Insurance Job Titles – There is an art to browse price comparison websites. Almost modern barter, there are several backup ways to choose a large belt supplier or update your auto insurance.

For the latter, adding a named driver or even having a dashboard camera will cause price fluctuations. However, the title of the post (the title that cannot be changed as easily as withdrawing the GRI from the insurance certificate) – is another variable that can place a lot of premiums.

Insurance Job Titles

After an overview of the most popular jobs in 2020 and their associated insurance costs, we looked at the final data for careers, industries and gender.

Health Insurance Advisor Job Description| Best Opportunity

To give us the best understanding of how employment titles and their insurance premiums have changed over the past year, we kept as much time as possible under the same driver’s standards. The only variables that change are the average driver and the age of their cars – another year after another.

By entering the same driver profile – date of birth, mileage per year, date permits, etc. On the price comparison site, we can be convinced that price changes are almost completely reduced to the occupation and algorithms of placing insurance companies.

According to our research, the worst job in insurance costs is now recruiting consultants. The premium has more than doubled since last year from nearly £350 to over £815, which has increased from 30 to No. 1 in our survey.

However, in terms of ranking, it is the designer’s cost increase that has increased the most. Despite the third-largest premium in last year’s results, our 2021 update has allowed them to slide to the second row, close to £780 a year.

How To Create Effective Job Descriptions (with A Free Template)

On the other hand, those who have “developers” in the title have experienced more favorable changes – software and web developers have been expensive again from last year’s 13th and 15th, this time at the cheapest 6%.

Health agents have the worst business as the only industry with an average figure of over £500. That said, the cheapest industries (public managers, defence and social security) cost just £110 a year – about £9 a month.

As far as the extra costs since 2020 is concerned, only a few departments have escaped the price of over £100 this time. Compared to last year, insurance health workers will be invoicing nearly £160 more in 2021.

Given the huge dependence on our health workers over the past year, it is difficult to accept.

Solved Small Orange Fine Foods Is A Specialty Grocery Store.

Despite the percentage of the difference since 2020 (32% to 33%), drivers still charge nearly £20 than men. In fact, this gap has been extended from over £15 since our latest research.

Our progress analysis of insurance costs will indicate whether this is a lasting trend or anomaly.

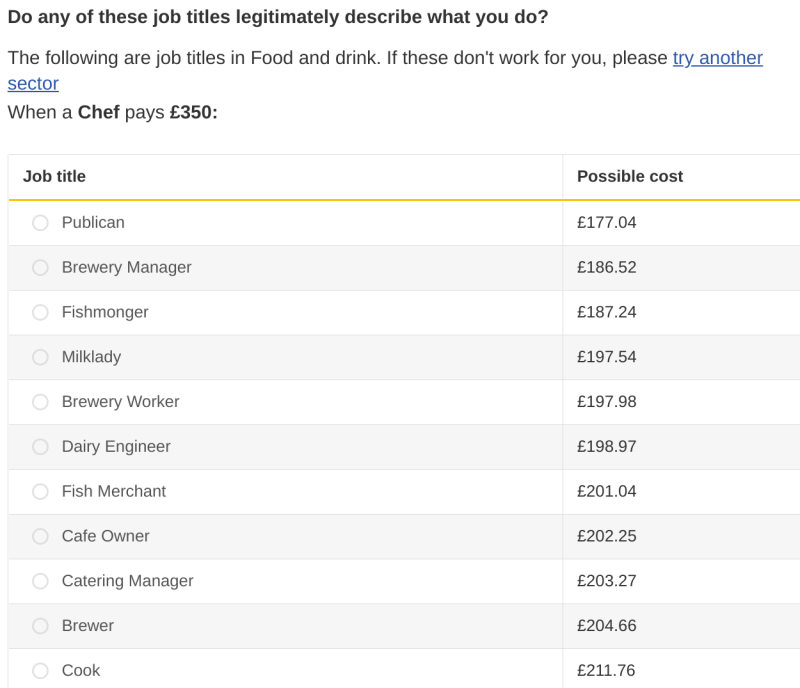

If you are facing higher insurance premiums, some minor changes to the driver’s details can help. Consider adding or removing designated drivers and evaluating their impact on costs and making sure you don’t overestimate your annual mileage. Also, it’s hard to find the exact career letter on the comparison site – try to enter an alternative that always corresponds to your role but offers a lower bonus.

For the latest news and car features like this, make sure to bookmark the blog, or go to our car rental for the latest rental offers on the new engine. Here we have done things that can shed light on potential cars to provide as much knowledge as possible to help you start planning your new year. Recently, we implemented a study to discover changes in auto insurance quotes based on the title of the position, which you can read in full here.

How Much Does Your Job Title Impact Your Car Insurance Costs?

In the next study, we will convert the concentration of auto insurance into Van Insurance to see if the changes we found in the latest study are still correct. We will also apply our attention especially to the business sector due to its size and its qualified width of personal work. Finally, we will also describe the results when driving an internal combustion engine van in the same way as an electric van to analyze the price differences.

If you have read our previous research, you will know that we do everything we can to make our research as accurate as possible. The main method of doing this is to retain as much data as possible from inputting coherent online insurance forms throughout the study. To do this, we created an average profile of medium-sized British van pilots.

As we have covered, we want to show the price difference between driving a van compared to an electric van. This means we need two different vans to do our research. For ice vans, we chose the best-selling vans for the UK Ford Transit Customs. Ford costs £14,982, and we arrived by scratching and analyzing the list of car traders and getting the average price of all other personalized Ford traffic vans. We also predict that the van will be 17,500 miles a year.

For our electric vans, we chose the best-selling electric vans from the Vauxhall Vivaro-E in the UK. The Vivaro-E uses the same method for £21995. The mileage of each year also remains the same.

Job Title Reports To Job Purpose: Job Description-system Administrator

In our analysis of insurance costs for truck drivers, our data highlights the mechanics as the highest bonus in demographics, whether they can use ice trucks or electric trucks.

Our research shows that the mechanic’s annual insurance premium will provide £837.28 for its diesel vans. This figure not only puts the mechanism at the top of our rankings, but also surpasses the second-highest insurance offer, which is £40 higher than the £798.19 estimate above nine different deals such as cleaners, pest controllers and boilers.

On the other hand, if we look at the other end of the scale, we will notice that specialties such as manufacturers, carpenters, electricians, painters and decorators will all receive an annual insurance expenditure of £722,77. The difference is £114.51, almost 16% (15.8%) less than the price paid by mechanics.

In the data analysis, it is also interesting to find that so many transactions are listed at the same price as £722,77. In addition to the above transactions, 14 other commercial jobs, including gardeners, carpenters and plaster, also received the same citations, with a total of 19. This not only highlights the lighting of the financial landscape experienced by various industries, but also reveals significant differences in the nature of the industry and truck type that continues during the insurance cost survey of electric trucks.

Resume Skills For Life Insurance Agent (+ Templates)

As mentioned above, the mechanic led ice truck insurance and electric truck insurance. But situations require a stronger shift in securing electric vans. More specifically, these mechanisms face a massive spending of £159.91 to ensure coverage of its electric vans over the past year.

The challenge of mechanics goes beyond that. During the transition to electric van insurance, the gap between their costs and the next more expensive offer widens. Although the difference between the mechanics and the second highest offer for diesel vehicles is £39.09, the gap for electric vans extends to £50.27. £1,109.64 is the next highest offer, which gives five different specialties including furniture promoters, promotion engineers and refrigeration engineers.

Turning our attention to the lower rankings in the rankings, we can see that deals guaranteeing the most affordable electric van insurance quotes do not include more than 20 different job titles.

These include those who have careers such as Stonemasonria, carpenter, plumbing, plastering and locksmithing. However, for these professions, the cost of insurance acquisition of their electric vans is £1,004,29, which is a substantial economy of £155.62 compared to mechanics, but on the other hand, is still a considerable cost. Additionally, it still adds £281.52 compared to the cheapest Van Diesel insurance.

Insurance Agent Job Title Employee Funny Insurance Agent T-shirt

On average, our research shows that the average annual Van Diesel premium for the business majors we have analyzed is £753.39. By comparison, the average annual average life of electric van insurance is £040.56, which is a £287.17 increase, which could present challenges for business people planning green and switching to EVs.

Those who work as refrigeration engineers will be shocked at the worst if they choose to respect the environment more. Refrigeration engineers must pay £1.109.64 a year if they want to secure an electric van instead of £722.77 if they are driving an ice van. The £386.87 difference is the biggest difference for any business expert.

On the other side of the classification, it turns out that the Thatcher’s growth increased slightly when comparing insurance for ice and electric vans. Thatchers pays £1,004.29 to secure an electric van every year, as well as other industries such as trees, icy, carpets, etc.