Insurance Company Vs Insurance Broker – They have different relationships with the various insurance companies that allow them to find the best offer for your situation.

Their only activity is to offer opportunities for the best cover at affordable prices. Household insurers want your business to find only those with the best coverage and price.

Insurance Company Vs Insurance Broker

Home insurance mediation can help you find your current cover at a better price. They can also gain new policy with lower fees and provide the same level of protection.

Top 10 Insurance Broker Powerpoint Presentation Templates In 2025

Providing homeowners plays an important role in protecting the house and the family. There are many options to provide homeowners, so what do you need to do? There are benefits to a broker that helps you find a policy that suits your needs.

The average cost of securing a residence owner is $ 1, $ 200. At the same time, you can save up to 30% on your policies with a broker instead of passing directly to the company.

The broker compares the proportion of multiple companies and finds the one who is best for you and your needs. This year’s competitive insurance company may be expensive next year.

Homeowners’ insurance premiums can increase by at least 10% per year. If you are not sure what you need to look for on a bond and the best supplier to meet your needs, the insurance broker can help compare the policies of multiple companies without having to do all the search alone.

Fassbender Insurance Agency

The average cost of the homeowner’s bond is $ 1 per year, $ 070, but if you use an insurance broker for the plan, the average annual costs will be reduced to $ 780 per year!

Real estate insurance becomes more expensive every year, especially in places like Florida and Texas, which have more weather challenges, as there are three separate policies: wind, fires and floods.

Homeowners’ insurance brokers help you find the best company to work together and interfere with the better price.

In addition, when you can contact them, you can provide quotes from a number of insurance companies in your area, thus comparing prices for the available. This can give you the opportunity to save money if you have a cheaper option.

Insurance Broker Cover Letter: Sample & Guide (entry Level & Senior Jobs)

They also have access to special agreements that agents who only sell only one type of coverage opportunity do not know. For example, individual companies sometimes offer discounts for customers or offer fees programs that are not publicly advertised, but the homeowner’s insurance brokers do so because they have heard of mouth -to -mouth between clients, which makes you a priority.

Insurance brokers can make sure that all this information can be easily found for the owner of the house. They have a lot of information that can be hard to compile for the average person, and it will probably take more time than you want to spend when you get quotes from various insurance companies.

Homeowners can receive the use of a broker certified by the National Association of NAIC and work with several insurers to find competitive quotes.

If you are not sure what you need to look for in a policy and the best supplier to meet your needs. The insurance broker can help compare the policies of several companies without having to do this research.

Understanding The Role Of Insurance Brokers

Expert will be in the hands of a specialist, trained and authorized broker to help you when you buy or renew the best suited insurance bond

It would be difficult for an average person to compile this information, take more time than most people spend while examining their opportunities and trying to quote from different companies. There are so much information out there that they would not be easy for those who do not know what they do when agents were asked what type of plan I need to buy to cover theft.

A broker is a person who helps you find the best possible price to secure the homeowner. You can also use them to find better interest rates in the cover of vehicle insurance, service life and other types of insurance such as commercial responsibility and umbrella.

It is worth considering when you want to save monthly payments or if you have been refused to cover it, as another company has a high -risk label in the past.

Insurance Insights: Insurance Broker Vs. Insurance Company

Agents or brokers can help you cover and cover your responsibility and do not forget to cover the content. Personal wealth inside the house.

It can be used for free to find insurance brokers to find cheaper fees because they are compensated by the insurance company based on policies. This means that there is no pocket and nothing if you find no insurance bond for you for a low -traffic home.

If you try to save homeowners’ insurance bonds, it is worth considering the idea of using the insurance broker.

There are many different reasons why people decide to use a broker instead of buying for their own policies, but something that is often neglected is how brokers can help with proper coverage and avoid lack of protection.

Brokers Vs. Direct Agents: Key Differences In Choosing Insurance

Let’s start with what the insurance broker actually does: they buy for you, so you don’t have to go to a company that tries to understand which one you offer at the best price.

They examine all aspects of all politics, including coverage, franchise and other expressions to find something that perfectly adapts to your needs at an acceptable price.

Insurance brokers can offer other valuable services, for example, from reviewing all your policies every year, or all the great purchases or changes in your lifestyle, to know what happens to everything at once, instead of calling regularly when something happens. House insurance brokers will examine your current situation and recommend that you make some adjustments if necessary.

Most home insurance brokers, such as insurance brokers, pay nothing for the service, while others charge a percentage of the fee.

Best Insurance Company In Abbotsford

Less concern for you or your family when you have a new coverage is time to buy all the work and you are looking for your account to make sure you make sure you make a well -founded decision

The best companies such as Hartford, Liberty Mutual, progressive home insurance, travelers and many other quotes! You have access to many options, without a lot of legs.

If something changes in your life situation (for example, civil status), it is worth managing this process to manage this process because the post -sale service is automatically inserted.

You know they are looking for your best interest and not trying to sell just one company. Insurance agents only allstate, agricultural state, farmers, etc. They act as captivity at their insurance company and can only buy only one company.

Underwriter Or Broker; Who Works For You?

Independent insurance agents, or generally know that insurance brokers represent dozens of companies. Their goal is to find the best plan, regardless of the company.

Domestic insurance is a necessary cost and can be expensive if you don’t know what to look for.

When looking for the most comfortable home insurance, consider the use of the broker’s power, which specializes in search of competitiveness and coverage that suits your needs.

A good broker not only helps you find better prices for different companies’ policies, it can also make suggestions for discounts or other benefits that can even save money!

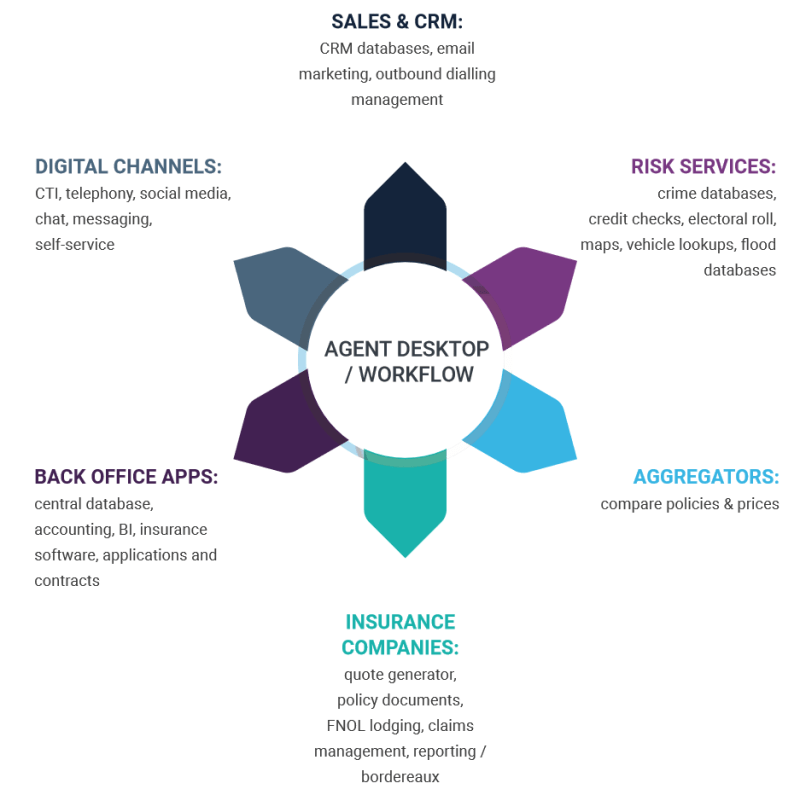

How Insurance Broker Services Streamlines Processes

If this seems to be worth considering, click here to start with an independent domestic insurance company today! The process only requires minutes and all quotes arrive without obligations, so there is no risk.

In this way, when the time comes to change the way along the way, a new home or other reasons that the home insurance agency broker can move with you can move with you.

If this article on insurance brokers has aroused your interest to investigate more opportunities than an online list, where it is difficult to say who is legitimate or not. Contact us directly at 314-569-1010 and talk to an authorized insurance broker or online quotes click here for your state.

The insurance brokerage group is unique in the sense that our insurance agency focuses on a personal insurance consumer market as commercial insurance. This gives us the opportunity to attract more insurance companies than homeowners than a typical insurance agent or broker.

Insurance Brokers License

The insurance broker is a key player in the purchase of residential property insurance. They are there to help you understand what your needs are, find the right policy for your home and budget, and make sure you get all the discounts that are about your situation.

You can ask how to choose an insurance broker. First and foremost, it is important to know that they have experience with the policy of homeowners. Are they well informed about other types of coverage? What customer service does your company offer?

It may be useful for the question: Friends or family had pleasant experiences in the