Insurance Ko Meaning – One of the worst experiences for the owner’s owner is to request home safety insurance only if he is told he is not covered. After years paying the premium, the insurance company does not deliver when it is the most necessary. What a disappointment.

This interruption of the relationship occurs because we rarely take time to review our housing insurance policies every year. With confusing conditions such as the real monetary value (ACV) and the value of replacement costs (RCV), it is easy to feel overflowing and ignoring the details.

Insurance Ko Meaning

But as a financial samurai, it is crucial to be prepared for the worst. If you know how to protect your family from domestic invasions, see an insane framework for a vehicle collision, or predict the rules that your next mayor could push, prepared allows you to continue moving forward, regardless of the challenge.

Insurance In Hindi

Let’s review some basics of home insurance. If you have a mortgage, your bank requires you to transport the insurance you pay. However, if you have your home directly, you are not legally required to keep coverage.

Below is an example of a recording of a home insurance policy that costs $ 3, $ 900 a year, and I will take all the items.

Covering the residence is the amount required to repair or renew your home. In this example, the residence coverage is 1, 771, 000 for a home of 4, 800 square meters, which means $ 369 per square meter. It is important to make this calculation and compare it with the current construction costs in your area.

In San Francisco, $ 369 per square meter are low, but it is probably more than enough in places like Little Rock, Arkansas. According to agricultural insurance, the industrial standard is closest to $ 602 per square meter in San Francisco. Ask your home insurance agent what is your city’s standard.

Edelweiss Life Insurance Company 2025

If you live in an area where assets and construction costs increase, coverage of your apartment may be gradually insufficient. Some insurance companies automatically adjust coverage every few years, but in many cases you will have to make sure their amount of coverage is correct.

Below is the cleaning of the way they reached 1, 771, 000 to cover the residence. This breakdown also provides information on the high costs of remodeling the undamaged house.

Personal property insurance covers your belongings: protection, electronics, devices, clothing and anything else that falls from your home if you demolish it. In this example, the coverage of personal goods is $ 708, 400, which is 40% of residence coverage.

!! Many policies establish coverage of personal assets as a percentage of residence coverage, and often 40% is minimal.

1 Crore Term Insurance: Buy Best Term Insurance Plan For 1 Crore At Rs.21/day*

This approach offers an interesting view of the culture of American consumers. Insurance companies are based on the percentages of millions of past demands to establish a basic value.

Personally, I find $ 708, 400 exaggerated for my belongings. In addition to collecting objects (coins, books, sports memories) and family images, there is not much significant value in my home. We do not have design furniture or expensive art. So if the thief was aimed at my house, it would be disappointed.

For those who follow the minimalist lifestyle, like many personal financial enthusiasts, this coverage could feel too high.

Cover the cost of repairing or renewing the buildings of your property, except your main home, such as a fence, a barn or a deployed garage. It is important to clarify with your agent if the attached garage without life space counts as a separate structure. In most cases, this should be considered a part of the main apartment.

Deductible Vs Co-insurance Plans In Malaysia 2024

Cover personal liability protects whether someone is injured on your property or if it is legally responsible for another person’s property damage. Here are some examples of what you could cover:

For those who usually have fun at home, the coverage of personal responsibility is crucial. In this example, the policy includes a $ 300,000 liability coverage, which seems reasonable. However, if you organize a big party and the balcony falls, you could run out of $ 300,000 quickly.

If you think the coverage of personal responsibility is not enough, you definitely get an umbrella policy. The umbrella bookcase crosses the car insurance and the housing insurance policy.

Filling in loss of use is key because you will need a place to live if your home becomes natural. Depending on your situation, they may take years for permits and renewal.

How Much Sum Insured (si) Do You Need For Nri Life Insurance

To calculate your needs, evaluate the monthly income for a comparable home, multiply with how long you think the renewal will last and then add 50% because construction usually takes longer than expected.

For example, if the rent of a similar house costs $ 5,000 a month and predicts a 12 -month renovation will multiply $ 5,000 with $ 18,000 to get $ 90,000. For total destruction, plan 24-30 months of rent elsewhere.

Fill in medical payments care for reasonable medical costs for accidents accidentally injured on your property. You can cover medicine accounts, an emergency vehicle, bite, x -rays and more. This coverage is designed to offer a

The maximum limit is usually $ 5,000, but you can often increase it. In this example, the coverage of medical payments is only $ 1,000, which may want to increase.

What Is Forfeiture? Definition And How It Works In Investing

The owner must pay a deduction before the insurance company pay the request. Deductions are usually 1% to 10% of their residence coverage (coverage A). The bigger the rebound, the more you are your premiums and the other way around.

Covering responsibility (cover E) with a deduction of 0 USD means you do not pay your pocket for requests for responsibility. For example, if someone slips and falls into their property and demanding, the rules will cover up to $ 300,000 without deduction. Insurance pays the application to the coverage limit specified on the shelf.

This housing insurance policy may reject $ 88, 550 for each application under residence (coverage A). If you feel a loss, you should exceed 88, 550 to apply. For example, if the fire causes $ 120,000 damage, insurance will cover 31, 450, as you pay the first $ 88, $ 550.

Insurance carriers often establish a deduction given by citing the shelf. It is important to wonder how the premium changes at different repulsive levels, ranging from 1% to 10% of your residence. Your goal is to find the right coverage for the right expenditure.

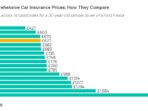

Car Insurance Low Rates

For example, if you are among 40% of homeowners in America without a mortgage and the main residence only makes 20% of their net value, you may not need extensive coverage. It can increase a 10%residence coverage, which in this case would be $ 177, 100 higher costs of pockets for claims.

Deciding a high deduction basically gives you a disaster coverage. If you live in an area without a background of frequent disasters, it could be a valuable strategy. However, if your region has usual disasters, you may prefer a lower deduction despite the highest premium.

When resolving property requirements, it is crucial to understand the difference between the real monetary value and the replacement costs. The replacement cost is desirable by sending the application, as the insurance company covers the current cost to replace the damaged items. In contrast, the actual cash value takes into account depreciation, which means you can get much less.

For example, these rules pay ACV for roof materials. If your roof is 40, the insurance company could only pay 10% of the costs to replace it, while covering the replacement cost would pay 100%.

What Is The Difference Between A Pre-need And A Life Insurance? The Most Frequently Asked Question Before Buying A Life Insurance

According to agricultural insurance, if they lack a record that shows that the roof has been replaced in the last 15 years, the shelf has not been paid ACV, which may also refer to fences and other structures – to save the insurer money while it costs the owner.

Of course, the cost of substitution cost is more expensive than the actual cash value. This is why it is important to ask about the cost difference. If you recently reorganized your home or replaced the roof, decide on the actual coverage of cash value could save you money.

But if your home is 60 years old, cover the costs to be replaced you may be worth the additional costs. It’s like getting a new iPhone 16 that will replace the iPhone 7 damaged by replacement costs.

Now that you know all the basics of housing insurance, I thought it would be good to share the most common requirements for insurance houses in California. The percentages will vary according to the country, but at least these percentages will provide a good idea for optimal coverage and protection.

Become An Insurance/pos Agent

If you are remodeling or building a house, pay attention to plumbing. The pipes erode and fail the joints. If your plumbing has not been updated for decades, it is advisable to consider any preventive maintenance. According to my experience, water damage so far were the most common. I noticed the ceiling because of the flooded bathtub, I repaired the broken water, re -installed the windows and repair the light that is filtered well.

Referring to water damage incidents in my homes over the last 21 years, I would not request insurance for either. Each repair costs less than one deduction. So something to think when your deduction is determined or you want to provide housing insurance.

Cover the damage of the original floods outside your home (heavy rain,