Insurance Coverage Kids – In planning, life insurance usually involves adults not notice according to their money. However, the amount of parent increase in Canada processes the benefits of buying their children’s children. Despite the first decision, understand the reasons behind the decision, they can shine on family finance safety.

Life insurance for children who work in the same virtue of adults. It provides financial stability, providing a fee payable when the childhood is bad. While it would seem to be considered such a situation, the truth is a test disaster can reduce the load in a difficult time.

Insurance Coverage Kids

When it comes to verifying your family financial future, think about the life of children can give many benefits. This is especially considered in this investment is appropriate for consideration:

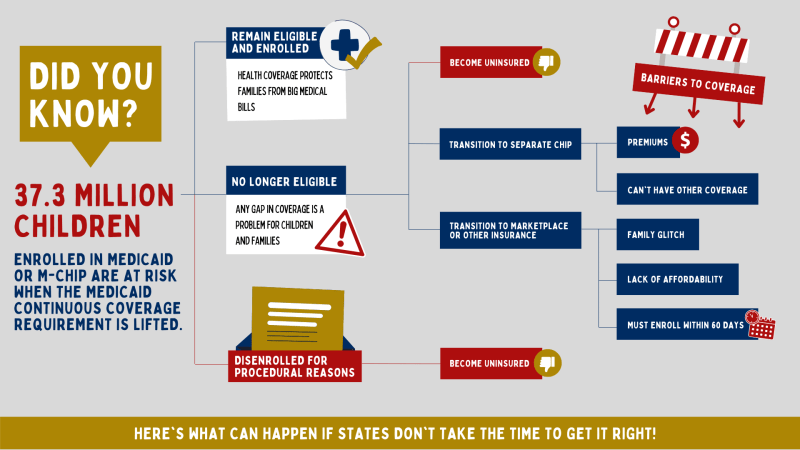

Medicaid: Cost-effective Coverage That Works For Children

Warranty’s clarification: If you are purchasing the child’s life insurance system early, parents can confirm their beliefs, even if they are healthy. This is especially important for families with a history of medical problems or livestock. Through the life insurance of children, lock to reach their insurance skills no matter how to.

Lifelong Management Insurance for Life Insurance: Children’s Life Insurance often take insurance form. Unlike life insurance on the expiry date, all the Insurance of life supplies peace of mind. This means that your child will remain network of communication, verifying their financial safety.

The total amount of money: One of the prominent things for all children’s life insurance to accumulate money on time. Since culture is paid, the portion of the payment is to create the amount of money within the policy. This amount of money can serve as a purpose-meaning explanation of the meaning of the future. Whether education, repayment in the house, or even savings installation, the money proposes well and security.

FINANCIAL CONCLUSION OF THE FUTURE’S NEWS: Because your child is growing, their financial needs and their wishes are not calculated. Child insurance programs are adaptable to suit this varied. Whether they help them in higher education, they start doing business, or profit policy of the insurance policy for living than protection.

All Generations + Life Insurance = Increased Financial Security

Firm financial construction: investment in your child’s life insurance policy is not just a protection against their financial nation. By forming the importance of budgeting from a little, he puts them into success and gives them the strength to become all of them.

Therefore, children’s living insurance produces, adapting, and potential growth. It is a way of future future benefit and maintaining financial safety. While you receive your Option, it is better to get the advisory advisor to a reliable financial adviser to make sure you select the best

Life Supplements are compatible with your family’s goals and priorities. After all, make sure your child’s future is one of the most important choices you can do as parents.

Before entering into the life insurance of children, parents need to examine their financial situation. While children’s policy level may be less than the adults, it is necessary to protect family budget. By examining income, expenses, other obligations, parents may see the investment of children can be.

Children’s Health Insurance Program

When choosing the health insurance policy for their children, parents often face the difficulty of choosing the right management amount. While tempting temptation may choose a minimum treatment to maintain low power, it is important to balance the power during a suffixed ability. Consider the same amounts of future demand, possible spending, and financial hardships for a long time can help access the fair quality of management. By receiving a valid balance, parents can ensure that their children are adequately protected while there are their budget limits.

Children’s life insurance is not financially secure when he died; And in relation to the future planning. Parents should consider possible expenses while their children grow, such as educational expenses, or even pay at home. By predicting this money spending, parents can choose the number of stewards who give enough peace and peace of the children.

While focusing can ensure the coverage of their children, parents should consider the length of long-term insurance policy. All the Insurance of life, commonly used as insurance for children insurance, providing financial trip and accumulating money. This is the constant amount that provides the important asset of its children in the future, provided the fluctuations of funds and growth opportunities. By examining long-term insurance benefits of living in children, parents can decide as intelligent financial purposes.

In the Canadian market, the Insurance Provider provides a specific insurance policy for the Child Children. Parents are required and to compare different policy options to find the best life insurance program that meets their needs and decisions. Features such as administrative benefits, significant rate, and additional features should be considered carefully when assessing policy. By making a detailed research and comparing policy options, parents can ensure that they choose the appropriate child security coverage.

Keeping West Virginia Kids And Families Covered

By carefully considering these things, parents can decide the best in deciding on buying their children’s life insurance.

There are different types of children’s life insurance in Canada. This gives the opportunity to allow their child’s future for their needs. The best way to get the best life guarantee of your child follows the point below:

Start your journey by the research insurance provider of children’s life insurance for the Canada. Take a survey of their offer, administrative options, and authorities within the industry. Seek the providers who work better Children’s Policy, as they can provide the right solution to your family.

Once you have received a few potential providers, it is time to compare words. Ask each provider, in relation to the total number of management, premium, and additional features or features. Comparing claims will help you determine how the provider is good for your money and you are still equal to your budget.

Families For Life

Digital, multi-insurance suppliers provide online names and applicable applications for the health of the health of children. Use these Internet platforms to get words immediately and the comfortable ones from your home. The Internet option can save time and difficulty, make it easy to get your simple and accurate choice.

As you compare the words and get different providers, think about your family’s needs and clarifications. Consider the number of supervisors you want, as well as additional qualities or benefits of you. Not that you want a policy with changing billing options, make sure not to be satisfied, or to accumulate the amount of money, and your family.

If you need to be specified that life insurance policy is appropriate for your child, feel the need for advice advice. The seller and financial advisors can provide a better understanding of the guidance to help you exceed the difficulties of the children’s Insurance. They can count on your unique situation, personal advice, and repair all questions you can have in the way.

Once you have purchased your child’s life insurance policy, it is necessary to update and convert and ensure that it requires your family’s needs. Health conditions can be changed in time, so fix your management is important. Whether you experience changes in the salary, family size, or financial purposes, make sure you keep your mistakes.

Some States Push To Limit Health Coverage For Poor Children

By following these steps and explores Canadian market and your child’s life insurance policy to give you peace. Remember, invest in the best life insurance policy for your child to grow and welfare.

In conclusion, when the idea of purchasing children’s life insurance may seem unusual, understand the benefits and maintenance of the family. By verifying unhappiness, it gives all health treatment, and money is accumulated, parental life insurance.

When you think of your family’s future, consider your child’s life insurance policy. Whether you give their future education, to prevent an unexpected situation, or create financial listening, the investment of life insurance can protect your child’s future.

![]()

Please don’t wait until it is too late. Take