Insurance Company Ratings System – This page is the blog compilation we have around this keyword. Each header is attached to the original block. Each link in italics is a link to another keyword. Because the content of our content has more than 4,500,000,000, readers have requested a function that allows you to read / find extensive blogs around some keywords.

+ Free help and discount of fast capital! Become a partner I need to help increase the growth of funding ($ 200m), the larger technology company ($ 1,000), marketing, marketing analysis and 50K VCS 50K worldwide. We use our AIC system and introduce you to investors with hot guidance! Send here and get the% 10 lobes you mentioned: Select $ 0 $ 5 million – $ 2000 $ 100K – how much $ 100K – $ 100K – how much $ 100K – $ 100K – how much $ 100K – $ 100K – how much do you invest in your company? * Do you plan to raise a lot? If so, how much do you try to increase in the next three years? * How did you try to contact this investor? Cold or hot promotion? What results did you receive? * Are you looking for investors themselves or are the outside parties that help you do that? We cover% 50 of costs by equality. Subsions here allow you to get a free $ 35K business package. Dear Expense: Choose $ 15K – 50K – 50K $ 500K – $ 500K – $ 500 Do you have to fund? Select Yes No We Create, review your Pitch Design, Pitch plan, business plans, business models and others! What the material you need: select all decks, all the financial model of the top deck about what you are looking for: Choose reviews we help the world’s largest projects to raise funds worldwide in funding. We work with the project in real estate, construction, fishing film construction and other industries that need a lot of capital and help them find the VCS loans quickly! You invested: Select $ 50 $ 500 – $ 5 million – $ 10 million $ 1 million $ 1 million $ 1 $ 100K – $ 200 c. Zhakhakhakhak for $ 200 for $ 500 for $ 500, higher than 500K, how much of your company have you been in your company so far? * How much is your monthly burning rate cost? If so, how much do you try to increase in the next three years? * How did you try to contact this investor? Cold or hot promotion? តើអ្នកបានទទួលលទ្ធផលអ្វីខ្លះ? * Are you looking for investors yourself or have an external party that helps you do? The area I need support to select the study of the viable analysis of the analysis analysis analysis required for the analysis: Get the list of these 10 potential customers through their email, email and their phone number. What services do you need? Select the sale, sales, sales, sales, sales, better sales of sales funded for the update of social media marketing and report 50%. What services do you need? Choose digital marketing social marketing on social marketing social marketing all available funds for your marketing activities for your marketing activities: $ 500K-business email shipping will respond within 1 or 2 trading days. Personal Email Shipment will be sent longer

Insurance Company Ratings System

Evaluation of financial strength, keywords and insurance companies are 42 parts. Compress your search by choosing any of the following keywords:

When Fragile Insurers Meet Climate Change, Taxpayers End Up On The Hook

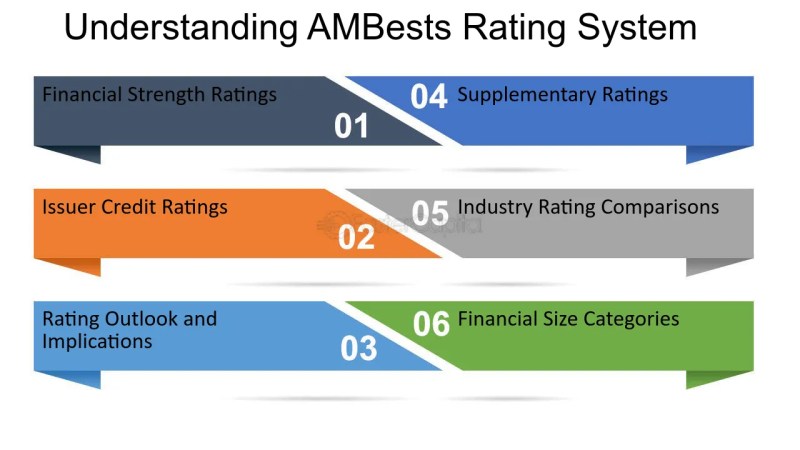

A.m. The best financial assessment of the best thing is an important tool for understanding the financial stability, financial stability and strength of the insurance company. These assessments give a valuable understanding of the insurance ability to fulfill their financial bonds and pay claims. While assessment can appear complex first looking first, they can be easily aware of some understanding. In this section we will find out the essential aspects of A.M. The best financial assessment of the best of the best importance and how they can introduce customers to make information with information when choosing an insurer.

A.m. The best letter classes are best for insurance companies from ++ (higher) to D (poor). These estimates reflect the bonus of the insurance company to fulfill the bonds of its political owners and are an indicator of financial strength. The higher the higher estimate, the larger the company is. It is important to note that each rate -class shows significant differences in financial stability. For example, insurance companies with ++ rates are considered high as higher rates, while rate of receiving rates may have moderate risks. Customers must intend to recruit companies that rank in ranks or higher to ensure greater access to financial stability.

A.m. Estimate many key factors when estimates of financial strength. These include the balance sheet of the insurance company, operations, operations, business forms and corporate risk management. By analyzing these aspects a.m. Evaluate the capacity of the insurance company to develop profits from risk management and maintain a large position. For example, companies that have a portfolio of various products and profitable profits may be higher than the company with financial results that are focused and inconsistent.

A.m. The final financial assessment of the best thing plays an important role in helping users make decisions that have information about their insurance requirements. When choosing an insurer, you need to consider the financial stability of the company. High rating shows that insurance companies are likely to have financial resources to pay for fast and effective demand. Warranty guarantee is important when it comes to significant losses or complex requirements. By choosing a high ranking, politicians can be peaceful to know that their claims are likely to pay quickly and full.

What Are Security Ratings? Cybersecurity Risk Scoring Explained

When comparing estimates between various insurance companies, it is important to consider the average industry for each ranking. For example, a classified insurance company can be considered strong in a field, but very weak in another field. Compared to the same industry, customers can better understand how an insurance company is located among its friends. In addition, it is recommended to review assessment of assessment and trends to evaluate the company to maintain its financial strength. Companies that maintain high ranking over time than time showing the Strong record of financial stability.

In addition to a financial assessment, A.M.M. The best estimate of the company’s potential for the near future, the potential of the company. ទស្សនវិស័យទាំងនេះអាចមានលក្ខណៈវិជ្ជមានអវិជ្ជមានឬមានស្ថេរភាព។ ទស្សនវិស័យទាំងនេះអាចមានលក្ខណៈវិជ្ជមានអវិជ្ជមានឬមានស្ថេរភាព។ Positive perspectives indicate that assessment can be improved, which indicates an improvement in financial strength. On the contrary, the negative point of view implies may decrease due to the more impaired financial condition. Customers need to consider both the current rankings and prospects to evaluate the long -term stability of the insurance company.

Discover A.M. The best financial strength estimate is essential for users who are looking for reliable insurance. Understanding the considerable assessment volume, the importance of an individual assessment can make decisions with additional information when choosing an insurer. Compare estimates between companies and consider more competitions to improve the ability to evaluate the funding of the insurance force. Eventually using A.M. The best clients on human financial assessment can receive coverage from the financial stable financial company in the best capacity of their insurance requirements.

When it comes to evaluating insurance companies, one of the most important factors to consider is their financial strength. An assessment financial procedure gives a valuable understanding of the ability of an insurance company to complete its financial bonds and wage claims. These estimates are allocated by independent assessment agencies such as A.M. The best and widely used by business users and industrial professionals to evaluate the insurer’s stability and reliability. In this section, we will make the importance of assessment, financial strength and their role in the insurance assessment, which gives understanding from different perspectives and will give insights into their meaning.

Best Travel Insurance Companies Of July 2025

1. Trust and reliability: Finance