite beneficial during the epidemic, although we cannot make a profit without administrative value. In all four markets we have studied, the average gross margins are higher, and medical loss conditions are lower than last year.

The return of optional and ordinary care in the fall, which is combined with the continuous value of testing and treatment of patients with Sovzy, contributed to Medicare’s advantage over a slightly higher level of group markets, but increasing demands from June to September, however. Weight does not weigh at the beginning of the year. The average intercourse between medical losses between individual marketing programs remained more stable and still well below the 80% threshold set by ACA. Tap the terms of the Medicaid MCO market this year is low. However, the margins in the MEDICAID MCO market are lower than in other markets, and the data does not reflect the implementation of the mechanisms of the existing or new imposed risk.

It remains to be seen whether the latest 2020 costs and use will change. Virus. The indicators of the discussions for the assumptions and hospital reception will probably increase the requirement of some insurance companies. Insurance companies are still required to cover the entire value of 19 tests, and many have expanded their exceptions for the end of last year for Covid-19 treatment. (The impact of Covid-19 hospital admission to Medicaid MCO Economy will be different by the state, as states have several options for resolving the value of 19th Soviet treatment