Insurance Kpi Meaning – Insurance companies use different targets to measure their activity and health. Think as necessary for business about these squares, measure them to keep track of insurance health. Let’s break some very important key performance index (KPIS) for insurance companies (KPIS) for insurance companies (in traditional and primary businesses:

The GWP is the premium that the warranty premiums before the strike by discount. The GWP contains an administrative premiums, while gross straight premium (GDP) they exclude on the premiums collected.

Insurance Kpi Meaning

This is the money that the insurance company should keep in account of different factors. Think of him as if taking a household picking “company.

Kpis To Measure The Value Of Your Apis

It shows that the insurance company is paying on his allegations than premiums they collect. Generally, the lesser proportion of the loss indicates the financial health, because it means more premiums to receive more than money in claims. However, the most low proportion of damage may recommend that the company will lead to its approach, may cause future financial difficulties if claims are higher than expected.

Example: If the tragge is to report the damage from 100.3, it means that for each ₹ 100 to collect in premiums. The remaining ₹ 30 30 help me meet other expenses and hope to leave some benefits.

This proportions add all outgoing money (Payment and Operational Expenses Allegations) and it’s coming. If more than 100%, the company only spends more than receiving premiums. This is an important DPA for insurance companies.

Example: India’s new guarantee has reported the joint ratio of 11.64% of the joint. This means they spend about 113 for each ₹ 100. 100 they benefit the benefits in premiums. They will need to remain useful through investment income or other resources for this way.

The Importance Of Kpi Management In Today’s Workplace

This is a security check to ensure that the insurance company has enough money to give all potential claims, even in unexpected situations. The government needs at least for policies of policies.

Example: The proportion of 1.85 lic sillors means 1.85 they have 1 1.85 for each ₹ 1. They may require payment. This additional structure helps ensure that they can attract unexpected great attribute.

It shows that the insurance company spends compared to premium they win. This is what the restaurant earnings rental revenues are presented on Cross, salaries and other running costs.

Example: Reports of the ICICI Lobbard on proportion of 30% costs, so that means they get in the operating costs for each ₹ 100. Generally, low cost ratio indicates more effective operation.

Insurance Agency Kpis You Need To Track

It shows the metric that the insurance company is at risk of self as it is at risk to assurely. It’s like watching how much weighs the weight is choosing yourself to carry with friends.

Example: If the trailing aliens have a 75% purebred ratio, it means to self-risk (and premiums) for yourself (and premium) for yourself and the 25% of the – Keeps 75% to the menro. High ratio can mean more potential benefits, but also a lot of danger.

Of a mentioned accused or including the premiums obtained. This proportion is different from. The ratio of the losses include but reports of buying crops (Ibn) reported (Iblon) reported (Iblon), while hurting salary.

Example: Claiming proportions by 65% of claiming proportions by HDFC is 65 in the claims of 65% for each ₹ 100.

Customer Service Kpi & Metric Reference Guide (pdf)

This shows how many customers are active by continuing your policy to continue palm of premium payment. It’s like a loyalty score for an insurance company.

Example: The Life’s life insurance continues 84% of the month. This means 84 of 100 customers is available after the first year, which Customer consent is a good sign.

It tells you how much the company claims the company paid compared to the made of made of used products. This is an important element of customers.

Example: Permissions of the compromise of 99.6 shld dfc life means that they almost all allegations are made by customers. It gives a great percent of potential customers that their allegations will be respected.

10 Crucial Insurance Kpis & Metrics For Agencies In Growth Mode (plus 60+ You Should Be Tracking)

Insurance companies invest premium they make extra money. This metric shows how well such investments do.

Example: SBI Life’s Investment Product Generation Earnings Investment Investment The Product of SBI’s Life’s Investment

For life insurance companies, it represents the best part of the new policies sold. It’s a sign that the company is how well the company grows customer’s basis.

Example: ICICI Life Business Premium grows in 10, 038 Chrome to attract new customers and expand their business.

The Must-have Call Center Kpis

It shows how many customers use company online services instead of traditional paper or personal methods.

Example: ICICI Lobbbr has been processed at 94% of their claims, suggests that they make them fast for the clients.

This provides consequences of customers and a desire to recommend company for the company. High security PSPSP can lead to a customer protection decline, and eventually growing better business. By tracking NPS on time, insurance companies can identify the area and improvement, such as claiming, or product recommendations. This information can be used to decide data-vertical decisions and promotes all the customer experience.

Insurance companies usually collect NPS information through customer survey. This survey often contacted the company, such as after recording a claim, or receiving a policy of recording. The survey usually includes a question that its possibilities measure the possibility of submission of 0 to 10. Information from information to report in a minute or less. Is the second! • to start free.

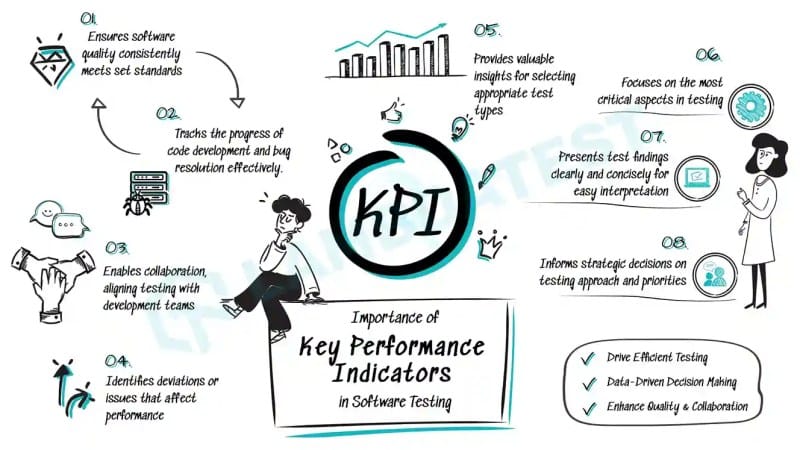

Kpis: What Are Key Performance Indicators? Types And Examples

Insurance is insured insurances that insurance companies use to monitor their activity and efficiency. They look at various aspects of business to vision, to customer satisfaction from financial health.

Insurance agency operates in the most rival market where data is new gold. Growing, the measurement of what is necessary to be important.

This article indicates 26 key performance indicators that insurance agencies should be addressed closely. By tracking this expertise, you can identify areas to improve, and the growth of stimulus.

Insurance DPS (Applicable Metrics) There are Metrics of Appointment) to use insurance companies to measure their performance and efficiency. This metris offers a visualization to trade various aspects of business, financial health.

16 Finance And Accounting Kpis To Prioritize

Insurance DPI Yes Successful life of insurance is life. They provide the necessary books in business activity that helps:

The main objective of the main DPA original DPA in insurance industry is to measure financial and health activity. These metrics look at the visible, ability and general economic stability to visuality.

The main purpose of customers in the insurance industry measures the customer satisfaction, loyalty, and general customer experience. By following tracking these experts, insurers can identify areas for development, promote customers’ relationship, and promotes long-term development.

The main purpose of active cypass in insurance industry is to measure internal process and effectiveness. By following tracking these experts, insurers can indicate grain growth, and expenses.

Kpis: Understanding Key Performance Indicators In Business

The main purpose of sales and marketing in the insurance industry is measurement of sales and marketing efforts to establish revenue and marketing efforts, and keeps the existing.

Find how to make a strong insurance DPA DPA DPA DPA DPA DPA DPA D-SCHOOL with your steering-2step directory. Try for free two to see how easy it can be.

KIPI Following The Choice depends on most factors, including your KPI complexity, your organization, your budget, and your technical skill. There are some famous options:

Start by identifying specific goals and objectives of your institution. Then, select KPI that coordinates with these goals and executions appear practical. Consider how much, the type of insurance, and your administration goal market when to create your choices.

Top 9 Kpis For Effective Revenue Cycle Management

The ratio of damaged proportion makes the premigrant in a significant clause, while cost ratio’s proportions compare operating expenses with selected premium. Both necessary to evaluate the benefits.

Customer protection level differs with the type and insurance market. However, in general, high-keeping level indicates strong satisfaction and loyalty to customers.

Use data photographing tools to make dashboard that shows key metric in the bright and short format. Consider the combination of artistic, graphs and graphs and desks to deliver the composition effectively.

50+ KPI and Real Estate Mati to follow August 8, 2024 Estimated Property Activity To Assess the Real Estate Trade Activity, Investment, …

8 Critical Metrics For Your Insurance Kpi Dashboard You Won’t Want To Skip (+ Examples)

24 دا د دې لپاره DPI او میرتونه د اګست 6 مثالونو کې، 2024242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424242424..24

There are 10 administrative sufficks for the performance of the administrative branch of July, 202427, the key process of the key to the administration of the administrative dpa.

EBITDA Computer in -llein: Calculating July 924anadda acquit that is a device that helps you the company’s earnings before interest, taxes, faithful …

TOOL IS A Free Ebit Calculator on -lein with formula Example July 4, 2024an Ebit Calculator Ebit