Insurance Depreciation Meaning – Depreciation is the value of the standard donkey, and it is all cumulative depreciations recorded. In a wide range of economic sense, depreciation is the total amount of “used” capital used during the fiscal year. You can accurately calculate the company’s capital expenditure trend and how aggressive the depreciation is.

The depreciation of real estate evaluation is an accounting method used to determine the useful value of business and individuals. Trained costs are not the same as market value. The market value is the price of assets according to market supply and demand.

Insurance Depreciation Meaning

Depreciation is reduced to depreciation over time after the useful life of real estate. Since the value of the real estate continues to decrease by calculating the cost, the depreciation method is always allowed to allow the toshovan property to the current value of the current value. It also allows measurement cash flow generated by property in relation to the value of real estate.

Annuity Method Of Depreciation

LabrecitedCost = Purchase Price (Orcostbasis) -CD = HumulativeDepREGATION START & TEXT

If a construction company can sell cranes that are impossible at a price of 5,000, the construction company is the cost or rear value of the crane. If the same crane is initially cost of $ 50, 000, the total amount of useful life is 000 45, 000.

Suppose the crane has a useful life for 15 years. At this point, the company has all the information necessary to calculate depreciation every year. The simplest way is straight lines depreciation. This means that there is no curve to the degree of gratitude. This is a lot of new cars when driving many new cars. Or when depreciation is increased when a large repair of the material is needed. Using this method is the same depreciation every year. Total depreciation ($ 45, 000) It is divided into useful life (15 years) or annual $ 3. Insurance claim support (79) Insurance contractor (26) General adjustment (22) Property damage (21) Insurance Policy (12)) Business property insurance (10)

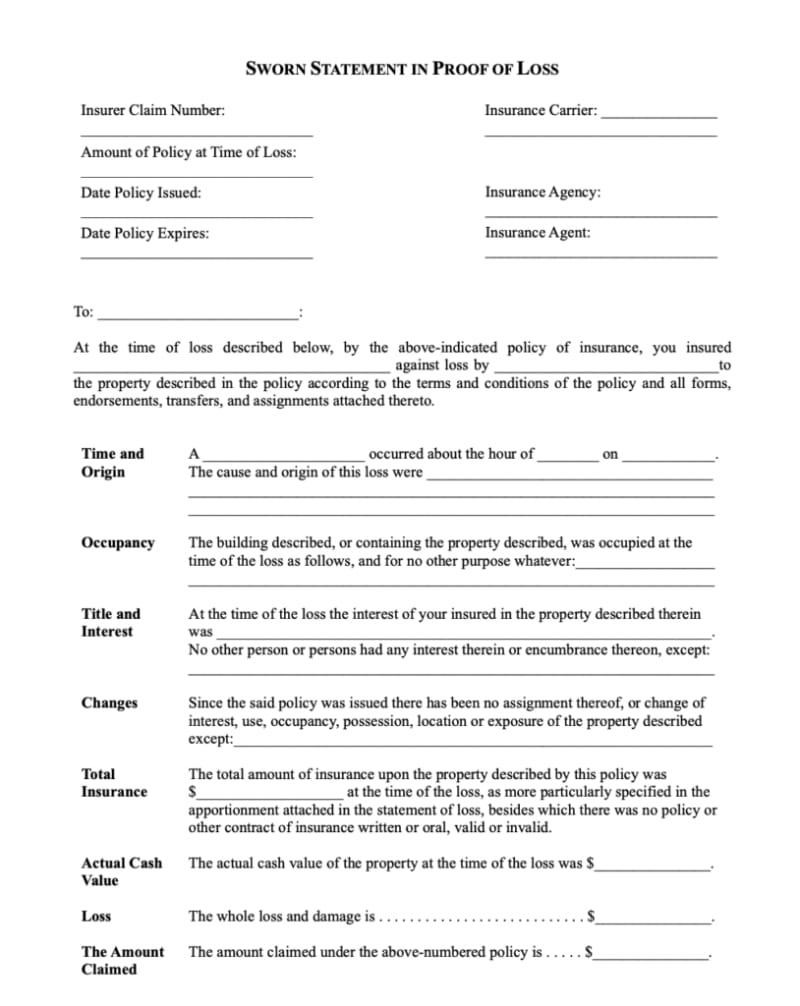

When understanding the amount of insurance, most insurance contractors have unprecedented norms and languages. This includes compensation, actual cash value (ACV), alternative cost value (RCV) and depreciation. What is ACV (real cash value)? The word “real value” is not easily defined. Some courts meant “reasonable market value”. But most courts have confirmed the cost and quality of replacement with the traditional definition of the insurance industry, that is, new assets. What is RCV? The word “alternative cost value” is generally defined or described as a principle that represents the cost of replacing damaged property without exhaustion. This value is that insurance companies are returning to prior conditions to change today’s market situation. What is depreciation? Hearing impairment is a loss of value due to all causes such as age, wear and deterioration. What is a reward? Rewards are the most basic and basic policy of property insurance. The basic purpose of insurance is to compensate for the loss you have experienced. Compensation is a fee for the insurance company’s insurance company (insurance company), but it is not a real loss. This allows your property to return to “complete”, so the property is recovered 5 minutes before the loss. Compensation compensates for the insurance company’s loss, but the insurer does not allow profits. An example of how ACV, depreciation and RCV works. Most insurance policy is the same language. “We will pay repair or replacement costs with similar architecture for the same purpose. Only the actual cash value is paid when the actual repair or replacement is carried out.” Alternative Cost Value Policy and Tree will fall home. It will fall home and home. There is the right to pay the insurance company damage. They take the initial inspection of ACV (actual cash value) to take the age of the roof as a factor and change the damaged roof. If you hire a contractor and change the roof, the insurance company allows the insurance company to provide the suspended depreciation and collect the entire RCV (replacement cost) of the damaged roof. In short, real money value = replacement cost -depreciation. Recruitment, license and experience of general adjustment can help you get the best solution for your insurance billing solution.

Agreed Value Vs. Market Value In Car Insurance

Thank you for visiting us. My name is David Miller. I know what it means to fight an insurance company to get a fair fee for your property damage claim. My family suffered a total loss of a house fire, which solved almost two stresses. First, we combined the construction experience with the expertise of the contract language to create a general adjustment of Miller. We only work for the insurance contractor. Please tell us how to speak, ask questions, and help.

Support for ownership insurance claims (79) Insurance contractor (26) General adjustment (22) Property Insurance Policy (12) Business Property Insurance (10) General Adjustment (9) Business Insurance claim (4) Judgment (3) Lawyer (3) ) 1) Business property loss (1) Greetings (1)

Use a guide from a free expert guide for property insurance claims to manage your insurance claim as an expert.

Our free electrical electrical engineering download experts will guide you through the stage that helps to increase immigration after finishing insurance claims from the beginning.

What’s The Difference Between Replacement Cost And Actual Cash Value?

If you can give important advice to a person who suffers a big loss due to fire and water damage, contact Miller’s general adjustment!

“The best experience. I had a big fire and it destroyed my business. My insurance company was hostile and negative. Miller’s general adjustment has been hired. They did everything. I am ambiguous and there is no need to have a different conversation with a semi -insurance company. If the general adjustment of Miller represents me, I have lost everything. ‘

“Dave has been in the industry for many years, but I have a personal experience in my fire damage. No matter how small questions are, it will take time for his employees to answer questions and understand change. It has become.

“Top Service Miller is recommended for anyone for regular adjustment services. Thank you very much. The process was good.”

What Is Recoverable Depreciation?

“David and his staff are pending. They are worth the weight of gold. If you need help with insurance ownership, you will be satisfied with what you have done! , I will do it! “

. It is worth all penny you pay for their services. “

“Fortunately, the restructuring company mentioned us here. From that point on, Miller Public Dechuster was convinced that David would do everything with his own strength and knowledge to prove that our homeowner should compensate for insurance damage. Eventually, we won the case and the claim was paid. David is not grateful for Miller Public Attasters! ‘

We cannot go to the world of chaotic total loss demand without their help, guidance and expertise. ”TODD emphasized. “I encourage people who faced a traumatic claim to deal with big insurance. They will completely help to alleviate most of the pain.

Zero Depreciation Or Zero Dep Is A Must Have Add On For Your Car Insurance. , It Helps You Get The Entire Cost Of A Damaged Part As Opposed To The Lower Value Because Of Depreciation When There Is A

They succeeded in getting the biggest solution from an insurance company. I and my family thank you for always asking us about Miller’s public adjustment. You can’t be grateful to them.

“Miller knows what he’s doing for the general adjustment and stands firmly against the insurance company. Miller Public Adjusters has all the rights we have thought. In a few months we do not need to deal with the insurance company. Further