Insurance Nz – Housing insurance is provided for safety required for home loss, damage or deterioration. Here we offer the best home insurance company in New Zealand depending on your requirements and income. You can use a comparison page for other prices, trade and other regional insurance companies. Rental homeowners and tenants can be selected from the best household insurance companies to provide safe and protected furniture. Find the right home insurance today and enjoy home comfort without worrying.

ExpressVPN is one of the fastest and most reliable VPN lenders in the world. More than 160 areas and 94 VPN server areas allow customers to download and stream different content via ExpressVPN. There is also unlimited speed to optimize your browsing experience. It is easy to use and versatile to meet different customer needs. Netflix, Spotify, Hulu and other streaming sites users have a powerful locking ability to access more content through ExpressVPN.

Insurance Nz

They practice business sustainability and devote to the social, environmental and financial indicators of the company. They are members of the New Zealand Insurance Council (ICNZ) who follow ethical norms. With this reputation, they provide simple discounts and programs in the nearest competitors.

A Student’s Guide To Car Insurance In Nz

Westpac has more than 1.1 million customers across the country and more than 200 branches. WestPAC provides WestPac House insurance as a bank, insurance and lending service provider and investment company to provide the ability to use the insured house in the desired way. Westpac allows you to add the benefits of homeowners. They offer discounts for customers over 50 and customers applying for one or more insurance with WestPac.

WestPAC allows customers to link home insurance to land insurance, protecting losses or damage from accidental loss or loss from who lives in the tenant or insured. If the house cannot live, temporary accommodation can be covered up to $ 20 and 000 for 12 months.

NZI has been insurance for more than 160 years. They worked with local brokers and encountered new challenges and found the right signs for customers. NZI home insurance policies are classified on the basis of targeted and insurance. You have a flexible opportunity to guarantee your home with other stated assets and assets.

NZI home insurance makes it easy to understand the policy. All processes are convenient because the broker runs you from start to finish. The NZI also offers insurance policies only through brokers until they choose the insurance policy. NZI brokers are from other financial companies such as Aon, Crombie Lockwood, Insurance Advisernet and Marsh.

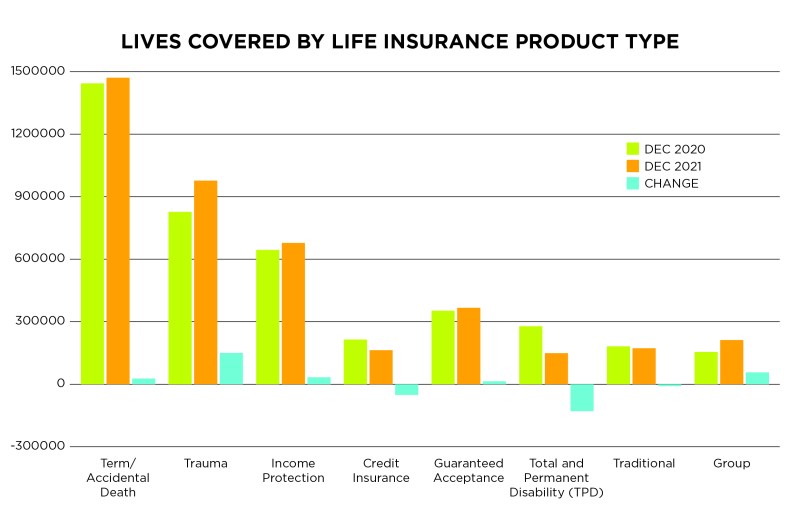

Life Insurance Nz

Warehouse groups guarantee a healthy home, from home products and accessories to insurance policy for all kinds of kiwi customers. Their home insurance capabilities provide additional features with 24/7 customer service for flexible payment options and requirements every month, month or each year to help additional policies. The warehouse also offers a daily cover for daily coverings and daily budgets.

Warehouse housing insurance guarantees customer satisfaction by choosing the best payment option you can request. They have competition insurance support providing relevant information you need to know about your insurance. It is customer friendly to make their insurance policy unique. In addition to the reasonable, we do not move the necessary covers to pay for those in need.

With a flexible option, Anz House insurance is designed for all kinds of kiwi customers. This will help you understand policies, goods, measures and payment amounts that are dealt with in providing the right tools, such as Anz Home Insurance Calculator. AnZ has more than 30% of New Zealand housing loans, and more than one of two Kiwis is the bank’s relationship with one of the brands. Due to versatility and high quality customer service from which anyone can benefit

Kiwis has comprehensive benefits with selective additions to expand other essential assets. This benefit is that up to 5%of the temporary accommodation site will cover their home if they cannot insure for 12 months, if they are evaluated low, if various claims are made, if various statements are made due to accident or damage caused by accidental loss or damage to damage (water from water from pipes), accident or damage.

Do I Need Life Insurance In Nz?

AA Home Insurance The goal is to meet the specific needs of existing and new customers. Their home cover is one of the most comprehensive and flexible things today on the market. If it is a customer service standard, we have won countless prizes, including reader Digest, reader Digest’s most trusted general insurer and quality service awards for auto insurance since 2015.

AA home insurance can save money by linking a qualified insurance policy such as AA home. Several policy discounts also help save bonuses. You can also get AA’s membership discount depending on the time with them. They will help you return on request. If you benefit from other options, select excess amount by adding benefits to help reduce the bonus.

Vero home insurance is practical and easy to understand. There are two options as needed to choose Maxi Cover and Flexi Cover. When choosing, it is best to know about your home insurance using Vero House insurance calculator.

Brokers and retailers can receive the necessary support from start to finish. The more you integrate it with the service, the more you can save more costs and get more benefits through Vero. If you guarantee your home and content, you can get up to 10% off bonuses. Real people with valid competence are engaged in your insurance, so your policies are suitable for your personal situation, family insurance and your assets. When they quote you, they do not match speculation or one size.

Health Insurance Industry Spotlight December 2021

The TSB home insurance policy provides important benefits of Kiwi, such as homeowners’ responsibility, natural disaster damage, temporary accommodation costs and tenant coverings. TSB policy phrases are easy to understand, so don’t worry about technical terms.

Kiwi receives the greatest benefits of TSB home insurance thanks to a competition policy that can be customized to your wishes and can be purchased for your home insurance. When the house is destroyed by the fire, all replacement is received. TSB can renovate the house, even though it costs more than it is insured. You can link your home insurance to other policies and save up to 20%of the bonuses. If you have to make a number of requirements in one case, you only have to pay once. These many practical benefits can be guaranteed if necessary.

The ASB aims to speed up all New Zealand’s financial progress through investments, loans, Kiwisaver and insurance. Today they meet the financial requirements related to about 1.3 million customers. They offer ASB home insurance so Kiwi customers can pay their homes and pay for them. ASB is not free discounts on temporary accommodation, replacement of excess or loss requirements, lock replacement, legal liability and other benefits.

If you have an existing policy with ASB, you will be entitled to a multipolitic discount if you get home insurance. Other suppliers offer similar discounts, but no one is better than ASB. The ASB multipolitical discounts deserve to get discounts on bigger discounts and professionally installed theft of anxiety if you are 55 years old or older without a year of year up to 40%.

How To Purchase Nz-based Life Insurance For Kiwis Overseas

For me, home insurance is made simple and convenient through the online application. You can only get home insurance calculations with a few clicks. Trade provides me as an independent policy and provides a comprehensive policy than the opponents of a competitor.

Kiwi customers living in the low compartment community can get exclusive discounts to make it easier. Some of the trade mission is to place everything they do in the center. Anyone can access it. If you are a trader, you can get a 15% discount and you can get a 20% multi -policy discount by applying for more than one policy.

Mas House insurance provides policies differently than others. The cover of the cover at the site of comprehensive or homeowners is applied according to the value of the product and the desire to pay, that is, local replacement, consensus and the value of immunity. It gives you an easier way to understand more flexibility and insurance, so you can really focus on what is really important.

MAS provides value