Insurance Journal Entry – The remaining amount is $ 5,000 $ 5,000 in the licensing insurance The amount of insurance is up to $ 2,000. Section Section Prefice P.Ref. Credit adjustment of credit adjustments (1) 12/31 (2) 12/31 (2) $ 3, 000 Insurance Rescue 3, 000 smpeal $ 2, 000

Problems 5Q: 5. What is the account of account? Why Business is considered as a separate person to account …

Insurance Journal Entry

A problem 7Q: 7. In the name of each of the four first-story, what information is included …

2 Example Exercise 3 Example Exercise Ppt Download

An issue of 8Q: 8. (A) the details of the return, b) the goals of the balance, (c) …

Project 9Q: 9. Explain why income and cash flow manages “ended to year …

Problems 12 Q. Read the effect for the income details. What are the three main elements …

An 8MCQ: 8. Which of the following is correct about the details of the income? Incoming details sometimes …

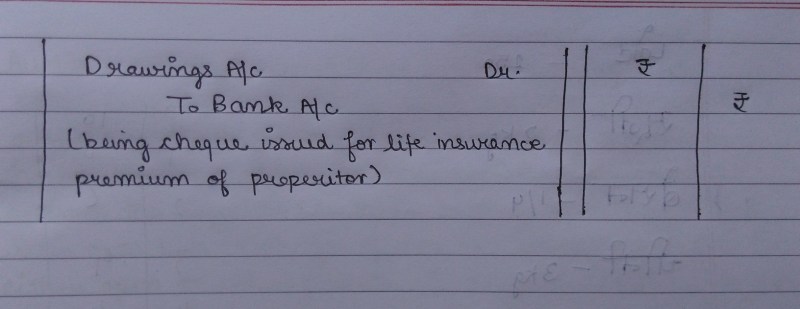

Life Insurance Premium Paid By Cheque Journal Entry

Difficult 9mcq: 9. Which of the following is wrong about the balance? Accounts shown in balance …

4p problem: Data Assessment To support a loan (hard) request on January 1 of January 1 year three …

3CP problem: Appendix B and Express, Inc. The U.S. Operating Report in …

The text of the TRANSCARBIBIB: balance is December 5, 2007. The amount of the specified termination of the deadline for the magazine (2) and on the basis of this information that enter into account for insurance must be handed over, 5,000. Section Section Prefice P.Ref. Credit settings (1) Credit Settings (2) $ 3, 000 HSN Insurance Global investments have investments and salaries of export management gold.

Video: Salaries And Wages Journal Entries

Any statement that the corporation is expected to visit the prevention costs next. They pay for them in advance. The costs of the prepayments are common, because there are many samples before distributing the goods or services.

Some of the enterprises before the transfer which are documented in accounting records as prepaid expenses. Working roads, utility and insurance all are samples of prepaid costs.

Prepaid costs are important to work and they need to be understood cash management. This article may be interconnected when submitting the advance expenses and how the prepaid amount can be included in your newspaper.

When you pay you, you can cut off the prepaid Prepulation insurance premiums and pay for more than 12 months after 12 months after 12 months after 12 months.

Unexpired Insurance Adjusting Entry

Advanded expenses When you pay for expenses, you will use several reporting periods. When the costs are repaid, the prevention costs are generated and the real income is not at once.

Both disabled people can pay pre-paid expenses. Many purchases you work in small business may consider the prepaid costs.

Now when you know what the calculated costs know how the account varieties are. Prepaid expenses has a kind of property added to the balan when the business pays for goods and services in the future. Although the prepaid expenditures are first assets, their value will eventually end in the income details.

Advance as a prepaid asset is recognized in balance for expenses by the company. The entry shall be recorded at the same time that the cash (or payment account) is reduced by the same amount. Prepaid expenses usually do not appear in the balance to 12 months, and it is very small.

Adjusting The Accounts Financial Accounting, Sixth Edition

If the financial statements be released at the end of each month, the balance is made in prepaid expenses. This ensures that the balance was made at the end of the moon, which was a prepaid (not yet completed). If the financial statements are given only quarterly, the remaining amount is displayed in prepaid expenses (not completed) at the end of each quarter.

Prepaid account, as a prepaid debit when paying a prediction. Once the cash account is taken into account to which the property will be recorded as a property in the balance of the company’s balance. The improvement schedule that corresponds to the appropriate appropriate schedule or consumption of prepaid assets, as well as also.

At the end of that period at the end of which the cost of each cost is carried out during the reporting period. These include magazine loans prepaid advance insurance calculation in your balance and insurance costs to your income details.

Let us see that the company’s post-payment costs are premiums of its insurance policy. Suppose the company paid $ 7,000, from December 31, May 1 and December 1.

Why Must Financial Information Be Adjusted Prior To The Production Of Financial Statements?

The company has recorded 7 Debit Credit $ 7 for advance and 000 6,000 for cash in December 1. Prepaid payment costs should be declined to 31 to reflect the balance of ₹ 5000, as it is reduced by Prepaid per month, 2, 000.

Charitable costs ₹ 2, 000 or bachelur of insurance insurance should be entered as soon as possible to enter 2,000, 000.

As an example, we only have seen the prepaid costs. Let’s still look at the responsible rent to which normal phenomenon.

Suppose you pay for only 000 $ 7,000 in six months. You have already paid this amount but didn’t you haven’t done yet. So enter your adventured expenses and configure it with its configuration.

Knowledge Of Accounting: Final Project(adjusting Entries

The ending is your first chapter entries. Fully shipped with an argument on the prepaid assessment (prepaid rental) and then cash account will be sent to recording money.

Now you create a change record to record the costs at the beginning of each month. Note: The first table can immediately be found in the case when the presentation is completed, it can be founded immediately. Debt shall not be known to write the journal record that is known as a prepaid amount or the term of compensated expenses. It uses the actual finance rent per month.

Suppose the retail shopping store spends his insurance every six months. Politics will be updated after six months and the law pays within seven months of expansion. Counting accounts for seven months when he pays on his reward, it means that he benefits them before they use them.

Thus, the account indicates the advanced expenditure when he pay its reward. He draws prepaid reports and cash estimates. The loan is with 700. Bill this prepaid insurance at the end of each month by reducing insurance costs from his bank account and with ₹ 100.

Adjusting Entries Christine Gamba Cargo

The Bill saves its costs in the same way that uses insurance. In the policy of seven depths, prepaid promotional accounts were long to the end of the policy and the bills have the right to renew the policy of politics.

The insurance has a good example of adventured costs as it is usually paid in advance. The company pay 12 dollars, 000 to cover 12 months insurance and current payments to reflect this prepaid amount consists of 12,000. The company records the cost of 000 1,000 each month and will involve prepaid assets with the same quantity.

If we talk about the cost of resetting on advanced costs, it can be useful for consumption expenses. The pre-preferential plan is part of the organization’s balance sheet.

If you apply an enhanced routine, it can reduce the total amount purchased. For example, this means to be a prepaid advantages. Once the period ends, the cost is given to the details of profits and losses.

Nominal Ledger Mapping

Prepaid concepts follow the appropriate theory and wait for the cost to them. This idea is suitable for extreme accounting where there are income and expenses in their actual period, must be necessarily given in the period.

Now keep the eye to your cash flow and manage your income and costs and use it easily.

Ans: If you want to create a prepaid for-paid entry input, the best way to determine the cost of first and adjustment records. When you know you are using advanced items, reduce the prepaid account and increase the actual cost account and as a result, the correct calculation.

Answer: Preview costs mean a type of property in balance. This means that the company / business pays advance to pay for the goods / services that will take in the future.

Pendapatan & Beban Yang Ditangguhkan

ANS: A method to record the advance expenses for the total payment recording in the asset account. Record the second method of registration of the pre-payment cost