IndoBeritaTerkini.site – Imagine driving a car at 100KMPH without wearing a seat belt on a smooth highway. It may look like something we’ve seen on a daily basis, and nothing usually happens, but what if some animals don’t have anywhere, and you need to use brakes !!!

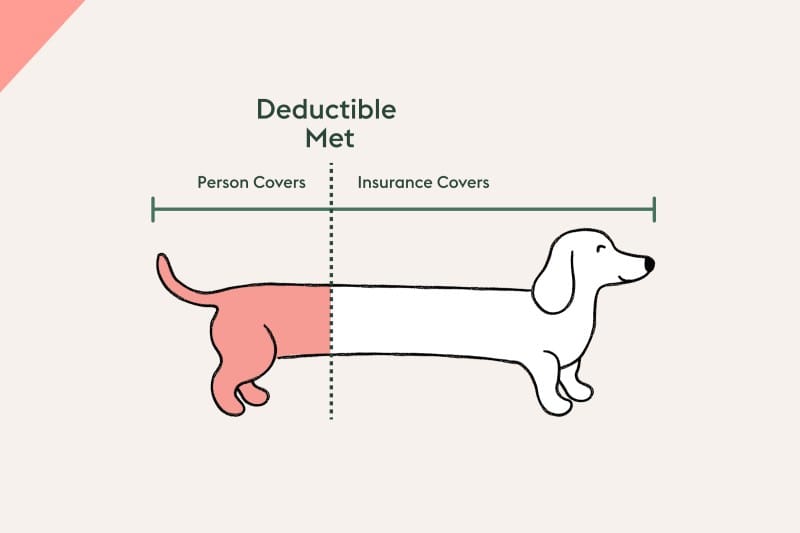

An acceptable amount you have to pay in your pocket before your insurance covers the rest. And they come in two types – volunteers and compulsory deductions. In the article below, we will dive in detail for these two types and how they can affect your car insurance policy.

Insurance Deductible Meaning Car

Car insurance deductions refer to the costs you need to shell from your pocket before your insurance arrives to pay the rest of your application. These easy values are built by Irdanai and counted based on the cubic capacity of your vehicle’s engine. It is important to understand two types of car insurance deductions, and we will attract them further.

What Is A Comprehensive Insurance Policy For Vehicles

As discussed earlier, a volunteer deduction is the amount you pay from your end for car repair. While this option reduces your policy premium, it also increases costs outside the filing.

If you buy your policy to start, you need to know the amount you are comfortable with yourself. The selected incremental amount applies to all claims you have filed throughout the policy period. Remember that the insurer will only cover the proportion of the overall compound of voluntary and compulsory deductions.

Below, you will find a table that reflects voluntary options to receive and the corresponding discount offers after application –

A 20% reduction applies to your own damage to the vehicle’s premium, with the maximum reduction of Rs. 750.

The Basic Car Insurance Terms

Automotive damage to the vehicle is subject to a 25%reduction, tapped to the highest Rs. 1, 500.

A 35% reduction offers self-injury to damage to vehicles, up to top Rs. 2, 500.

Sultan decides to buy a car insurance policy with IDV from Rs. 5 Lakhs. The premium for total policy around Rs. 12, 000. He chose a voluntary reduction in Rs. 5, 000 to reduce this cost.

As a result, the premium he was required to pay less Rs. 10, 500 (12, 000 – 1, 500). However, there is custody – every time it files a claim, Sultan should first put the voluntary discount in Rs. 5, 000 / – before the insurer contributes the rest of the claim.

What Is Full Coverage Car Insurance?

It is important to note that for clarity, we do not cause a compulsory reduction in this explanation.

In car insurance, you must pay mandatory discounts as part of any claim. According to the Irdai regulations, compulsory cars with cubic capacity (CC) cars up to 1, 500 BC stands in Rs. 1, 000 and Rs. 2, 000 for cars with engine capacity over 1, 500 BC.

It is important to note that this mandatory acceptance does not affect the insurance premium, determined by the model, the year of production, and insured declared value (IDV).

Let’s talk about a Sultan car, which is a 1300 BC car. In this case, the compulsory reception he has to pay is Rs. 1000.

Is This A Good Full Coverage(lender Required) For Mylr? Progressive Insurance

If Sultan did not choose for any voluntary deduction, he must pay Rs. 1000 every time he claims before the insurance company contributes for the rest. However, if he chooses a voluntary discount, he must pay Rs. 5000 + Rs. 1000 each time it files a claim.

Please note that to keep things simple, we do not include additional cases, as modest cases, in this explanation.

You have the option to voluntarily select this amount. If you choose this, you need to pay this amount each time you make a claim.

In accordance with Irdai regulations, the mandatory car insurance is determined based on the vehicle’s cubic car capacity.

Tax Deductible Expenses For Company In Malaysia 2022

You can refer to the table mentioned above to see the effect of voluntary deductions you choose.

In this comparative analysis, we hope to get a clear idea of how volunteers and compulsory deductions differ.

The compulsory deductions are the payments you have to make with a claim filing. However, you have the freedom to decide whether or not to be raised involuntarily acceptable.

Your comfort level and risk level you want to make if a claim knows how much voluntary choice you choose. Choosing a voluntary deduction helps to reduce the amount of the claim, but you need to pay a higher cost.

Auto Insurance Premiums In 2025 (insurance Cost Explained)

To protect your car and finances, you need to consider important facts when deductions are selected for your car insurance. The compulsory deductions are compulsory payments, while voluntary deductions offer flexible. Choosing the correct corrupt value depends on the comfort level, risk consent, and different factors such as the value of your vehicle, driving the skills and settings. Choosing for a senior volunteer saves you money on premiums, but means a higher cost of your pocket claims during claims claims at the time of claims to claim during claims claims during claims during claims during during claims during a claim. Estimating your needs and evaluating these reasons will help you make informed decisions about volunteer deductions in line with your circumstances.

So next time you’re on the back of the wheel- don’t forget to take care of yourself with a seat belt and, yes, car insurance.3 minutes can save you hundreds. Enter your postcode below and take part in thousands of Canadians who can save insurance.

Serves as an independent intermediate between you, financial institutions and licensed professionals with no additional payments to our users. For the benefit of the transparency, we reveal that we are linked to some providers we wrote – we listed a lot of financial profit. Without working in a financial institution or broker and to ensure accuracy, our content was assessed by licensed professionals. Our unique position means that we have not returned a share in your policy, securing our mission to help Canadians make financial decisions or better discrimination.

Most car insurance policies will list a slippery amount. This is what you agree to pay every time you file a claim.

Cheap Auto Insurance In Louisiana For 2025 (save Big With These 10 Companies!) Cheap Auto Insurance In Louisiana For 2025

But how is car insurance in the car? What is the ideal value to receive? How is this effect on your premium? In this article, we give you all the information you need to understand the car deductions and if they apply to you.

Car insurance with an amount you should pay each time you file a claim before your insurance starts paying the rest of it.

For example, let’s say you make a claim for $ 1000 repairing your car with $ 100 acceptable. The total you can earn from your insurer will be $ 900, and you can only claim it after paying for the first $ 100. The other $ 100 is “taken” (ie that is sent to you), so the term “draws”.

In both cases, while your insurer may bear the cost, the deliberate amount comes from you.

Everything You Need To Know About Your Car Insurance Deductible

Being acceptable can help for expensive healing, because it strengthens a “ceiling limit” how much you get, while your insurer includes others. But what about examples where the cost of repairing totals is less than you receive?

Insurers take your acceptable payment at any cost. Therefore, if your receipt exceeds the cost of healing, it could be more economical to pay pockets only instead of filing a claim.

In this sense, if you file a claim, the receiver is the same “ceiling limit” (ie the maximum you pay for filing).

Only a few different types of automatic securing out there. Make sure you talk to your insurance broker and ask the right questions to get you the best deal.

Car Insurance Deductibles

You should have or you can’t get Dedyab car insurance at your end. The advantage of taking a reduction in car insurance is that it can lower your insurance premiums.

In verbal, you may think of insurance premiums and deduction insurance with an uneven relationship. That is, when one goes, the other goes. Your insurer can offer lower premiums if you agree to pay a higher reception, which can save you money in the long run. If you do not see your own claims to claim regularly, it can be a great arrangement for you.

On the other hand, having a higher decay means you need to pay every opportunity to make a claim. Also remember that your acceptable will be reduced first to make a claim, so establish your decay too high that can work against you.

Here’s an example: We say you’ve been in an accident and the total cost for repairing the less than you receive. If you file a claim to your insurance company, that’s the easy value that is still sacrificed to you. In this situation it is more economical to pay for a full repair